- United States

- /

- Software

- /

- NasdaqGS:CVLT

Is There Room for Commvault Shares to Grow After Recent Earnings Rally?

Reviewed by Bailey Pemberton

If you’re looking at Commvault Systems and wondering if now is a good time to get involved, you’re not alone. With its shares closing recently at $180.3, the stock has been on quite a journey. There was a minor dip of -6.6% over the past week, but it has held steady with a 0.7% gain across the last month. What really grabs attention, though, is the bigger picture: Commvault has surged 18.5% year to date and an impressive 304.6% over five years. There has been some volatility, but the company’s long-term growth is notable.

Some of this upward momentum can be tied to broader market trends that favor cloud data management and cybersecurity solutions, sectors where Commvault stands out. Investors are clearly turning to companies that can weather uncertainty and drive digital transformation. This optimism has fueled considerable returns for those who have stayed the course.

But here is where it gets interesting: While the stock’s performance has caught many eyes, Commvault currently holds a valuation score of 0 out of 6, meaning it is not considered undervalued in any of the key valuation checks. This might have you asking whether the current price reflects all that growth or if there is still room to run.

To answer that, let’s break down exactly how analysts assess value and explore whether these traditional methods really tell the full story, or if there is a smarter way to evaluate Commvault’s potential in today’s market.

Commvault Systems scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Commvault Systems Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model works by estimating a company’s future cash flows and then discounting those projections back to their value today. This process helps investors determine what a business is truly worth, based on how much cash it is expected to generate over time.

For Commvault Systems, the most recent Free Cash Flow stands at $189.7 Million. Analysts forecast this figure will steadily increase, with Free Cash Flow expected to reach $300.1 Million five years from now. Beyond that, longer-term projections by Simply Wall St suggest free cash flows could approach $447 Million by 2035. It is important to note that only the next five years are based on analyst estimates. Projections further out are extrapolated.

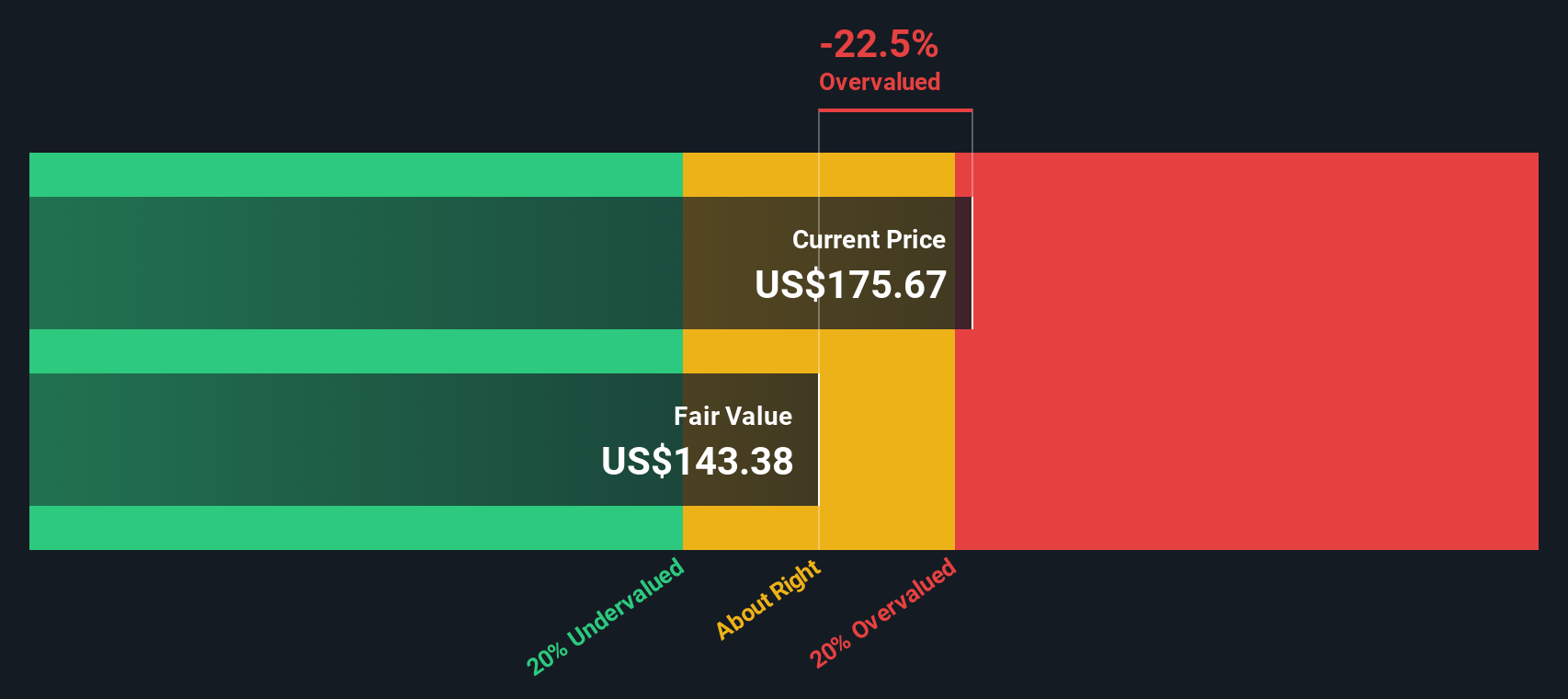

When all these future cash flows are added up and discounted to the present, the DCF model estimates an intrinsic value of $135.49 per share. With the current share price sitting at $180.3, this model suggests the stock is trading at a premium and is approximately 33.1% overvalued relative to its current fundamentals.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Commvault Systems may be overvalued by 33.1%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Commvault Systems Price vs Earnings (PE)

The Price-to-Earnings (PE) ratio is often considered the go-to valuation measure for profitable companies like Commvault Systems. This is because it provides a straightforward way to weigh a company’s stock price against its actual earnings, giving investors a clear sense of how much they are paying for each dollar of profit generated.

It is important to note that what constitutes a “normal” or “fair” PE ratio can vary, depending on growth expectations and perceived risks. High-growth, reliable businesses often justify a higher PE ratio, while slower-growing or riskier companies typically see lower ones.

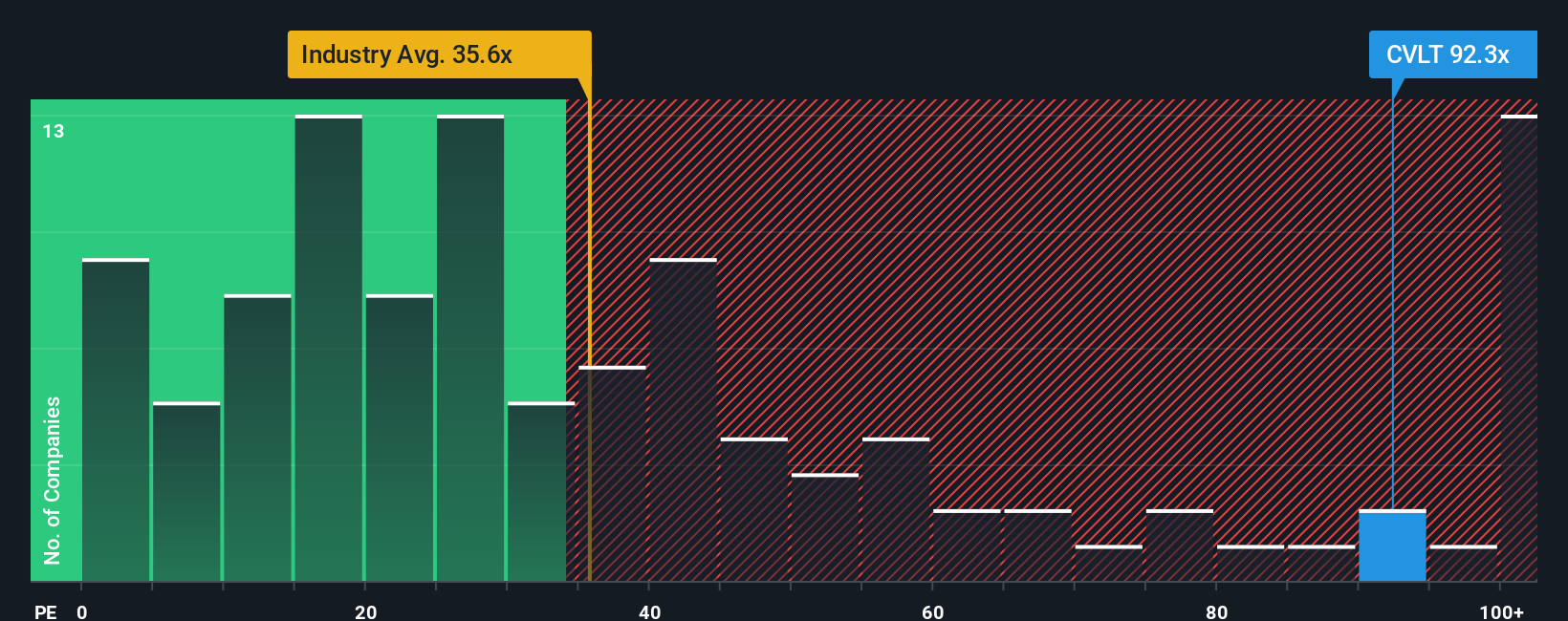

Currently, Commvault trades at a lofty PE ratio of 98.9x. This is well above the Software industry average of 35.7x and the average of its listed peers at 26.3x. To give a more tailored view, Simply Wall St calculates a proprietary “Fair Ratio” in this case 40.3x which factors in Commvault’s unique profile, including anticipated earnings growth, profit margins, risk, industry trends, and market cap.

The Fair Ratio offers a far more customized benchmark than relying solely on industry or peer averages, as it adapts to the company’s actual fundamentals and helps avoid misleading surface comparisons.

When comparing Commvault’s current PE ratio of 98.9x to its Fair Ratio of 40.3x, the stock appears to be significantly overvalued based on this metric.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Commvault Systems Narrative

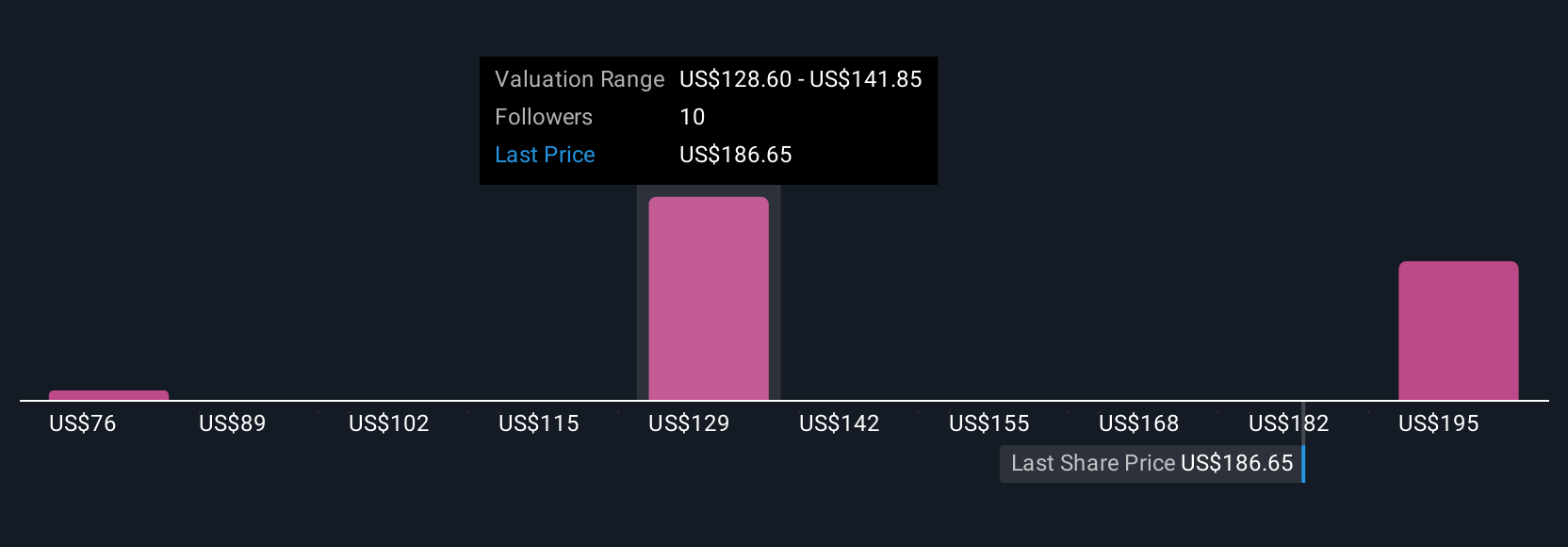

Earlier we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your story and perspective about a company, where you connect what you believe about its business future to actual financial forecasts and, ultimately, to your own fair value estimate. Narratives link what you think about Commvault’s market position, strategy, risks, and opportunities to the numbers, like expected revenue, earnings growth, and profit margins.

Narratives make investment decisions more personal and powerful, because every investor can easily create, update, and share their own scenario using Simply Wall St’s Community page. With millions already exploring Narratives, this tool guides you in deciding when to buy or sell by comparing your Fair Value to the latest share price, based on your own assumptions. Whenever new information such as quarterly results or major news comes out, Narratives automatically update so your analysis always stays current.

For example, some investors see Commvault’s move to SaaS and cybersecurity as supporting sustained double-digit growth and set a Fair Value above $225 per share. Others focus on customer dependency or integration risks, arriving at a fair value below $177. Where you land on this spectrum is your unique Narrative, and that is the real edge in smart investing.

Do you think there's more to the story for Commvault Systems? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CVLT

Commvault Systems

Provides a cyber resilience platform for protecting and recovering data and cloud-native applications in the Americas and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives