- United States

- /

- Software

- /

- NasdaqCM:CLSK

A Look at CleanSpark (CLSK)'s Valuation Following New $100 Million Bitcoin-Backed Credit Facility

Reviewed by Kshitija Bhandaru

CleanSpark (CLSK) announced a new $100 million bitcoin-backed credit facility, increasing its total capital base to $400 million. This fresh funding highlights the company’s ongoing push into data center growth and digital asset initiatives.

See our latest analysis for CleanSpark.

CleanSpark’s headline-grabbing $100 million credit facility comes on the heels of sector-wide momentum, as bitcoin miners outperform bitcoin itself and companies race to expand capacity. September saw CleanSpark mine 629 BTC and close out a transformative fiscal year with notable acquisitions and balance sheet moves. Reflecting all this activity and growing optimism, CleanSpark delivered a strong 1-year total shareholder return of nearly 66%. This is evidence that the market is rewarding its strategic bets on growth and renewable energy.

If CleanSpark’s financing play has you considering where the next big winners might be, it’s a great moment to broaden your outlook and discover fast growing stocks with high insider ownership

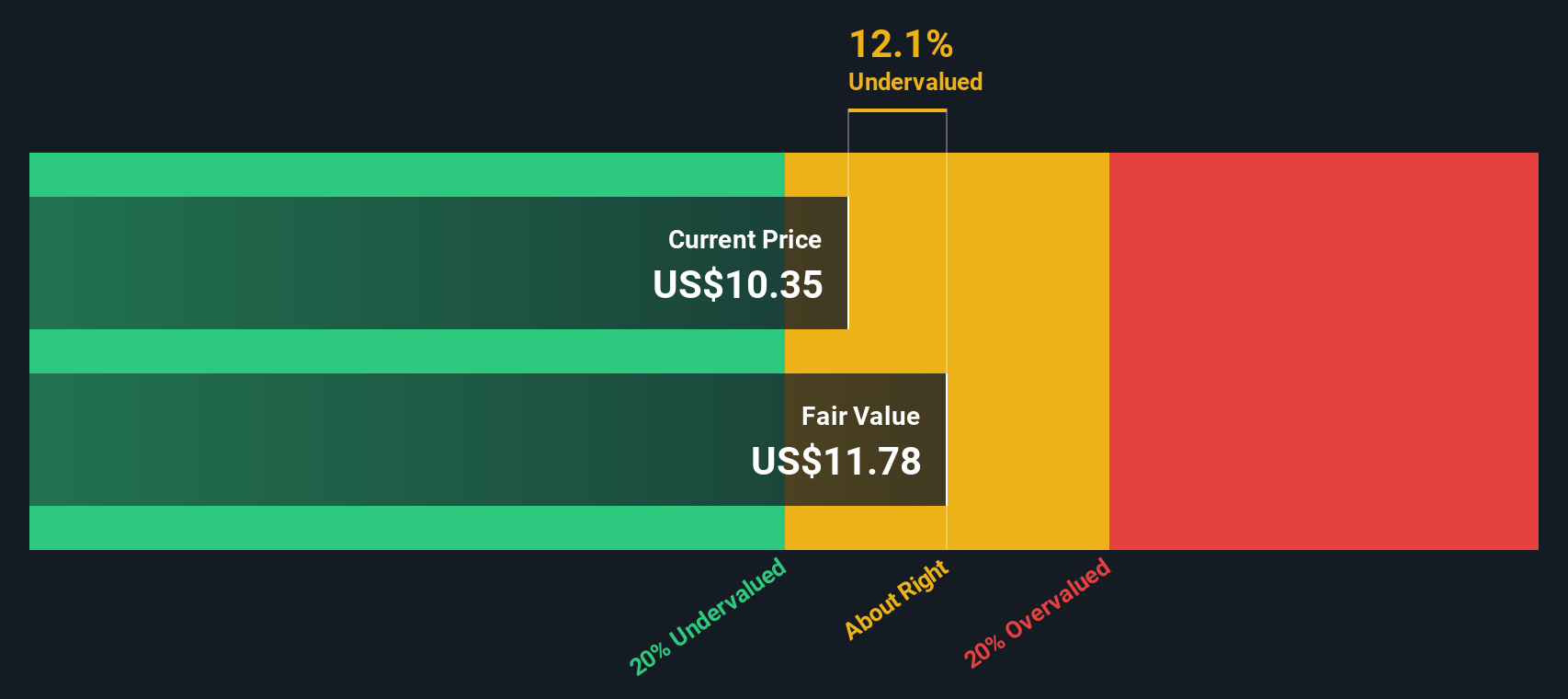

With CleanSpark’s shares climbing and optimism fueling the mining sector, the real question for investors is whether CLSK remains undervalued after its run or if future growth is already reflected in today’s price.

Most Popular Narrative: 20.9% Undervalued

With CleanSpark’s fair value estimate pegged significantly above the last close, momentum has shifted. The most widely followed narrative sees room for further upside from today’s price and sets high expectations for future results.

“CleanSpark’s fully self-operated, scalable, and power-efficient infrastructure enables it to mine Bitcoin at a significantly lower cost than the market price. Further capacity expansion (an additional 10 exahash and over 200 megawatts of contracted power, ready for rapid deployment) is poised to drive sustained increases in Bitcoin production, improve revenue, and support higher net margins.”

Want to know what’s pushing CleanSpark’s price target so much higher than today’s market? The narrative leans on aggressive expansion and surprising profitability assumptions. What’s the magic metric behind the story? Get the full calculation that’s turning heads and see why analysts think more gains could be on the table.

Result: Fair Value of $20.16 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing Bitcoin price volatility and CleanSpark’s focus on a single sector could compress margins or dampen growth if market conditions shift suddenly.

Find out about the key risks to this CleanSpark narrative.

Another View: What Our SWS DCF Model Says

While analysts see upside based on growth and sentiment, our SWS DCF model tells a more reserved story. According to our calculations, CleanSpark's shares are actually trading above our fair value estimate. This suggests the optimism could already be fully priced in. Should investors be concerned that the market’s expectations are running ahead of the fundamentals?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out CleanSpark for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own CleanSpark Narrative

If you see things differently or want to dig into the numbers yourself, it only takes a few minutes to shape your own view and narrative. So why not Do it your way

A great starting point for your CleanSpark research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t limit yourself to just one opportunity. Expand your watchlist and never miss a winning trend by harnessing the power of Simply Wall Street’s unique stock screeners.

- Boost your income potential and unlock steady cash flow by checking out these 19 dividend stocks with yields > 3% offering yields above 3%.

- Power your portfolio with the innovators revolutionizing healthcare through cutting-edge AI. Start with these 31 healthcare AI stocks.

- Position yourself early in tomorrow’s high-flying sectors. Uncover value among these 3558 penny stocks with strong financials showing financial strength.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:CLSK

Adequate balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives