- United States

- /

- Software

- /

- NasdaqGS:CLBT

How the Narrative Surrounding Cellebrite Is Shifting Amid Federal Delays and Future Catalysts

Reviewed by Simply Wall St

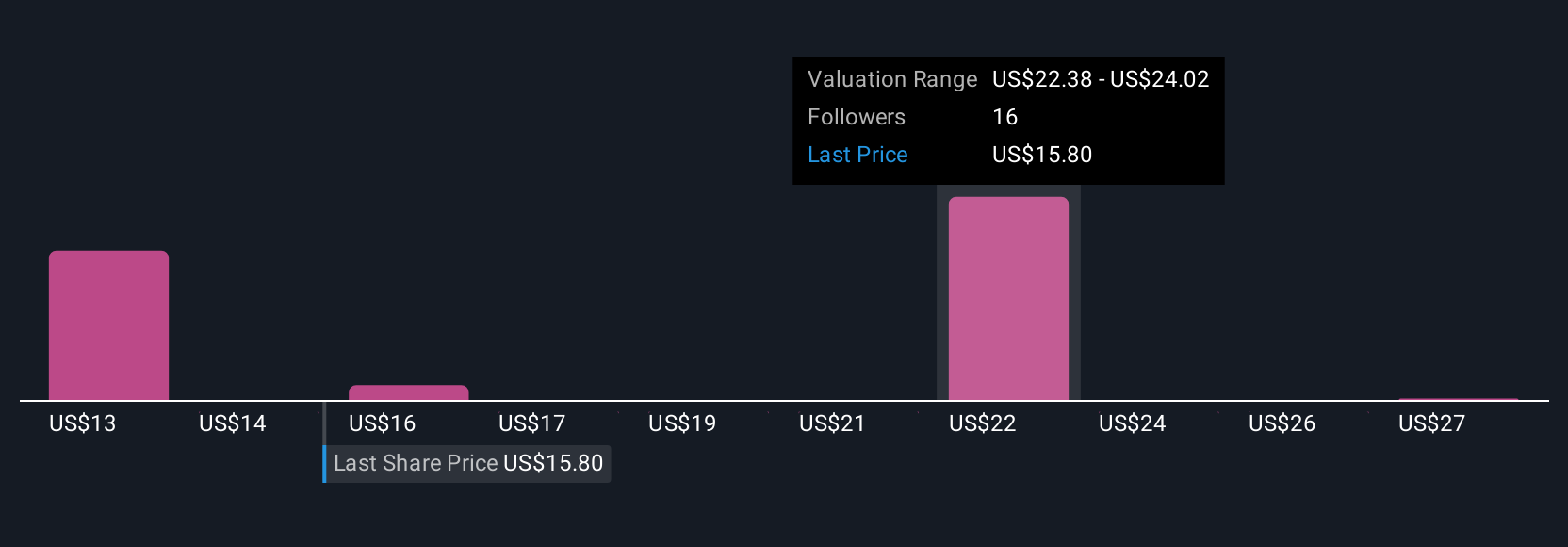

Cellebrite DI's consensus analyst price target has seen a modest uptick, rising from $22.57 to $23.14 despite several headwinds. While lingering softness in the U.S. federal market and revised revenue estimates have tempered enthusiasm, analysts attribute much of this to deal timing delays rather than a loss of demand. Stay tuned to find out how you can track ongoing developments in Cellebrite DI's evolving story.

What Wall Street Has Been Saying

Analyst coverage of Cellebrite DI reflects a mixture of cautious optimism and reminders of ongoing risks as firms dissect the company’s Q2 performance and outlook. Insights from both bullish and bearish commentators highlight the evolving narrative around Cellebrite’s near-term revenue challenges and future growth opportunities.

🐂 Bullish Takeaways

- Several analysts, including those from leading firms, emphasize that deal delays, rather than a decline in demand, are tempering recent revenue figures. They argue that as U.S. federal budgets stabilize, deferred deals may drive a revenue rebound later in the year.

- Bullish sentiment recognizes Cellebrite’s ongoing execution efforts, cost control measures, and high transparency in addressing investor concerns. Progress toward FedRAMP High ATO status, targeted for the first half of 2026, is considered a catalyst for future U.S. federal cloud adoption.

- Some analysts have maintained or moderately raised their price targets. One notable increase to $23.14 reflects confidence in Cellebrite’s medium-term growth prospects despite current headwinds.

- While acknowledging near-term risk due to customer budget constraints and market volatility, bullish analysts view valuation as reasonable and believe that much of the downside is already reflected in the stock.

🐻 Bearish Takeaways

- Bearish analysts caution that slower-moving federal deals in the U.S. are expected to weigh on revenue at least until October, contributing to a more subdued near-term outlook and a downward revision to 2025 revenue estimates.

- Commentary notes that Q2 financial results and second-half 2025 guidance missed market expectations, in part due to lingering impacts from DOGE efficiency measures and ongoing customer budget pauses.

- Some firms, pointing to the revised price target from $22.57 to $23.14 as a modest shift, warn that upside potential is limited and that current valuation already factors in much of the anticipated improvement.

- Bears emphasize that unless federal spending patterns improve sooner than anticipated, Cellebrite’s execution alone may not propel the stock meaningfully higher in the near term.

What's in the News

- Cellebrite DI announced Q3 2025 guidance, projecting revenue of $121 to $126 million and annual recurring revenue (ARR) of $435 to $445 million. For the full year 2025, the company expects revenue to range from $465 to $475 million and ARR to be between $460 and $475 million.

- Thomas E. Hogan has been appointed as the permanent CEO of Cellebrite DI, following his tenure as interim CEO and executive chairman. Hogan brings over four decades of experience in technology and software leadership to the role.

- Cellebrite named David Barter as its new CFO, succeeding Dana Gerner. Barter has held key finance leadership positions at prominent technology companies such as New Relic, C3.ai, and Model N, and is recognized for his expertise in scaling global software businesses.

How This Changes the Fair Value For Cellebrite DI

- The Consensus Analyst Price Target has increased slightly from $22.57 to $23.14.

- The Future P/E for Cellebrite DI has increased slightly from 71.00x to 72.93x.

- The Discount Rate for Cellebrite DI remained almost unchanged, moving only marginally from 10.67% to 10.74%.

🔔 Never Miss an Update: Follow The Narrative

Narratives on Simply Wall St connect a company's story with financial forecasts and fair value in an easy, accessible format. These dynamic stories, crafted by investors and analysts in the Community, help you see beyond the numbers and understand what is driving a stock's outlook. This allows you to compare fair value to price and know when to buy, sell, or hold. Narratives update in real-time as fresh news arrives, keeping your perspective current and informed.

Discover the full story and follow the latest Narrative for Cellebrite DI to stay empowered as the situation evolves:

- See how accelerating digital crime and rising security demands are driving adoption of Cellebrite’s forensic SaaS platforms and powering strong subscription growth.

- Track how new privacy regulations, AI innovation, and a pivot to recurring revenue are boosting market opportunities and improving margins.

- Stay alert to the latest risks, including reliance on U.S. federal contracts, regulatory shifts, and the need to keep pace with fast-moving tech competitors, which could impact future revenue and valuation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CLBT

Cellebrite DI

Develops solutions for legally sanctioned investigations in Europe, the Middle East, Africa, the Americas, and the Asia-Pacific.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)