- United States

- /

- Software

- /

- NasdaqGS:CORZ

Core Scientific (CORZ): Examining Valuation After Recent Share Price Volatility

Reviewed by Simply Wall St

Core Scientific (CORZ) has seen its share price fluctuate notably in recent sessions, with investors analyzing changes in the broader crypto mining landscape and company-specific performance trends. The company remains a focal point for those who are watching the blockchain sector.

See our latest analysis for Core Scientific.

After a rocky week where Core Scientific’s share price tumbled more than 20%, recent volatility reflects shifting sentiment in the wider crypto mining space, not just company headlines. Long-term momentum remains positive. A 19.6% year-to-date share price return and a 1.5% total shareholder return over the past year suggest investors are still weighing both potential and risks in the story ahead.

If these big swings have you looking for new opportunities, this could be a prime moment to broaden your search and discover fast growing stocks with high insider ownership

With shares still trading at a significant discount to analyst targets and annual revenue growth outpacing much of the sector, investors may wonder whether Core Scientific is an overlooked value play or if the market is already factoring in its future prospects.

Most Popular Narrative: 31.4% Undervalued

Compared to the recent closing price of $17.32, the most widely followed narrative puts Core Scientific’s fair value at $25.25. This substantial gap has investors wondering what’s driving such optimism in the face of recent volatility.

Core Scientific’s significant power portfolio, combined with strong demand for high performance computing and artificial intelligence infrastructure, positions it favorably within the digital infrastructure sector. Analysts anticipate continued positive re-ratings for companies with robust energy and data center resources. This suggests Core Scientific could benefit from broader sector tailwinds.

Want to uncover what’s fueling this bold price target? The narrative stands on projections of industry-leading revenue growth, improved profitability, and a shift into high-demand AI infrastructure. What financial leap is really baked in here? Click through for the sharp assumptions and daring numbers that shape this narrative’s fair value.

Result: Fair Value of $25.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent net losses and heavy dependence on a single major client mean that any missteps could quickly put the bullish outlook at risk.

Find out about the key risks to this Core Scientific narrative.

Another View: Looking at Sales Multiples

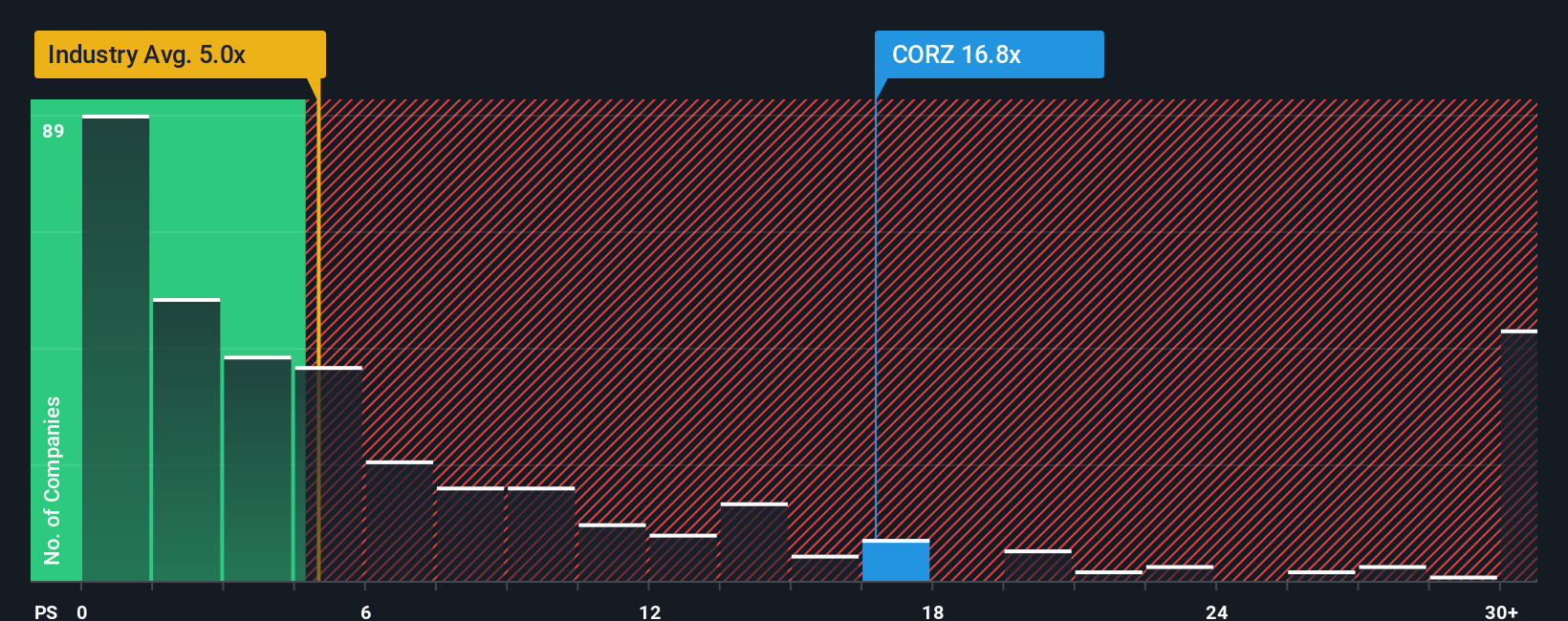

While fair value estimates suggest Core Scientific is undervalued, a quick check on its price-to-sales ratio presents a different picture. The company trades at 16.1 times sales, which is well above both the peer average of 5.1 and the industry average of 4.8. In addition, the market's fair ratio estimate is just 6.6.

This means that compared to its revenue, shares appear expensive relative to peers and what the market could price in. Is the optimism in the fair value justified, or does this signal caution for new investors?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Core Scientific Narrative

If the existing narratives do not align with your perspective or you want to dig deeper into the data, you can shape your own view of Core Scientific in under three minutes, all on your terms. Do it your way

A great starting point for your Core Scientific research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Expand Your Investment Opportunities Today

Don’t let this moment slip by. Tap into other standout investment ideas with Simply Wall Street’s powerful screener and put your money to smarter use now.

- Capitalize on the rise of game-changing technologies by tapping into the enormous potential of these 25 AI penny stocks.

- Start building passive income streams with generous yields when you review these 15 dividend stocks with yields > 3% offering stability and regular returns.

- Make the most of undervalued opportunities by putting your focus on these 854 undervalued stocks based on cash flows primed for tomorrow’s growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CORZ

Core Scientific

Provides digital asset mining services in the United States.

High growth potential with very low risk.

Similar Companies

Market Insights

Community Narratives