- United States

- /

- Software

- /

- NYSE:KVYO

US High Growth Tech Stocks to Watch in October 2025

Reviewed by Simply Wall St

As of October 2025, the U.S. stock market is experiencing a notable upswing, with both the Nasdaq and S&P 500 reaching new closing highs despite ongoing government shutdown concerns. This positive momentum in major indices highlights investor optimism, particularly in high-growth sectors like technology, where companies are often characterized by innovative products and robust potential for future expansion.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| ACADIA Pharmaceuticals | 10.33% | 23.81% | ★★★★★☆ |

| Palantir Technologies | 25.11% | 31.65% | ★★★★★★ |

| RenovoRx | 65.52% | 68.63% | ★★★★★☆ |

| Workday | 11.20% | 32.07% | ★★★★★☆ |

| OS Therapies | 56.64% | 68.61% | ★★★★★☆ |

| Vanda Pharmaceuticals | 22.66% | 59.11% | ★★★★★☆ |

| Circle Internet Group | 27.85% | 82.08% | ★★★★★☆ |

| Aldeyra Therapeutics | 42.88% | 74.81% | ★★★★★☆ |

| Zscaler | 15.74% | 40.36% | ★★★★★☆ |

| Gorilla Technology Group | 32.75% | 122.61% | ★★★★★☆ |

Click here to see the full list of 70 stocks from our US High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

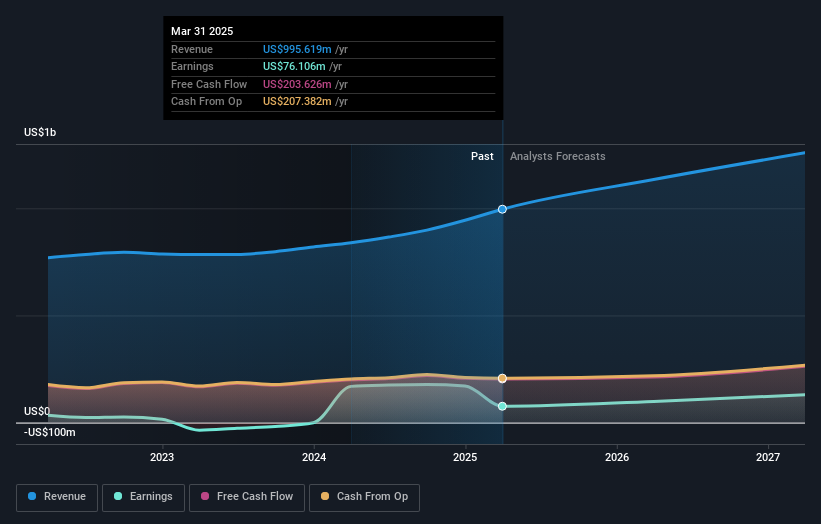

Commvault Systems (CVLT)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Commvault Systems, Inc. offers a cyber resilience platform focused on data protection and recovery for cloud-native applications across the Americas and internationally, with a market capitalization of approximately $8.02 billion.

Operations: The company's primary revenue stream is derived from its Software & Programming segment, generating approximately $1.05 billion.

Commvault Systems is navigating a transformative landscape with its recent launch of Clumio for Apache Iceberg on AWS, marking a significant advancement in data lakehouse protection. This innovation addresses the increasing adoption of Apache Iceberg by major tech players like Netflix and Apple, highlighting Commvault's strategic positioning in cyber resilience. Despite a challenging financial backdrop with earnings growth lagging at -53.6% over the past year, the company's forward-looking R&D investments and strategic partnerships, such as with BeyondTrust, underscore its commitment to enhancing security frameworks and data recovery technologies. Commvault's focus on high-performance solutions for AI-driven environments positions it to capitalize on future tech demands, although it must navigate current market complexities where it has seen revenue growth (11.4% annually) outpacing the US market average (9.8%).

- Click here to discover the nuances of Commvault Systems with our detailed analytical health report.

Evaluate Commvault Systems' historical performance by accessing our past performance report.

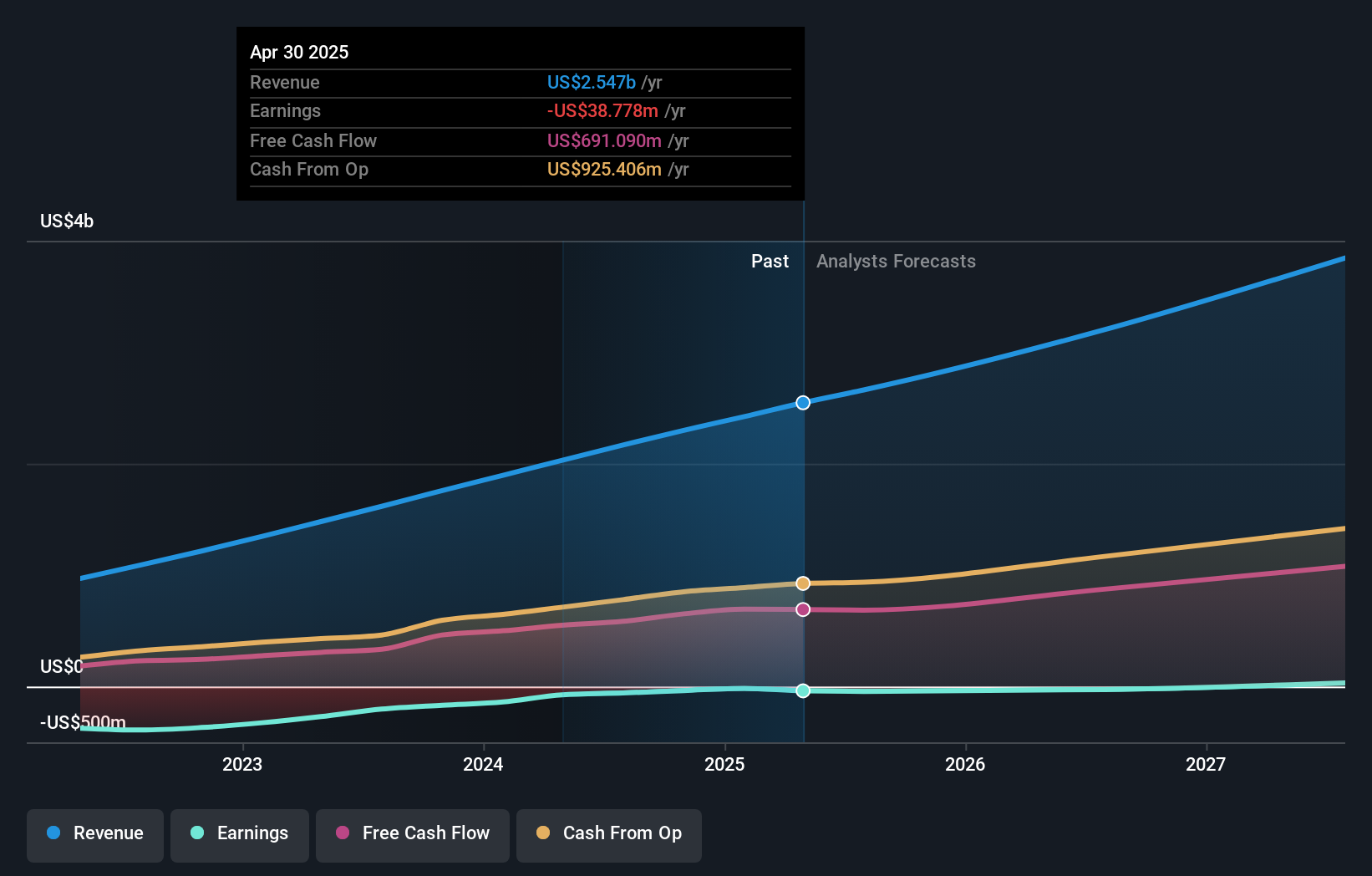

Zscaler (ZS)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Zscaler, Inc. is a global cloud security company with a market capitalization of approximately $48.35 billion.

Operations: Zscaler generates revenue primarily through the sale of subscription services to its cloud platform and related support services, amounting to $2.67 billion. The company's focus on cloud security solutions positions it as a significant player in the cybersecurity industry.

Zscaler's strategic involvement in developing the Zero Trust Maturation Model (ZTMM) underscores its commitment to advancing cybersecurity, particularly in healthcare—a sector increasingly vulnerable to cyber threats. This initiative complements their recent financial performance, where Zscaler reported a significant revenue increase to $2.67 billion, up from $2.17 billion last year, despite a net loss reduction from $57.71 million to $41.48 million annually. The company's forward-looking stance is further evidenced by its R&D focus and partnerships aimed at enhancing digital security frameworks across industries, positioning Zscaler as a pivotal player in the tech-driven security landscape while navigating current unprofitability challenges with an eye on future growth and profitability within three years.

- Unlock comprehensive insights into our analysis of Zscaler stock in this health report.

Review our historical performance report to gain insights into Zscaler's's past performance.

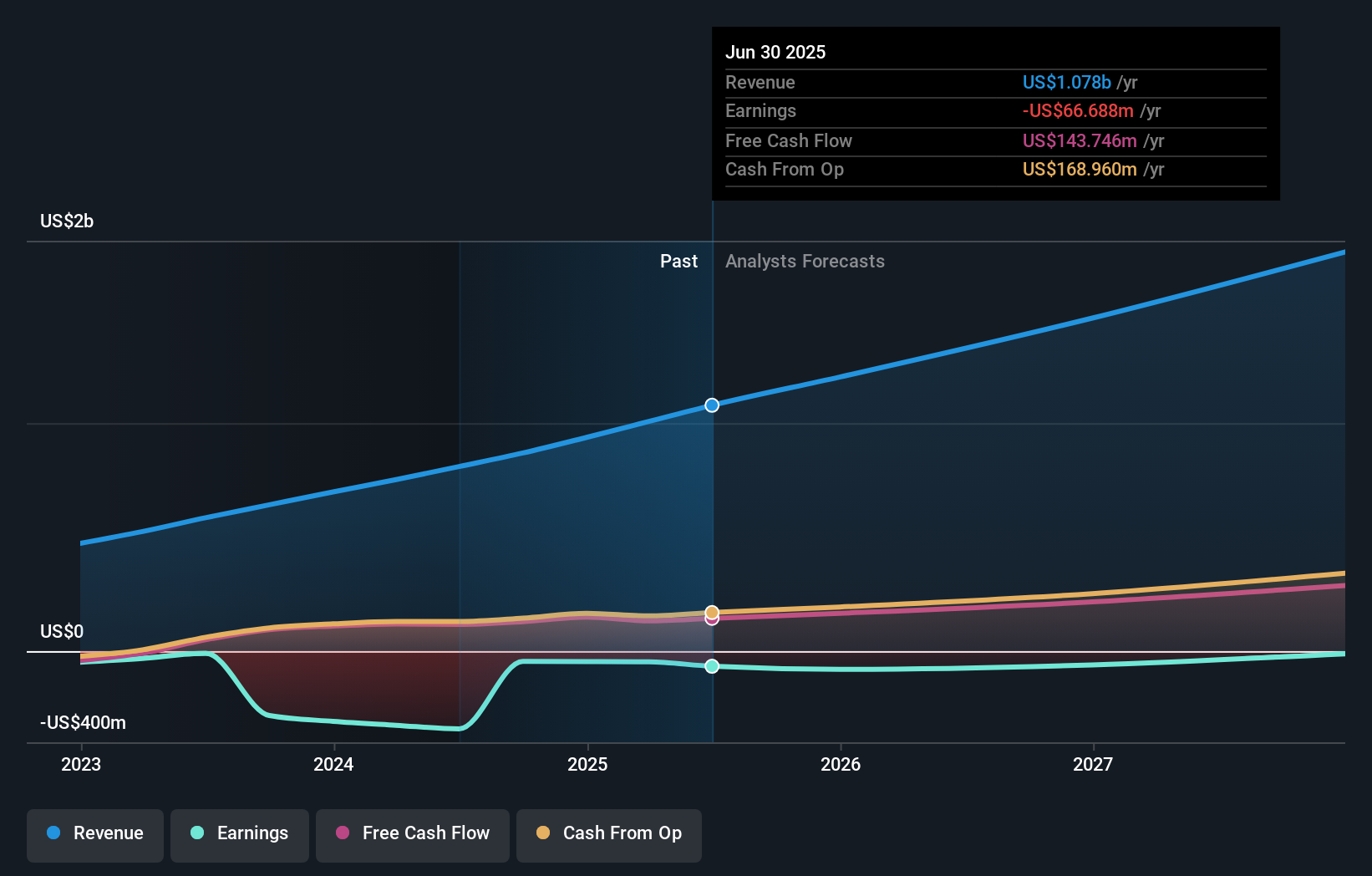

Klaviyo (KVYO)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Klaviyo, Inc. is a technology company that offers a software-as-a-service platform across various regions including the United States, other Americas, Asia-Pacific, Europe, the Middle East, and Africa, with a market cap of $7.77 billion.

Operations: Klaviyo generates revenue primarily from its internet software segment, amounting to $1.08 billion. The company operates a software-as-a-service platform catering to diverse global markets, including the Americas, Asia-Pacific, and EMEA regions.

Klaviyo is setting a new standard in the CRM market with its recent unveiling of AI-driven tools that redefine customer interaction and service automation. By integrating Marketing Agent and Customer Agent into its platform, Klaviyo not only enhances personalized consumer engagement but also ensures seamless, data-informed interactions across marketing and customer service channels. This strategic enhancement aligns with Klaviyo's vision to lead in the AI-first B2C CRM space, evidenced by a robust annual revenue growth of 17.6% and an anticipated transition to profitability within three years, reflecting an expected earnings growth rate of 46.6%. Moreover, Klaviyo's commitment to innovation is underscored by its R&D expenses which are crucial for sustaining long-term competitiveness in the rapidly evolving tech landscape.

- Click here and access our complete health analysis report to understand the dynamics of Klaviyo.

Assess Klaviyo's past performance with our detailed historical performance reports.

Key Takeaways

- Click through to start exploring the rest of the 67 US High Growth Tech and AI Stocks now.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Klaviyo might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KVYO

Klaviyo

A technology company, provides a software-as-a-service platform in the United States, other Americas, the Asia-Pacific, Europe, the Middle East, and Africa.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion