- United States

- /

- Professional Services

- /

- NasdaqGS:CSGS

Investors Met With Slowing Returns on Capital At CSG Systems International (NASDAQ:CSGS)

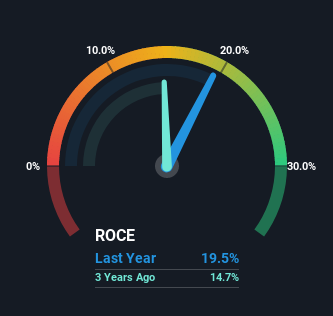

To find a multi-bagger stock, what are the underlying trends we should look for in a business? Firstly, we'll want to see a proven return on capital employed (ROCE) that is increasing, and secondly, an expanding base of capital employed. If you see this, it typically means it's a company with a great business model and plenty of profitable reinvestment opportunities. So when we looked at CSG Systems International (NASDAQ:CSGS), they do have a high ROCE, but we weren't exactly elated from how returns are trending.

Return On Capital Employed (ROCE): What Is It?

Just to clarify if you're unsure, ROCE is a metric for evaluating how much pre-tax income (in percentage terms) a company earns on the capital invested in its business. Analysts use this formula to calculate it for CSG Systems International:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.20 = US$119m ÷ (US$1.3b - US$683m) (Based on the trailing twelve months to June 2022).

Therefore, CSG Systems International has an ROCE of 20%. That's a fantastic return and not only that, it outpaces the average of 12% earned by companies in a similar industry.

View our latest analysis for CSG Systems International

In the above chart we have measured CSG Systems International's prior ROCE against its prior performance, but the future is arguably more important. If you'd like to see what analysts are forecasting going forward, you should check out our free report for CSG Systems International.

The Trend Of ROCE

There hasn't been much to report for CSG Systems International's returns and its level of capital employed because both metrics have been steady for the past five years. Businesses with these traits tend to be mature and steady operations because they're past the growth phase. So while the current operations are delivering respectable returns, unless capital employed increases we'd be hard-pressed to believe it's a multi-bagger going forward.

On another note, while the change in ROCE trend might not scream for attention, it's interesting that the current liabilities have actually gone up over the last five years. This is intriguing because if current liabilities hadn't increased to 53% of total assets, this reported ROCE would probably be less than20% because total capital employed would be higher.The 20% ROCE could be even lower if current liabilities weren't 53% of total assets, because the the formula would show a larger base of total capital employed. Additionally, this high level of current liabilities isn't ideal because it means the company's suppliers (or short-term creditors) are effectively funding a large portion of the business.

In Conclusion...

Although is allocating it's capital efficiently to generate impressive returns, it isn't compounding its base of capital, which is what we'd see from a multi-bagger. Although the market must be expecting these trends to improve because the stock has gained 62% over the last five years. But if the trajectory of these underlying trends continue, we think the likelihood of it being a multi-bagger from here isn't high.

On a separate note, we've found 4 warning signs for CSG Systems International you'll probably want to know about.

If you'd like to see other companies earning high returns, check out our free list of companies earning high returns with solid balance sheets here.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:CSGS

CSG Systems International

Provides revenue management and digital monetization, customer experience, and payment solutions primarily to the communications industry in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives