- United States

- /

- Software

- /

- NasdaqGS:CVLT

Commvault (CVLT) Margin Decline Challenges Bullish Growth Narrative Despite Premium Valuation

Reviewed by Simply Wall St

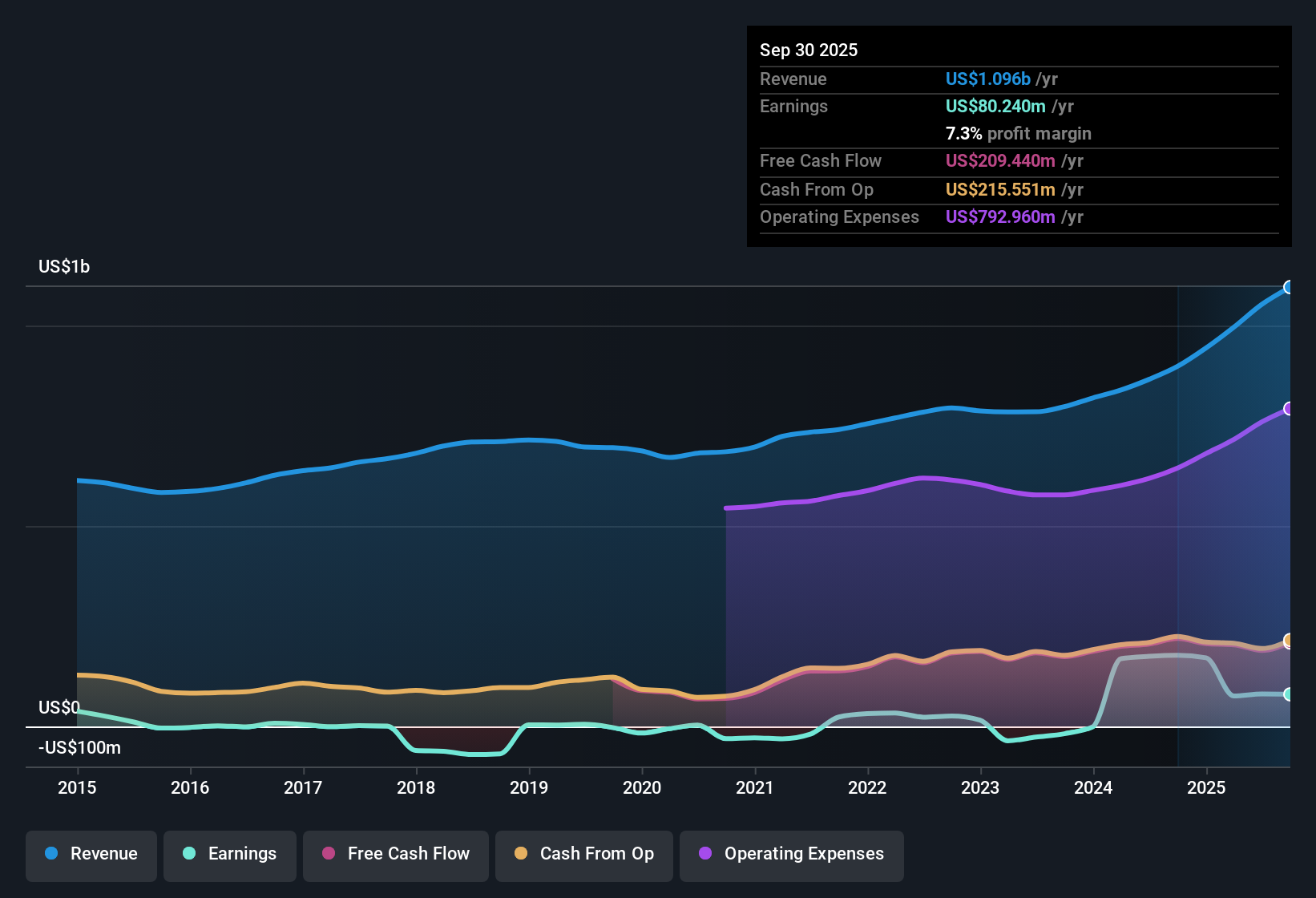

Commvault Systems (CVLT) posted a net profit margin of 7.3%, falling sharply from 19.7% the previous year, signaling a notable decline in profitability. Despite the recent pullback, the company has averaged 53.6% annual earnings growth over the last five years and is forecast to grow earnings by 18.7% and revenue by 11.4% per year, well ahead of wider US market trends. Investors are weighing the strong multi-year growth outlook against weaker recent margins and a lofty price-to-earnings ratio.

See our full analysis for Commvault Systems.Next up, we will see how these headline numbers compare to the most widely followed narratives in the market and on Simply Wall St. This will highlight where the consensus holds and where the data tells a different story.

See what the community is saying about Commvault Systems

Enterprise SaaS Surge: 63% ARR Growth Lifts Outlook

- Commvault's SaaS annual recurring revenue (ARR) grew by 63% and multi-product customers increased by 45%, signaling powerful cross-selling momentum and a strengthening of the company’s revenue base away from legacy licensing.

- Analysts’ consensus view sees this surge supporting higher earnings durability as greater SaaS adoption translates to improved revenue predictability and margin quality.

- Subscription-based revenues now make up 85% of total ARR, helping smooth out volatility from large one-off licensing deals.

- Projecting future growth, analysts expect profit margins to rise from 7.7% today to 11.6% within three years, banking on recurring SaaS revenues offsetting near-term margin dilution from acquisitions.

Consensus numbers point to increased SaaS strength fueling revenue growth and margin gains as Commvault shifts away from lumpy license deals. Discover how this stacks up to market expectations in the full Consensus Narrative. 📊 Read the full Commvault Systems Consensus Narrative.

Premium Valuation: Trading at 77.6x Earnings

- Shares change hands at a price-to-earnings ratio of 77.6x, which is over three times higher than the peer average of 23.8x and more than double the US software industry average of 34.3x. This suggests investors are paying a steep premium for growth and perceived quality.

- Consensus narrative highlights a key tension:

- While the current share price of $140.14 remains below the latest analyst price target of $194.70, it sits above the DCF fair value of $128.10. This raises questions about further upside unless expected growth and margin expansion materialize.

- This valuation gap means investors are relying heavily on the company delivering on its growth forecasts and improving profitability in a sector where high valuations are common, but where top-line outperformance is required to sustain such multiples.

Margin Pressure Despite Recurring Revenue Mix

- The net profit margin declined sharply to 7.3% from 19.7% last year, even as recurring SaaS and subscription revenue reached 85% of total ARR, reflecting ongoing headwinds from deal timing and integration costs.

- According to analysts’ consensus view, margin compression remains a watchpoint.

- Analyst projections banking on margin improvement to 11.6% in three years could be challenged if integration risks around recent acquisitions (such as Satori Cyber) outpace potential synergies and if reliance on expanding contracts from existing customers leads to deal timing volatility.

- Sustained margin increases will depend on continued SaaS revenue maturation and the ability to shift more business away from traditional perpetual licensing, which remains a risk if the SaaS transition stalls or integration costs mount.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Commvault Systems on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on these figures? Share your insights and shape your view on Commvault in just a few minutes. Do it your way

A great starting point for your Commvault Systems research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Commvault’s elevated valuation and ongoing margin pressure create uncertainty about whether the company can deliver the growth needed to justify its premium price.

If you want to sidestep these risks, check out these 854 undervalued stocks based on cash flows to find companies with more compelling valuations and a better margin of safety.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CVLT

Commvault Systems

Provides a cyber resilience platform for protecting and recovering data and cloud-native applications in the Americas and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion

Thanks for sharing these. They really help when I pick what dividend stocks to invest in