- United States

- /

- IT

- /

- NasdaqGS:CTSH

Should New AI Partnerships and Agent Foundry Launch Require Action From Cognizant (CTSH) Investors?

Reviewed by Simply Wall St

- Earlier this month, Cognizant Technology Solutions announced two major client collaborations to modernize IT platforms for SmartestEnergy and Kramp, alongside the launch of Cognizant Agent Foundry, a comprehensive offering enabling enterprises to deploy and orchestrate autonomous AI agents at scale.

- This combination of significant client partnerships and a platform-agnostic AI solution highlights Cognizant’s ongoing expansion into enterprise artificial intelligence and commitment to accelerating client digital transformation initiatives.

- We’ll now examine how Cognizant Agent Foundry may influence the company’s investment narrative by supporting AI-driven operational transformation for clients.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Cognizant Technology Solutions Investment Narrative Recap

Owning Cognizant Technology Solutions centers on the belief that investments in enterprise AI, digital transformation, and strong partnerships can translate into higher-value deals and ongoing client growth. While the recent client wins and the launch of Cognizant Agent Foundry align closely with catalysts around AI-driven transformation, the main short-term catalyst remains client spending on large technology modernization projects. However, the biggest risk, continued economic uncertainty pressuring discretionary corporate IT budgets, persists and is not significantly altered by this news.

The announcement of Cognizant Agent Foundry is especially relevant, as it showcases an enterprise-ready platform capable of supporting adaptive, real-time AI-driven operations for clients across diverse industries. This aligns directly with client demand for personalized digital transformation and positions Cognizant to accelerate deal cycles in large, innovation-focused projects, reinforcing its case for future revenue growth.

By contrast, investors should be aware of the ongoing risk that corporate technology budgets may tighten if...

Read the full narrative on Cognizant Technology Solutions (it's free!)

Cognizant Technology Solutions is projected to reach $23.5 billion in revenue and $2.9 billion in earnings by 2028. This outlook requires a 5.3% annual revenue growth rate and an increase in earnings of $0.5 billion from the current $2.4 billion.

Exploring Other Perspectives

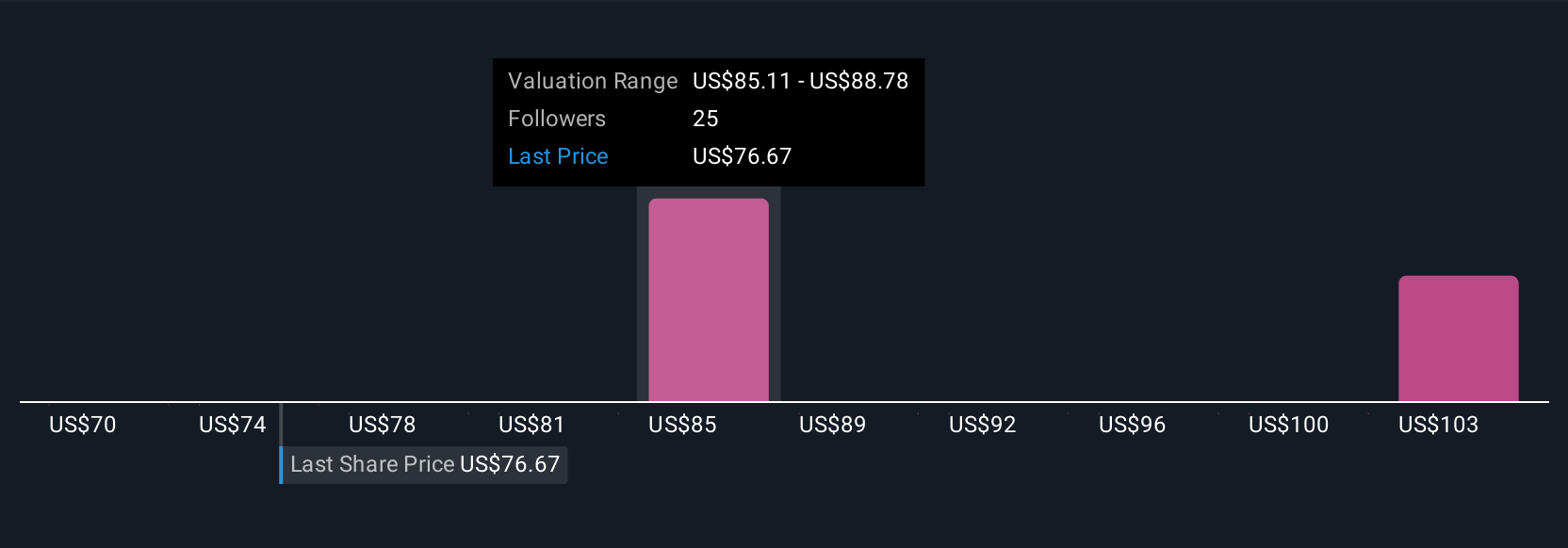

Four Simply Wall St Community fair value estimates for Cognizant Technology Solutions range from US$70.42 to US$107.18 per share. While AI-powered deals remain a key catalyst, these varied views reflect how investor expectations and confidence can differ, it's worth considering several perspectives before making portfolio decisions.

Build Your Own Cognizant Technology Solutions Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cognizant Technology Solutions research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Cognizant Technology Solutions research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cognizant Technology Solutions' overall financial health at a glance.

Want Some Alternatives?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- These 17 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 19 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CTSH

Cognizant Technology Solutions

A professional services company, provides consulting and technology, and outsourcing services in North America, Europe, and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives