- United States

- /

- Software

- /

- NasdaqCM:CLSK

What CleanSpark (CLSK)'s August Bitcoin Production and Sales Reveal for Shareholders

Reviewed by Simply Wall St

- CleanSpark, Inc. recently reported unaudited operating results for August 2025, producing 657 Bitcoin and selling 533.5 Bitcoin at an average price of approximately US$113,800 each.

- These monthly updates provide a clear view of CleanSpark's mining output and sales performance, critical in the highly variable cryptocurrency sector.

- With this operational snapshot in mind, we'll consider how August's Bitcoin production and sales volumes might influence CleanSpark's investment outlook.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

CleanSpark Investment Narrative Recap

To be a shareholder in CleanSpark, you need confidence in Bitcoin’s long-term relevance, institutional demand, and the company’s ability to maintain cost-efficient mining operations. August’s steady Bitcoin production and robust sales, while slightly lower than prior months, do not significantly alter the near-term outlook. The biggest current catalyst remains CleanSpark’s scalable, low-cost mining infrastructure, while reliance on high Bitcoin prices persists as the central risk.

The most directly relevant recent announcement is CleanSpark’s August 2025 operating update. This production snapshot confirms operational consistency, which matters given ongoing block reward halvings and the sector’s volatility. The interplay between Bitcoin output, average realized price, and operational efficiency ties directly to near-term revenue and margin catalysts, reinforcing how closely the stock’s outlook is tethered to core mining trends.

However, investors should also be aware that if Bitcoin’s price fails to keep pace with diminishing block rewards and rising costs, then ...

Read the full narrative on CleanSpark (it's free!)

CleanSpark's narrative projects $1.5 billion in revenue and $319.0 million in earnings by 2028. This requires 32.5% yearly revenue growth and a $26.5 million increase in earnings from $292.5 million today.

Uncover how CleanSpark's forecasts yield a $20.16 fair value, a 118% upside to its current price.

Exploring Other Perspectives

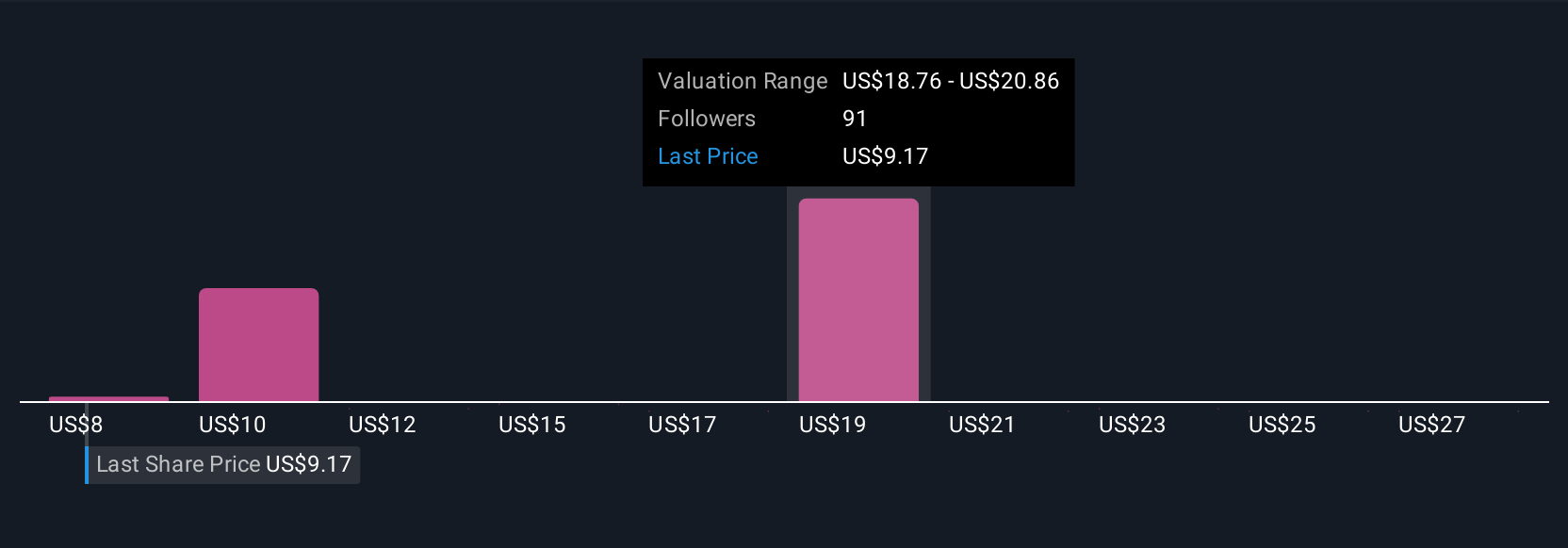

Private investors in the Simply Wall St Community published 17 fair value estimates for CleanSpark, ranging from US$8.26 to US$29.26 per share. While opinions differ, revenue growth forecasts above 20 percent annually remain a focal point for many participants weighing the company’s future potential.

Explore 17 other fair value estimates on CleanSpark - why the stock might be worth 11% less than the current price!

Build Your Own CleanSpark Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CleanSpark research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

- Our free CleanSpark research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CleanSpark's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 30 best rare earth metal stocks of the very few that mine this essential strategic resource.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:CLSK

Very undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives