- United States

- /

- Software

- /

- NasdaqGS:CVLT

A Look At Commvault Systems (CVLT) Valuation As Data Protection Momentum Draws Fresh Investor Attention

Commvault Systems (CVLT) is drawing fresh attention as investors focus on its growing data protection and cyber resilience offerings, including an expanding SaaS lineup and deeper ties with major cloud providers.

See our latest analysis for Commvault Systems.

At a share price of US$124.14, Commvault’s 90-day share price return of a 27.06% decline contrasts with a 1-year total shareholder return of a 21.33% decline and a 3-year total shareholder return of a 126.04% gain. This suggests longer term momentum has been stronger than more recent trading, while attention now turns to the upcoming third quarter fiscal 2026 earnings webcast.

If Commvault’s data protection story has your attention, this can be a good moment to see what else is out there with high growth tech and AI names using high growth tech and AI stocks.

With Commvault trading at US$124.14, a value score of 2 and only a modest 3.05% intrinsic discount, the key question is whether the recent pullback leaves upside on the table or if the market already reflects expectations for future growth.

Most Popular Narrative: 35.8% Undervalued

Against Commvault’s last close of US$124.14, the most followed narrative implies a fair value near US$193.36, putting a spotlight on its earnings and cash flow potential rather than recent share price weakness.

Analysts are assuming Commvault Systems's revenue will grow by 12.2% annually over the next 3 years. Analysts assume that profit margins will increase from 7.7% today to 11.6% in 3 years time.

Curious what kind of earnings profile and profit multiple are embedded in that fair value? The narrative leans on rising margins, compounding revenue and a premium valuation that many investors usually associate with high growth software names.

Result: Fair Value of $193.36 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, shorter contract terms and a softer near term margin outlook could put pressure on earnings visibility and challenge the premium multiples implied in the narrative.

Find out about the key risks to this Commvault Systems narrative.

Another Take: High Multiple, Tight Margin For Error

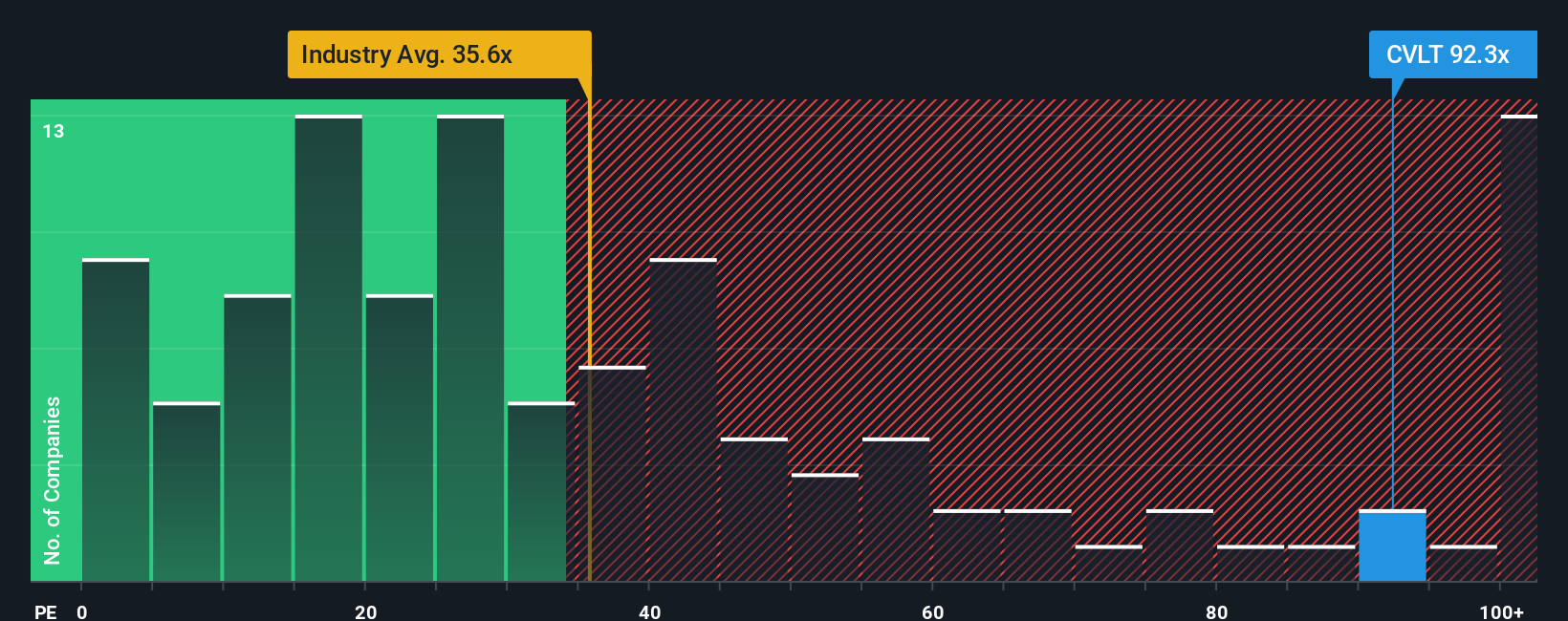

While the popular narrative points to a 35.8% undervaluation, Commvault is currently on a P/E of 68.2x, compared with a fair ratio of 34x, a peer average of 51.3x and a US software industry average of 32.7x. That gap suggests the market already prices in a lot of good news. If growth or margins shift, how comfortable are you with that cushion?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Commvault Systems Narrative

If you are not fully on board with this view or prefer to base your decisions on your own work, you can quickly build a custom thesis and Do it your way

A great starting point for your Commvault Systems research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more investment ideas?

If Commvault has sharpened your thinking, do not stop here. Use powerful screeners to quickly spot other opportunities that fit the style you prefer.

- Target high potential smaller names by reviewing these 3546 penny stocks with strong financials that already show solid financial foundations and room to grow.

- Position yourself in the AI trend by scanning these 28 AI penny stocks that tie artificial intelligence themes to listed companies.

- Focus on price versus fundamentals by checking these 878 undervalued stocks based on cash flows that our models flag as trading below their estimated cash flow value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CVLT

Commvault Systems

Provides a cyber resilience platform for protecting and recovering data and cloud-native applications in the Americas and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Ferrari's Intrinsic and Historical Valuation

Investment Thesis: Costco Wholesale (COST)

Undervalued Key Player in Magnets/Rare Earth

Recently Updated Narratives

Investing in the future with RGYAS as fair value hits 228.23

The global leader in cash handling

Wolters Kluwer - A Fundamental and Historical Valuation

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

I'm exiting the positions at great return! WRLG got great competent management. But, 100k oz gold too small in today environment. They might looking for M/A opportunity in the future, or they might get take over by Aris Mining, I don't know. But, Frank Giustra stated he's believed in multi-assets, so that's my speculation. Anyhow, I want to be aggressive in today's gold price. I'm buying Lahontan Gold LG with this as exchange. Higher upside, more leverage. WRLG CEO is BOD's of LG, that's something. This will be my last update on WRLG, good luck!

Thanks for your post but some of your calculations are wrong. It is only the actual silver that should be priced at 100/oz, not the zink and lead. The actual silver is about 5 million ounces and the rest is biproducts which cannot be calculated as 100/oz per silver equivalent. Since it would now require alot more zink and lead to create 1 AgEq with the current silver price which means their AgEq would become lower even if the production remains the same. I am still very bullish on the stock and I own it.