- United States

- /

- Software

- /

- NasdaqGS:CVLT

Assessing Commvault Systems (CVLT) Valuation After Recent Share Price Weakness

Why Commvault Systems Stock Is On Investors’ Radar

Commvault Systems (CVLT) has drawn fresh attention after a period where the share price has fallen about 27% over the past 3 months and roughly 23% over the past year.

See our latest analysis for Commvault Systems.

The recent 3 month share price return of a 27% decline, alongside a 1 year total shareholder return of a 23.24% decline, suggests momentum has faded recently even though longer term total shareholder returns over 3 and 5 years remain strongly positive.

If Commvault’s moves in cyber resilience are on your watchlist, this could be a good moment to scan other high growth tech and AI names using high growth tech and AI stocks.

With Commvault posting annual revenue of about $1.1b, net income of $80.24m and trading at $123.53, the real question is whether recent share price weakness leaves mispriced upside, or if the market already reflects future growth.

Most Popular Narrative: 34.1% Undervalued

Commvault’s most followed narrative puts fair value around $187, well above the last close of $123.53, and leans on long term recurring growth assumptions.

Rapid expansion and successful cross-sell/upsell momentum within the SaaS (Metallic) platform, evidenced by 63% SaaS ARR growth, a 45% increase in multi-product customers, and 125% SaaS net dollar retention, point to continued improvement in the quality and predictability of future revenues, directly supporting margin expansion and higher earnings visibility.

Curious what kind of revenue mix and margin profile sit behind that valuation gap? The narrative leans heavily on recurring SaaS growth and richer earnings power over time.

Result: Fair Value of $187.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, shorter contract durations and pressure on margins after the Q2 earnings miss are key watch points that could challenge the case for a large valuation gap.

Find out about the key risks to this Commvault Systems narrative.

Another View: High Multiple Keeps Expectations Tight

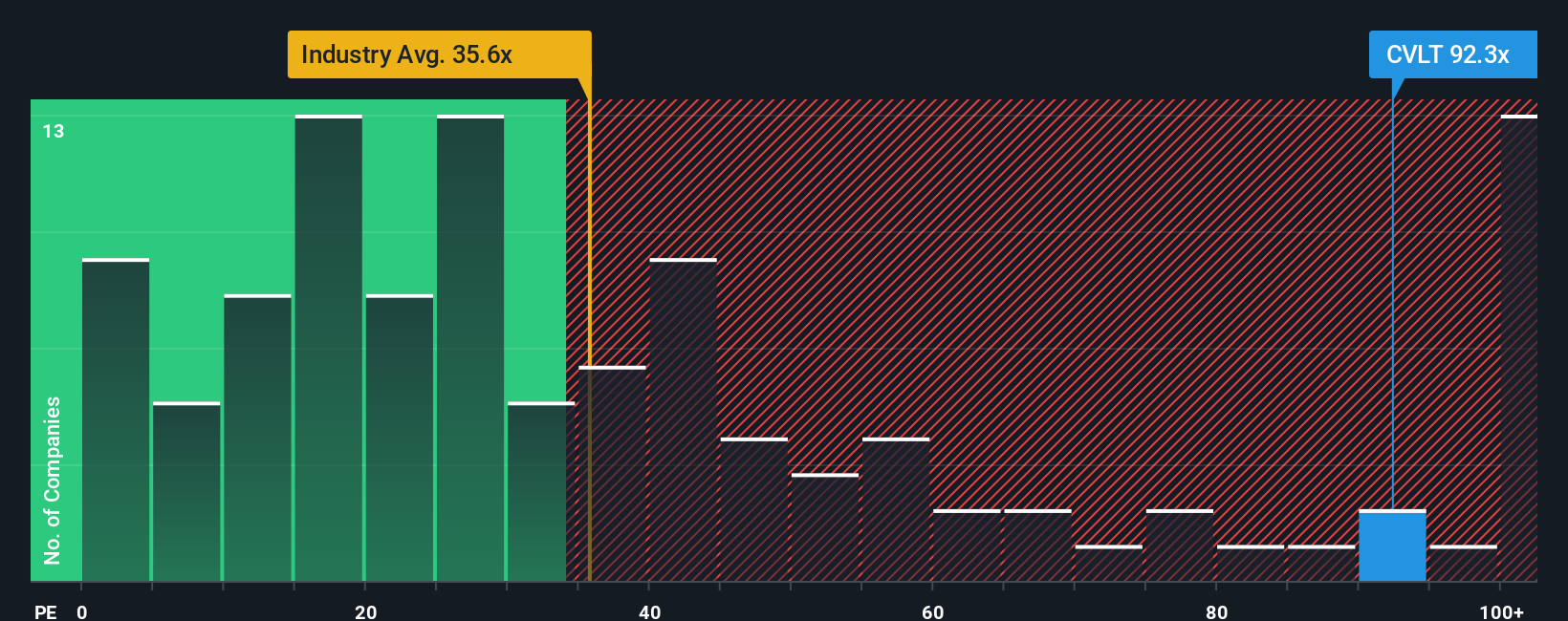

While our DCF model suggests Commvault is modestly undervalued, the current P/E of 67.9x looks rich next to both peers at 46.2x and a fair ratio of 33.7x. That kind of gap can work out well if earnings forecasts land perfectly, but what if they do not?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Commvault Systems Narrative

If you look at the numbers and reach a different conclusion, or simply prefer to shape your own thesis, you can build a full narrative in just a few minutes with Do it your way.

A great starting point for your Commvault Systems research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Commvault has sparked your interest, do not stop there. Use this moment to scan other angles before the next wave of opportunities moves without you.

- Spot potential turnaround candidates with strong balance sheets by checking out these 3522 penny stocks with strong financials that might be flying under most investors’ radar today.

- Target companies at the heart of artificial intelligence by reviewing these 24 AI penny stocks that align with your view on how data and automation reshape business models.

- Hunt for possible mispricing by filtering for these 880 undervalued stocks based on cash flows that could suit investors who care about price versus underlying cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CVLT

Commvault Systems

Provides a cyber resilience platform for protecting and recovering data and cloud-native applications in the Americas and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Ferrari's Intrinsic and Historical Valuation

Investment Thesis: Costco Wholesale (COST)

Undervalued Key Player in Magnets/Rare Earth

Recently Updated Narratives

QDay is coming - 01 Quantum hold the key

Salesforce's Market Dominance and AI Pivot Will Drive Earnings Re-acceleration

IREN's Trump Card: How Federal Policy Could Unlock Massive Value in AI Infrastructure

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Undervalued Key Player in Magnets/Rare Earth

Trending Discussion

I'm exiting the positions at great return! WRLG got great competent management. But, 100k oz gold too small in today environment. They might looking for M/A opportunity in the future, or they might get take over by Aris Mining, I don't know. But, Frank Giustra stated he's believed in multi-assets, so that's my speculation. Anyhow, I want to be aggressive in today's gold price. I'm buying Lahontan Gold LG with this as exchange. Higher upside, more leverage. WRLG CEO is BOD's of LG, that's something. This will be my last update on WRLG, good luck!