- United States

- /

- Software

- /

- NasdaqGS:CVLT

A Fresh Look at Commvault Systems (CVLT) Valuation After Analyst Upgrade Highlights Platform Strengths

Reviewed by Kshitija Bhandaru

Commvault Systems (CVLT) shares edged higher after Piper Sandler raised its rating, citing ongoing demand and the company’s flexible platform as factors supporting its ability to serve varied industry needs.

See our latest analysis for Commvault Systems.

Commvault’s recent analyst upgrade comes as the stock continues to show solid momentum, posting a 17.9% total shareholder return over the past year and an impressive 203% over three years. Short-term enthusiasm has been steady as well, with double-digit year-to-date gains suggesting investors see continued growth potential fueled by robust demand and platform strengths.

If this uptick in confidence has you looking for what else is surging in tech, check out the latest opportunities on our discovery list, such as See the full list for free.

But with shares already up nearly 18% over the past year and trading just under analysts' price targets, the real question is whether Commvault remains undervalued or if the market has already baked in its growth prospects. Could there still be a buying opportunity?

Most Popular Narrative: 16.2% Undervalued

Following the narrative’s fair value, Commvault’s last close price trails meaningfully, setting up a debate about upside potential. The details behind this target reflect some bold underlying business shifts.

Rapid expansion and successful cross-sell and upsell momentum within the SaaS (Metallic) platform, as evidenced by 63% SaaS ARR growth, a 45% increase in multi-product customers, and 125% SaaS net dollar retention, point to continued improvement in the quality and predictability of future revenues. This directly supports margin expansion and higher earnings visibility.

Curious what numbers create such a bullish outlook? The calculations are powered by ambitious revenue and earnings projections, alongside future profit margins rarely seen in this sector. Uncover the narrative’s secrets for yourself and see how analysts build their case.

Result: Fair Value of $208.09 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing reliance on existing customers and potential margin compression from recent acquisitions could pose challenges to the bullish scenario for Commvault’s long-term growth.

Find out about the key risks to this Commvault Systems narrative.

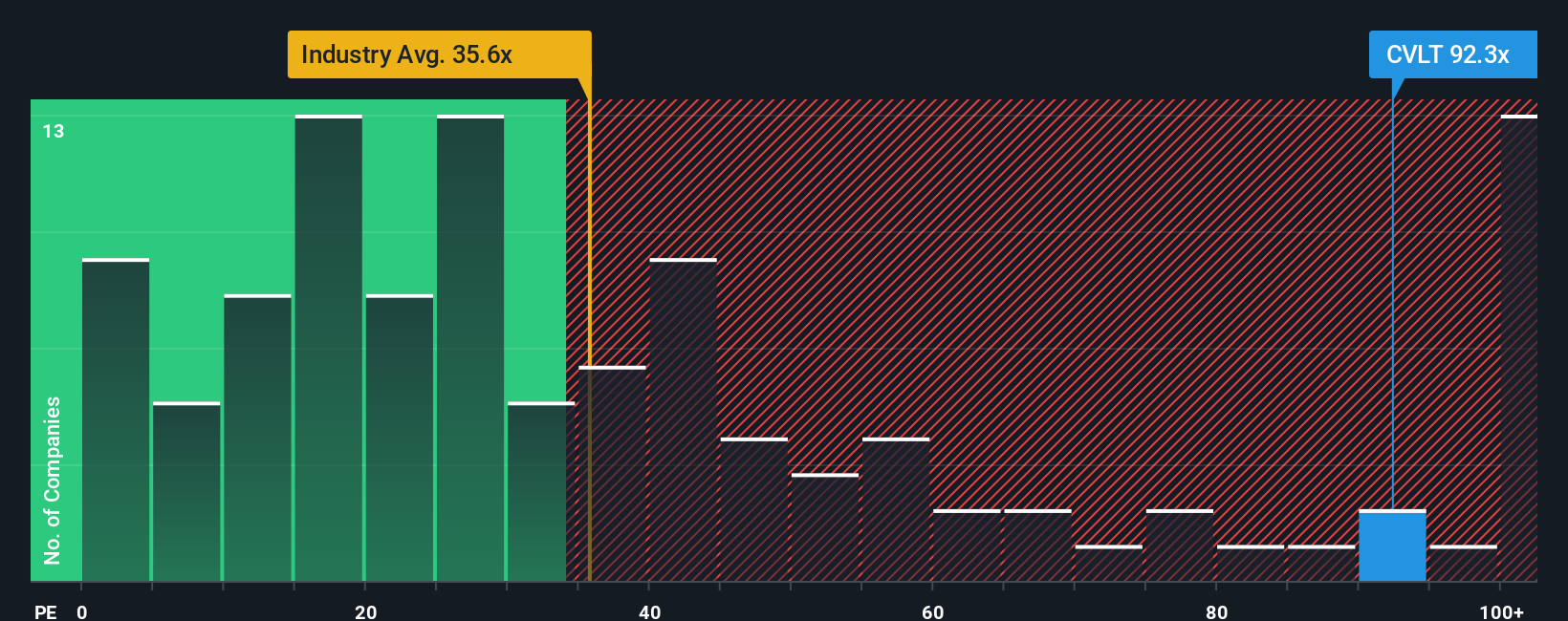

Another View: Multiples Suggest High Valuation Risk

While the fair value narrative paints Commvault as undervalued, looking at its price-to-earnings ratio reveals a different story. Commvault trades at 95.6x earnings, far above the US software industry average of 35.4x and its peer average of 25.5x. Even when compared to its fair ratio of 45.3x, the current valuation appears stretched. This sizable gap could signal a risk that the market may eventually realign, challenging the upbeat outlook. Should investors rely on optimistic forecasts, or is caution warranted as multiples soar?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Commvault Systems Narrative

If you’re keen to dig deeper and approach the analysis from your own angle, it’s easy to construct your personal perspective in just minutes, so why not Do it your way

A great starting point for your Commvault Systems research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t wait for opportunity to knock twice. Expand your investing edge with hand-picked companies targeting major growth, rising trends, and resilient financials right now.

- Tap into tomorrow’s technology gains by hunting for under-the-radar plays among these 25 AI penny stocks that harness artificial intelligence breakthroughs.

- Boost your income strategy by selecting from these 18 dividend stocks with yields > 3% which offer stronger yields and robust cash flow for stable returns.

- Ride the next financial revolution with these 79 cryptocurrency and blockchain stocks specializing in blockchain innovation and the digital economy.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CVLT

Commvault Systems

Provides a cyber resilience platform for protecting and recovering data and cloud-native applications in the Americas and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives