- United States

- /

- Software

- /

- NasdaqCM:CLSK

CleanSpark (CLSK) Expands Credit Line With Bitcoin-Backed Loan Is Data Center Growth Entering a New Phase?

Reviewed by Sasha Jovanovic

- In September 2025, CleanSpark reported the sale of 444.95 Bitcoin and the production of 629 Bitcoin, alongside the announcement of a new US$100 million Bitcoin-backed credit facility that expanded its total lending capacity to US$400 million.

- This increased lending capacity comes at a time of heightened institutional and governmental interest in Bitcoin, reflecting how capital access and infrastructure expansion remain central to success in the mining sector.

- We'll examine how CleanSpark’s expanded credit facility improves its ability to pursue data center growth in a rapidly evolving Bitcoin landscape.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

CleanSpark Investment Narrative Recap

For shareholders, the CleanSpark story ultimately hinges on the continued growth of Bitcoin adoption, high digital asset prices, and the company’s disciplined expansion of efficient mining infrastructure. The newly secured US$100 million credit facility meaningfully strengthens CleanSpark’s financial flexibility, but does not materially change the most important short-term catalyst, Bitcoin price performance, nor does it offset the ongoing structural risks posed by Bitcoin price volatility and mining economics.

Among recent developments, the announcement of the expanded Bitcoin-backed lending capacity is particularly relevant, as it gives CleanSpark more capital to deploy for data center growth at a time when mining competition is increasing. This enhances the company’s position but does not remove industry-wide pressures from rising mining difficulty and ongoing block reward halvings. Contrasting this, investors should also be aware of the risk of structural revenue compression if Bitcoin’s price or fees do not keep pace with growing network difficulty…

Read the full narrative on CleanSpark (it's free!)

CleanSpark's narrative projects $1.5 billion revenue and $319.0 million earnings by 2028. This requires 32.5% yearly revenue growth and a $26.5 million increase in earnings from $292.5 million.

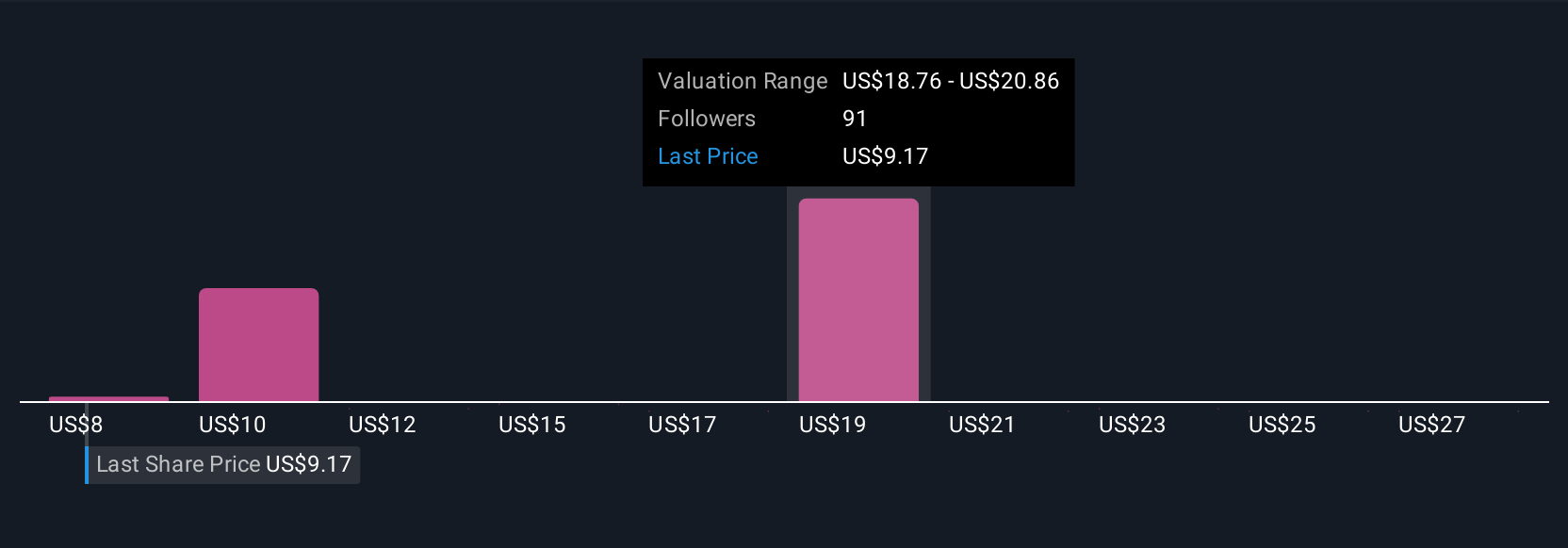

Uncover how CleanSpark's forecasts yield a $20.16 fair value, a 5% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members provided 19 individual fair value estimates for CleanSpark ranging from US$5.18 to US$33 per share. While views differ, many participants are watching how CleanSpark’s improved access to capital supports its growth as mining challenges mount. Consider exploring these views for insights outside consensus estimates.

Explore 19 other fair value estimates on CleanSpark - why the stock might be worth less than half the current price!

Build Your Own CleanSpark Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CleanSpark research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free CleanSpark research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CleanSpark's overall financial health at a glance.

Seeking Other Investments?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:CLSK

Adequate balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives