- United States

- /

- Software

- /

- NasdaqCM:CLSK

Assessing CleanSpark (CLSK) Valuation Following $400 Million Bitcoin-Backed Credit Expansion and Sector Optimism

Reviewed by Kshitija Bhandaru

CleanSpark, Inc. is drawing attention after expanding its Bitcoin-backed credit lines to $400 million. This move significantly increases its access to non-dilutive capital and aims to support its ongoing data center growth and high-performance computing projects.

See our latest analysis for CleanSpark.

After a remarkable surge this year, CleanSpark's share price is now up 104% year-to-date and sits at $19.28, even with some pullbacks such as the recent one-day dip of 4%. Momentum has been especially robust over the past month, with an 86% share price return. This reflects a broader wave of enthusiasm around Bitcoin miners expanding into AI and high-performance computing. With these strategic moves and a 581% total return over the last three years, CleanSpark is clearly attracting attention for both its near-term growth initiatives and long-term upside.

If you’re curious where else growth and innovation might be accelerating, this is the perfect moment to explore fast growing stocks with high insider ownership.

With CleanSpark’s share price soaring and the company positioned at the forefront of a surging sector, the critical question now is whether the current valuation fully reflects its future growth or if a genuine buying opportunity remains for investors.

Most Popular Narrative: 4.4% Undervalued

With CleanSpark shares trading at $19.28 and the narrative fair value at $20.16, the most widely followed view sees a modest upside from current levels. The real reasons for this gap lie deeper in aggressive growth assumptions and evolving business trends.

Regulatory clarity and supportive policy developments in the U.S., such as new federal and state-level legislation recognizing Bitcoin, stablecoins, and mining, are expected to drive increased institutional adoption and deeper integration with mainstream financial markets. This may boost future Bitcoin demand, positively impacting CleanSpark's revenue and long-term growth trajectory. CleanSpark's fully self-operated, scalable, and power-efficient infrastructure enables it to mine Bitcoin at a significantly lower cost than the market price. Further capacity expansion is poised to drive sustained increases in Bitcoin production, improving revenue and supporting higher net margins.

Think you know what powers this optimistic outlook? There is a bold financial forecast lurking behind these numbers, including a jump in revenue and profit margins that only a handful of miners could hope to achieve. Curious to see the assumptions and projections driving this consensus? Click through to unlock the details the market may be missing.

Result: Fair Value of $20.16 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, CleanSpark’s future depends on maintaining high Bitcoin prices and navigating uncertainties in profitability as competition and industry challenges evolve.

Find out about the key risks to this CleanSpark narrative.

Another View: The Market Multiple Perspective

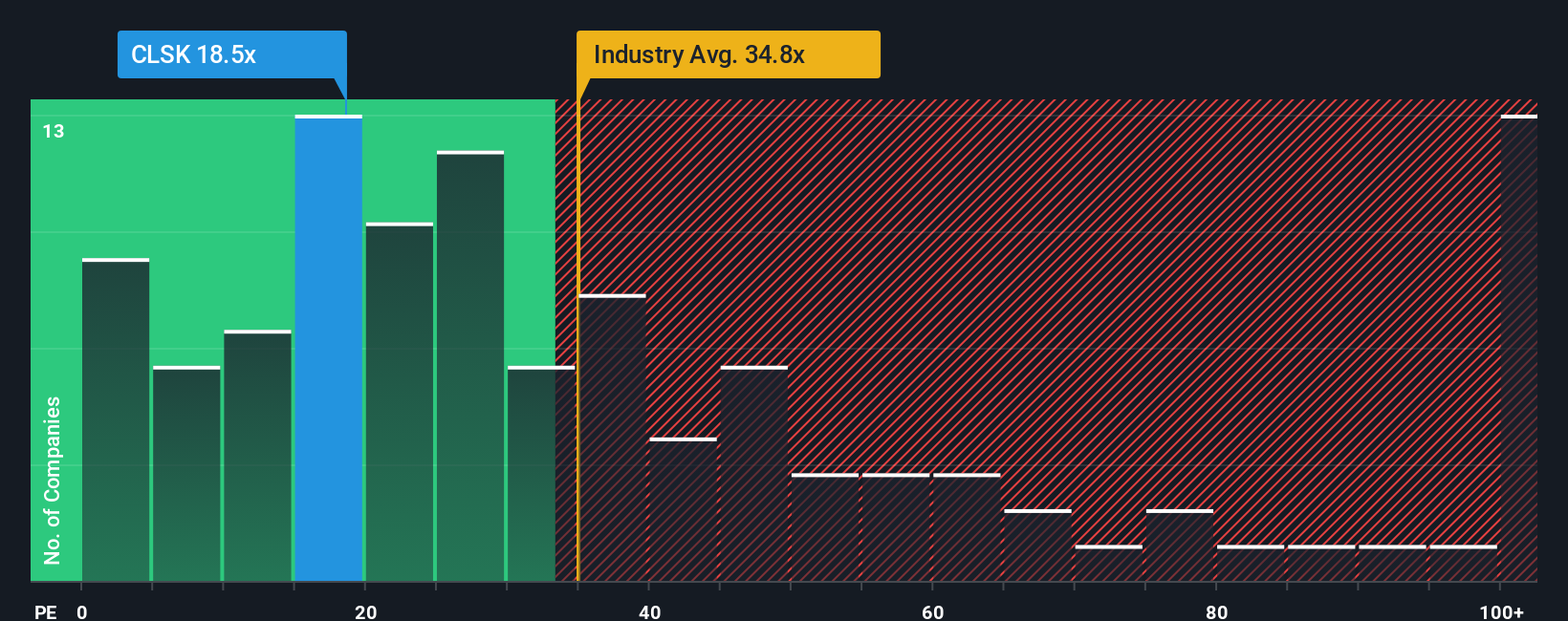

Looking from another angle, CleanSpark’s price-to-earnings ratio stands at 18.5x. This is higher than its peers, whose average is 12.8x, but still sits below the broader US Software industry at 34.8x. Compared to its fair ratio of 24.4x, the current market multiple suggests shares are trading at a discount to where the market could one day value them. With such a split between benchmarks, is this relative undervaluation a sign of opportunity, or does it point to hidden risks for new investors?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own CleanSpark Narrative

If you’re the type who prefers hands-on analysis or sees a different story in the numbers, you can easily shape your own CleanSpark outlook in under three minutes. Start now with Do it your way.

A great starting point for your CleanSpark research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Stock Ideas?

Don’t just watch from the sidelines while others seize opportunities. Level up your investing strategy and unlock real potential with these hand-picked opportunities available right now:

- Capitalize on tomorrow’s breakthroughs by checking out these 24 AI penny stocks that are transforming our world with artificial intelligence innovation and disruptive growth stories.

- Boost your portfolio’s income potential and stability as you target these 19 dividend stocks with yields > 3% boasting sustainable yields and consistent performance in changing markets.

- Ride the tailwinds of emerging technologies. Take a look at these 26 quantum computing stocks positioned at the frontier of quantum computing advancements and industrial momentum.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:CLSK

Adequate balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives