- United States

- /

- Software

- /

- NasdaqGS:CRWD

How CrowdStrike Holdings' (CRWD) Strong Revenue Amid Rising Losses Has Changed Its Investment Story

Reviewed by Simply Wall St

- CrowdStrike Holdings recently released its second quarter financial results, showing revenue of US$1.17 billion, but reported a net loss of US$77.68 million compared to net income a year ago, and updated its guidance for the next quarter and fiscal year.

- While the company achieved substantial revenue growth, it did not repurchase any shares under its recent buyback authorization and experienced a shift from profitability to a net loss year-on-year.

- We will assess how the company's strong revenue growth, despite increasing losses, influences its future investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

CrowdStrike Holdings Investment Narrative Recap

To be a shareholder in CrowdStrike Holdings, you need to believe in the company's ability to convert strong revenue growth into sustainable profitability amidst rising competition in cloud security. This quarter's results underscore the short-term catalyst of robust top-line expansion, but the return to net losses highlights a key risk: whether margin pressures and growing costs might persist. The recent news around buyback inactivity is not material enough to affect these underlying drivers.

The most relevant announcement is the new earnings guidance, which maintains a strong outlook for revenue growth through the next quarter and fiscal year. This supports ongoing optimism around customer adoption of subscription models and new AI offerings but also keeps the spotlight on the challenge of balancing rapid expansion with profitability objectives.

By contrast, investors should be aware that non-GAAP adjustments and bottom-line volatility could make it difficult to assess the company’s true margin trajectory and future...

Read the full narrative on CrowdStrike Holdings (it's free!)

CrowdStrike Holdings' outlook forecasts $7.6 billion in revenue and $610.6 million in earnings by 2028. This projection assumes a 22.4% annual revenue growth rate and an earnings increase of $782.9 million from the current earnings of -$172.3 million.

Uncover how CrowdStrike Holdings' forecasts yield a $468.95 fair value, a 13% upside to its current price.

Exploring Other Perspectives

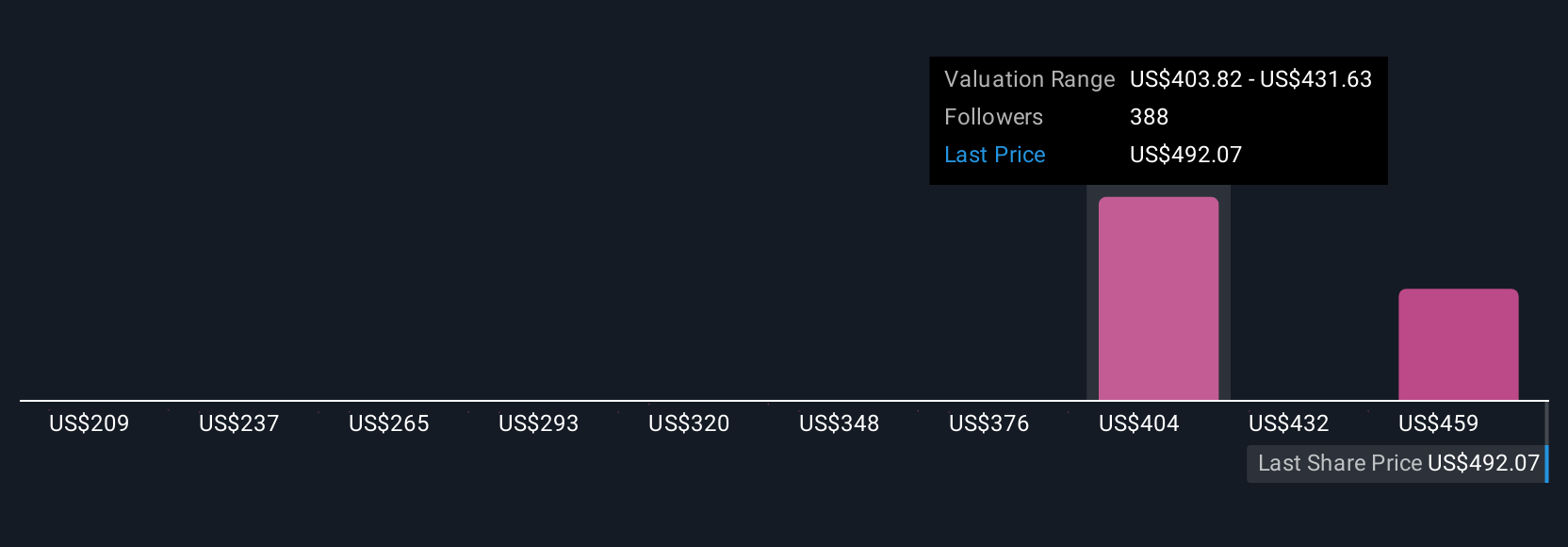

Fair value estimates from 33 Simply Wall St Community members for CrowdStrike Holdings range from US$200 to US$544.42 per share. While many see rapid customer and product adoption as key, the concern about profit volatility remains front of mind for those tracking the company's trajectory. Explore several alternative viewpoints and consider how your expectations align.

Explore 33 other fair value estimates on CrowdStrike Holdings - why the stock might be worth as much as 32% more than the current price!

Build Your Own CrowdStrike Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CrowdStrike Holdings research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free CrowdStrike Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CrowdStrike Holdings' overall financial health at a glance.

Curious About Other Options?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 29 best rare earth metal stocks of the very few that mine this essential strategic resource.

- AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Explore 23 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CRWD

CrowdStrike Holdings

Provides cybersecurity solutions in the United States and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives