- United States

- /

- Personal Products

- /

- NasdaqGM:ODD

June 2025's High Insider Ownership Growth Stocks

Reviewed by Simply Wall St

In the last week, the United States market has remained flat, yet it has seen a 10.0% increase over the past year with earnings anticipated to grow by 15% annually in the coming years. In such an environment, growth companies with high insider ownership can be attractive as they often signal confidence from those closest to the business and may align well with expected earnings growth.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Zscaler (ZS) | 36.4% | 47.7% |

| Super Micro Computer (SMCI) | 16.2% | 39.1% |

| Spotify Technology (SPOT) | 16.2% | 25.6% |

| Prairie Operating (PROP) | 34.6% | 75.7% |

| On Holding (ONON) | 17.4% | 22.8% |

| FTC Solar (FTCI) | 28.3% | 62.5% |

| Enovix (ENVX) | 12.1% | 58.4% |

| Credo Technology Group Holding (CRDO) | 12% | 45% |

| Atour Lifestyle Holdings (ATAT) | 22.6% | 24.1% |

| Astera Labs (ALAB) | 14.8% | 44.4% |

Let's take a closer look at a couple of our picks from the screened companies.

Corcept Therapeutics (CORT)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Corcept Therapeutics Incorporated focuses on discovering and developing medications for severe endocrinologic, oncologic, metabolic, and neurologic disorders in the United States, with a market cap of approximately $7.57 billion.

Operations: Corcept Therapeutics generates revenue primarily through the discovery, development, and commercialization of pharmaceutical products, amounting to $685.45 million.

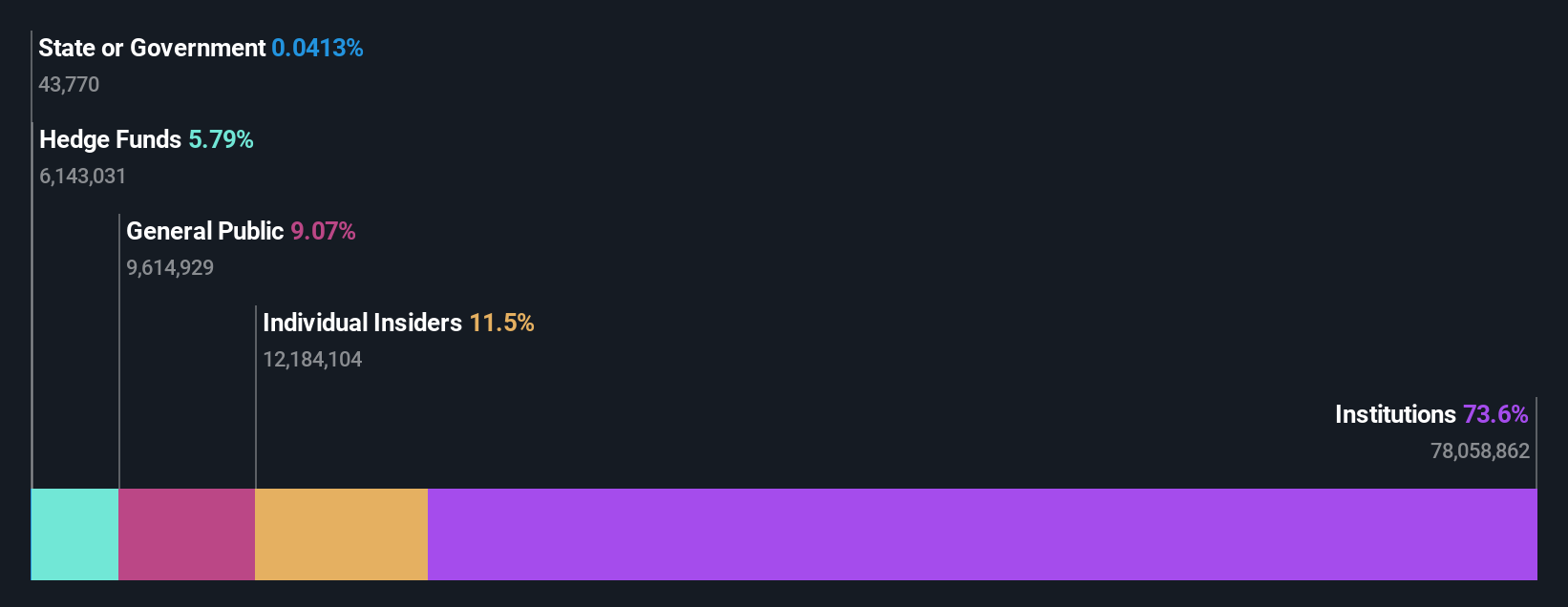

Insider Ownership: 11.5%

Corcept Therapeutics, known for its focus on cortisol modulation, exhibits strong growth potential with expected annual earnings and revenue growth rates of 42.2% and 26.4%, respectively, outpacing the US market. Despite recent earnings declines, the company remains committed to advancing treatments for serious disorders like ALS and ovarian cancer through promising trials such as DAZALS and ROSELLA. Insider trading activity has been minimal recently, with more shares bought than sold over the past three months.

- Click here to discover the nuances of Corcept Therapeutics with our detailed analytical future growth report.

- In light of our recent valuation report, it seems possible that Corcept Therapeutics is trading beyond its estimated value.

Oddity Tech (ODD)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Oddity Tech Ltd. is a consumer tech company that creates digital-first brands in the beauty and wellness sectors both in the United States and internationally, with a market cap of approximately $4 billion.

Operations: The company's revenue is primarily generated from its Personal Products segment, which amounts to $703.49 million.

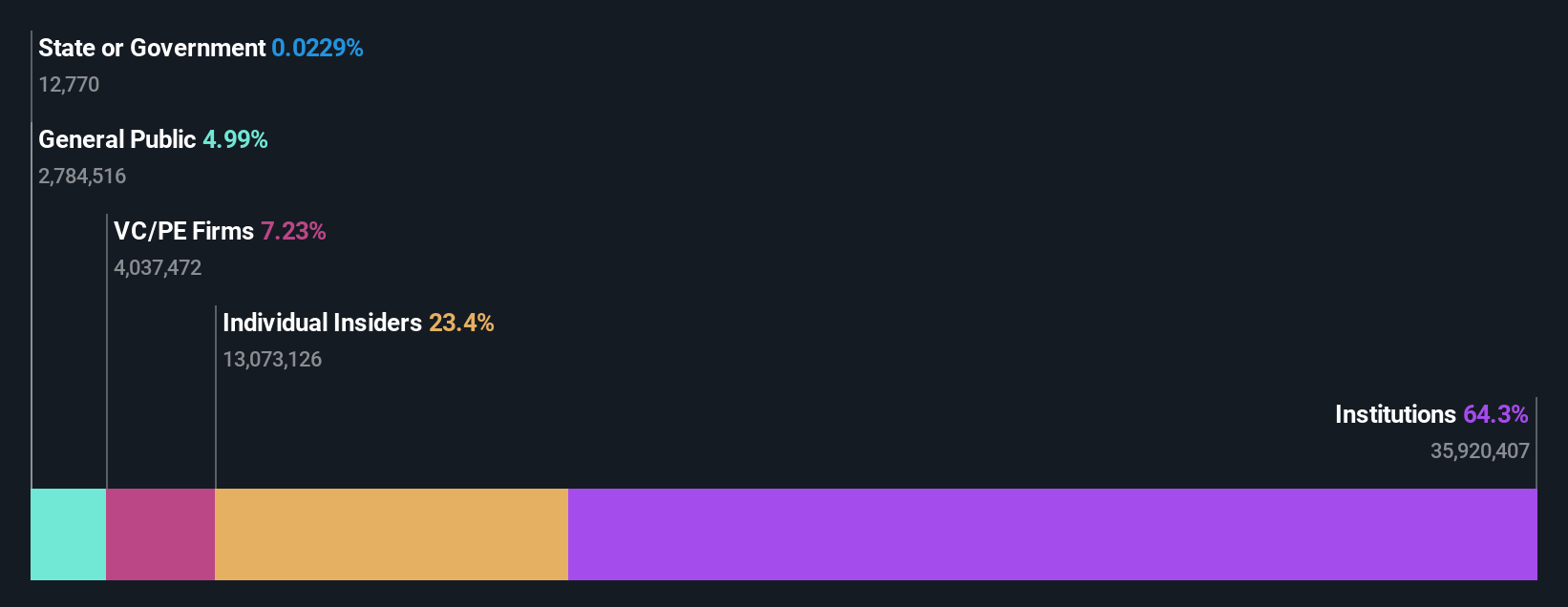

Insider Ownership: 23.4%

Oddity Tech demonstrates strong growth potential, with earnings forecasted to grow significantly at 24.79% annually, surpassing the US market average. Recent corporate guidance raised revenue expectations for 2025, indicating robust performance with projected net revenue between US$790 million and US$798 million. Despite high share price volatility, Oddity's return on equity is expected to be substantial in three years at 28.9%. Insider trading activity has been minimal over the past three months.

- Take a closer look at Oddity Tech's potential here in our earnings growth report.

- Upon reviewing our latest valuation report, Oddity Tech's share price might be too optimistic.

CoreWeave (CRWV)

Simply Wall St Growth Rating: ★★★★★☆

Overview: CoreWeave, Inc. operates a cloud platform focused on scaling, support, and acceleration for GenAI with a market cap of $88.11 billion.

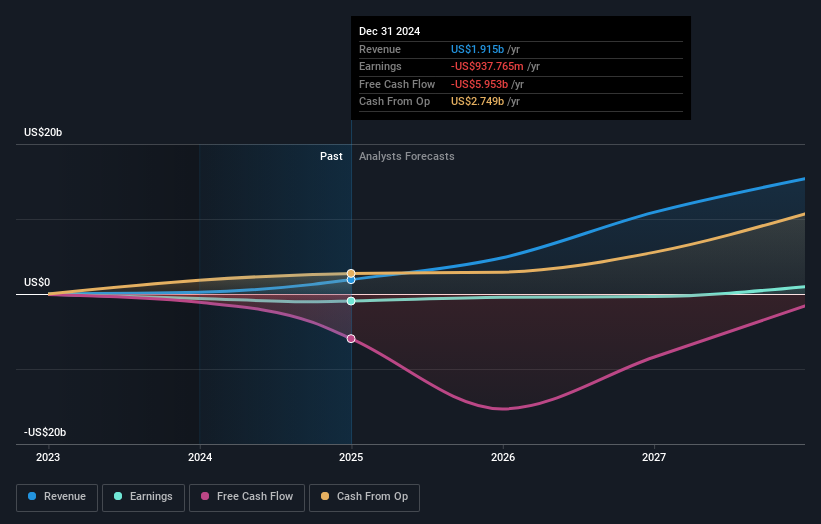

Operations: The company generates revenue from its cloud platform through the data processing segment, which amounts to $2.71 billion.

Insider Ownership: 29.6%

CoreWeave is positioned for significant growth, with revenue projected to increase at 37.1% annually, outpacing the US market. Despite recent share price volatility and a limited cash runway, CoreWeave's strategic initiatives include launching AI cloud products and securing substantial deals like a $4 billion contract with OpenAI. Although insider trading has been minimal recently, the company aims to become profitable within three years while leveraging its advanced AI infrastructure capabilities demonstrated through industry-leading MLPerf benchmark results.

- Delve into the full analysis future growth report here for a deeper understanding of CoreWeave.

- Our comprehensive valuation report raises the possibility that CoreWeave is priced higher than what may be justified by its financials.

Next Steps

- Investigate our full lineup of 194 Fast Growing US Companies With High Insider Ownership right here.

- Want To Explore Some Alternatives? Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:ODD

Oddity Tech

Operates as a consumer tech company that builds digital-first brands for the beauty and wellness industries in the United States and internationally.

Flawless balance sheet and good value.

Market Insights

Community Narratives