Three Stocks Estimated To Be Trading At Discounts Between 26.4% And 33.5%

Reviewed by Simply Wall St

As global markets exhibit mixed performance with a notable pivot towards value and small-cap stocks, investors are keenly observing opportunities where potential undervaluations might present attractive entry points. In the current environment, identifying stocks trading at a discount could align well with broader market trends favoring more conservatively valued assets.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Imeik Technology DevelopmentLtd (SZSE:300896) | CN¥161.43 | CN¥322.03 | 49.9% |

| Popular (NasdaqGS:BPOP) | US$101.20 | US$201.65 | 49.8% |

| PSK (KOSDAQ:A319660) | ₩31250.00 | ₩62191.28 | 49.8% |

| Oddity Tech (NasdaqGM:ODD) | US$39.45 | US$78.79 | 49.9% |

| First Community (NasdaqCM:FCCO) | US$21.61 | US$43.14 | 49.9% |

| Super Hi International Holding (SEHK:9658) | HK$12.94 | HK$25.78 | 49.8% |

| Radici Pietro Industries & Brands (BIT:RAD) | €1.10 | €2.19 | 49.8% |

| RaySearch Laboratories (OM:RAY B) | SEK140.00 | SEK278.40 | 49.7% |

| ArcticZymes Technologies (OB:AZT) | NOK24.55 | NOK48.82 | 49.7% |

| Glenveagh Properties (ISE:GVR) | €1.40 | €2.79 | 49.9% |

Below we spotlight a couple of our favorites from our exclusive screener.

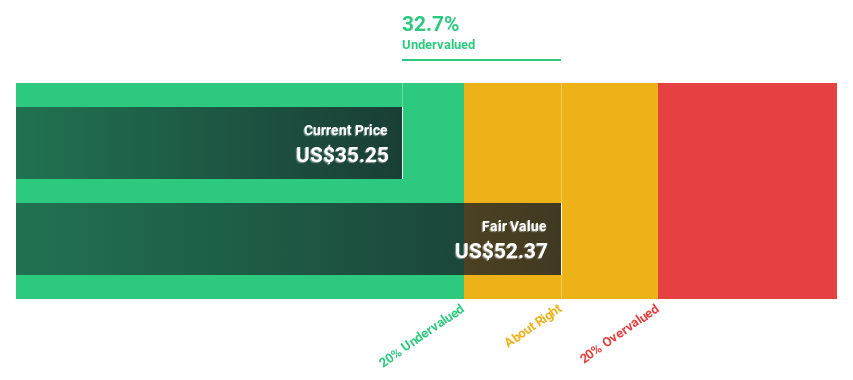

Cellebrite DI (NasdaqGS:CLBT)

Overview: Cellebrite DI Ltd. specializes in creating solutions for legally sanctioned investigations across various global regions, with a market capitalization of approximately $2.58 billion.

Operations: The company generates its revenue primarily from the Internet Software & Services segment, totaling $329.25 million.

Estimated Discount To Fair Value: 26.4%

Cellebrite DI, priced at US$13.15, trades below its estimated fair value of US$17.86, reflecting a significant undervaluation based on discounted cash flow analysis. Despite having negative shareholder equity and experiencing shareholder dilution over the past year, Cellebrite is expected to achieve profitability within three years with forecasted earnings growth substantially outpacing the market average. Additionally, its revenue growth rate of 14.2% annually is set to exceed the U.S market's 8.6%, bolstered by strategic expansions like the recent establishment of Cellebrite Federal Solutions to enhance U.S federal government engagements.

- According our earnings growth report, there's an indication that Cellebrite DI might be ready to expand.

- Unlock comprehensive insights into our analysis of Cellebrite DI stock in this financial health report.

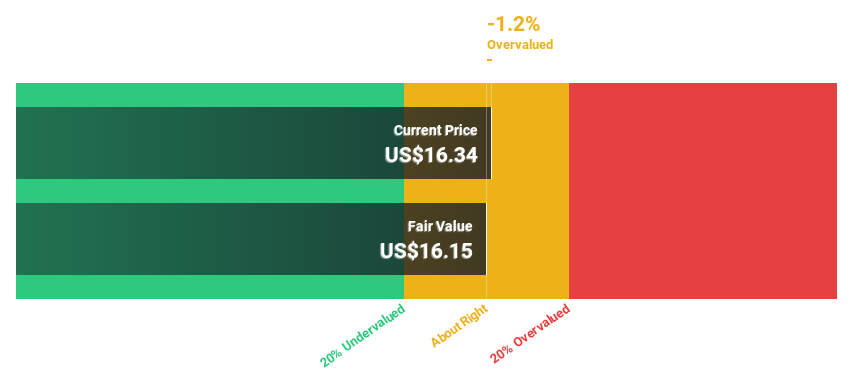

WaFd (NasdaqGS:WAFD)

Overview: WaFd, Inc. serves as the bank holding company for Washington Federal Bank, offering lending, depository, insurance, and other banking services across the United States with a market capitalization of approximately $2.79 billion.

Operations: The company's revenue primarily comes from its thrift and savings and loan institutions, generating $666.87 million.

Estimated Discount To Fair Value: 26.5%

WaFd, trading at US$34.98, is valued below its fair value estimate of US$47.6, suggesting a significant undervaluation based on cash flows. Despite recent shareholder dilution and significant insider selling over the past three months, WaFd's earnings are projected to grow by 25.1% annually, outstripping the U.S market average of 14.7%. Additionally, its revenue growth forecast at 13.9% annually also exceeds market expectations of 8.6%, positioning it attractively for future performance despite some current challenges.

- Upon reviewing our latest growth report, WaFd's projected financial performance appears quite optimistic.

- Get an in-depth perspective on WaFd's balance sheet by reading our health report here.

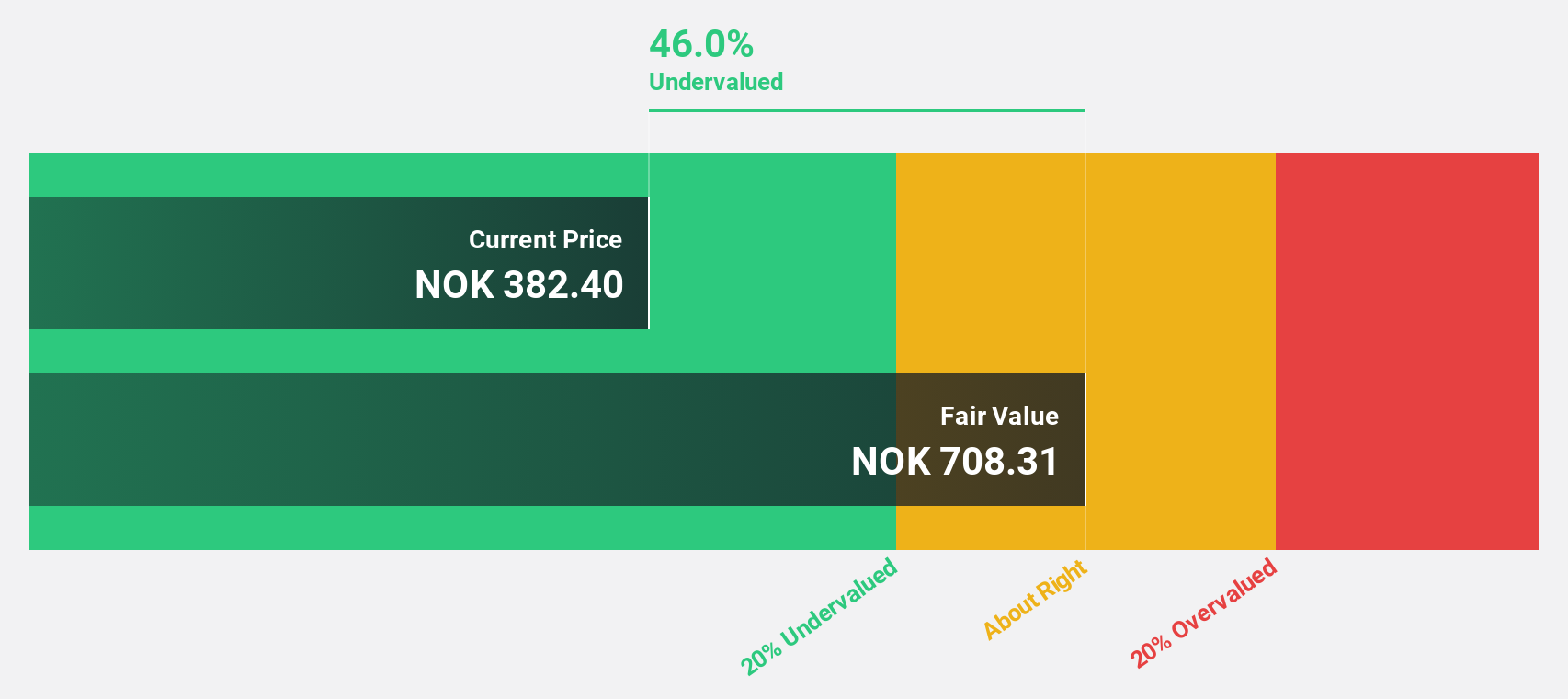

Yara International (OB:YAR)

Overview: Yara International ASA operates in providing crop nutrition and industrial solutions across various global regions, with a market capitalization of approximately NOK 82.07 billion.

Operations: Yara International's revenue is segmented into Europe ($4.33 billion), Americas ($5.47 billion), Africa & Asia ($2.89 billion), Clean Ammonia ($1.64 billion), Industrial Solutions ($2.40 billion), and Global Plants & Operational Excellence ($2.42 billion).

Estimated Discount To Fair Value: 33.5%

Yara International, priced at NOK322.2, trades significantly below its fair value of NOK484.79, indicating a notable undervaluation based on discounted cash flows. Despite this, the company faces challenges such as a high debt level and subdued profit margins—1.9% this year down from 4.9% previously. However, Yara is poised for robust earnings growth at 34.15% annually, outpacing the Norwegian market's 13.1%, with revenue growth also expected to exceed local market forecasts slightly.

- Our comprehensive growth report raises the possibility that Yara International is poised for substantial financial growth.

- Click here and access our complete balance sheet health report to understand the dynamics of Yara International.

Seize The Opportunity

- Gain an insight into the universe of 973 Undervalued Stocks Based On Cash Flows by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:YAR

Yara International

Provides crop nutrition and industrial solutions in Norway, European Union, Europe, Africa, Asia, North and Latin America, Australia, and New Zealand.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives