- United States

- /

- Software

- /

- NasdaqGS:CRWD

CrowdStrike (CRWD) Valuation in Focus After Raised Outlook and Strong Revenue Growth

Reviewed by Simply Wall St

If you’ve had your eye on CrowdStrike Holdings (CRWD) lately, you’ve probably noticed the recent buzz around its stock. The excitement started after the company reported earnings that beat expectations and raised its revenue guidance for both the third quarter and the full year. This upbeat tone is reinforced by a surge in demand for its Falcon Flex subscription, as well as deepening partnerships with giants like NVIDIA and Amazon Business Prime. For investors weighing their next move, this latest update puts CrowdStrike firmly back into focus.

The upbeat news has added fuel to a rally that has already been building this year. Shares of CrowdStrike are up nearly 21% year to date, handily outpacing competitors, and the momentum seems to reflect confidence in the company’s rapid customer growth and consistent expansion of its core business. Even over the longer term, CrowdStrike’s returns have impressed, with three- and five-year gains well above market averages. Continued strategic initiatives, including an acquisition to boost data processing power, contribute to the narrative that this is a company not just growing fast but also aiming to widen its lead.

The real question for investors now is whether there is still room for upside, or if the market has already priced in all that future growth.

Most Popular Narrative: 0.7% Undervalued

According to Tokyo, the current valuation of CrowdStrike is considered slightly below its fair value. This reflects optimism in the company's flexible business model and ambitious growth targets.

The falcon suit already covers 20 different modules. CRWD is also very active in acquisitions, so the suit will be extended continuously. This is ideal for customers because all modules are interconnected and silos are eliminated. In my opinion, they have the perfect product, similar to Netflix.

Think you’ve seen everything about CrowdStrike? This narrative claims the company could outpace expectations thanks to a unique modular platform, fast-growing subscription base, and continuous expansion. Wonder what bold growth assumptions are fueling this call? Discover the secrets behind Tokyo’s fair value calculation and see which driver stands out most.

Result: Fair Value of $431.24 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, rapid growth does not guarantee future outperformance. Slower-than-expected customer adoption or security incidents could quickly shift sentiment on CrowdStrike's prospects.

Find out about the key risks to this CrowdStrike Holdings narrative.Another View: Market Comps Tell a Different Story

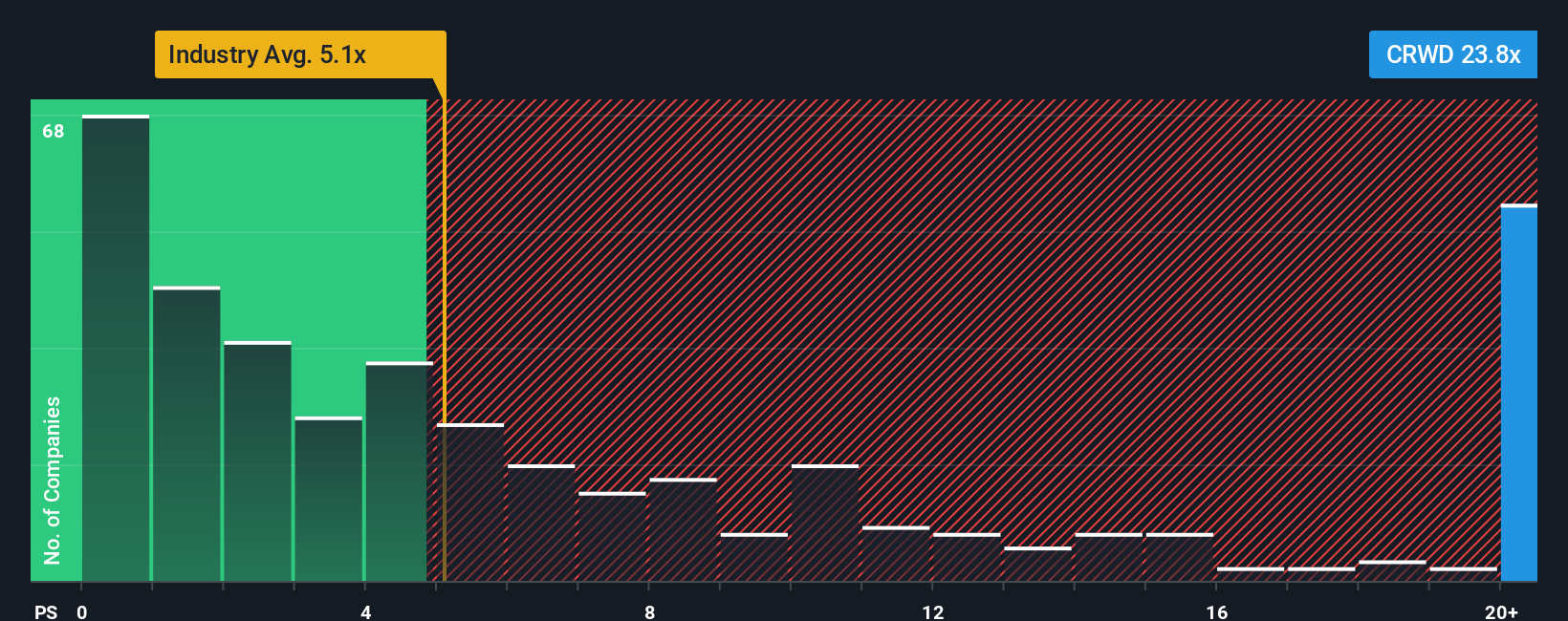

Yet, if we check how CrowdStrike stacks up against others in its industry using a common valuation ratio, a different picture appears. By this measure, the stock actually looks expensive. Which method will prove right in the end?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding CrowdStrike Holdings to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own CrowdStrike Holdings Narrative

If you see things differently or want to check the numbers for yourself, you can shape your own CrowdStrike story in just a few minutes. Do it your way.

A great starting point for your CrowdStrike Holdings research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Step up your investing game and unlock untapped opportunities right now. Strategic research helps ensure you never let tomorrow’s winners slip past you.

- Spot value by identifying companies trading below their true potential when you use our list of undervalued stocks based on cash flows.

- Enhance your search for reliable yields by accessing firms offering dividend stocks with yields > 3% for a stronger income stream.

- Explore the future of healthcare breakthroughs powered by artificial intelligence through our handpicked collection of healthcare AI stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NasdaqGS:CRWD

CrowdStrike Holdings

Provides cybersecurity solutions in the United States and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion