- United States

- /

- Software

- /

- NasdaqGS:CIFR

3 US Stocks With High Insider Ownership And Up To 103% Revenue Growth

Reviewed by Simply Wall St

As the U.S. stock market approaches record highs, buoyed by recent data on inflation and trade policies, investors are keenly observing companies with strong growth potential and significant insider ownership. In this context, stocks that combine robust revenue growth with high insider stakes can offer a compelling proposition, reflecting confidence from those who know the business best.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 25.6% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.4% | 27.6% |

| On Holding (NYSE:ONON) | 19.1% | 29.7% |

| Astera Labs (NasdaqGS:ALAB) | 16.1% | 62.6% |

| BBB Foods (NYSE:TBBB) | 16.5% | 41.1% |

| Kingstone Companies (NasdaqCM:KINS) | 20.8% | 24.9% |

| Clene (NasdaqCM:CLNN) | 21.6% | 59.1% |

| Upstart Holdings (NasdaqGS:UPST) | 12.7% | 103.9% |

| Credit Acceptance (NasdaqGS:CACC) | 14.3% | 33.8% |

| Ultralife (NasdaqGM:ULBI) | 36% | 43.8% |

Let's uncover some gems from our specialized screener.

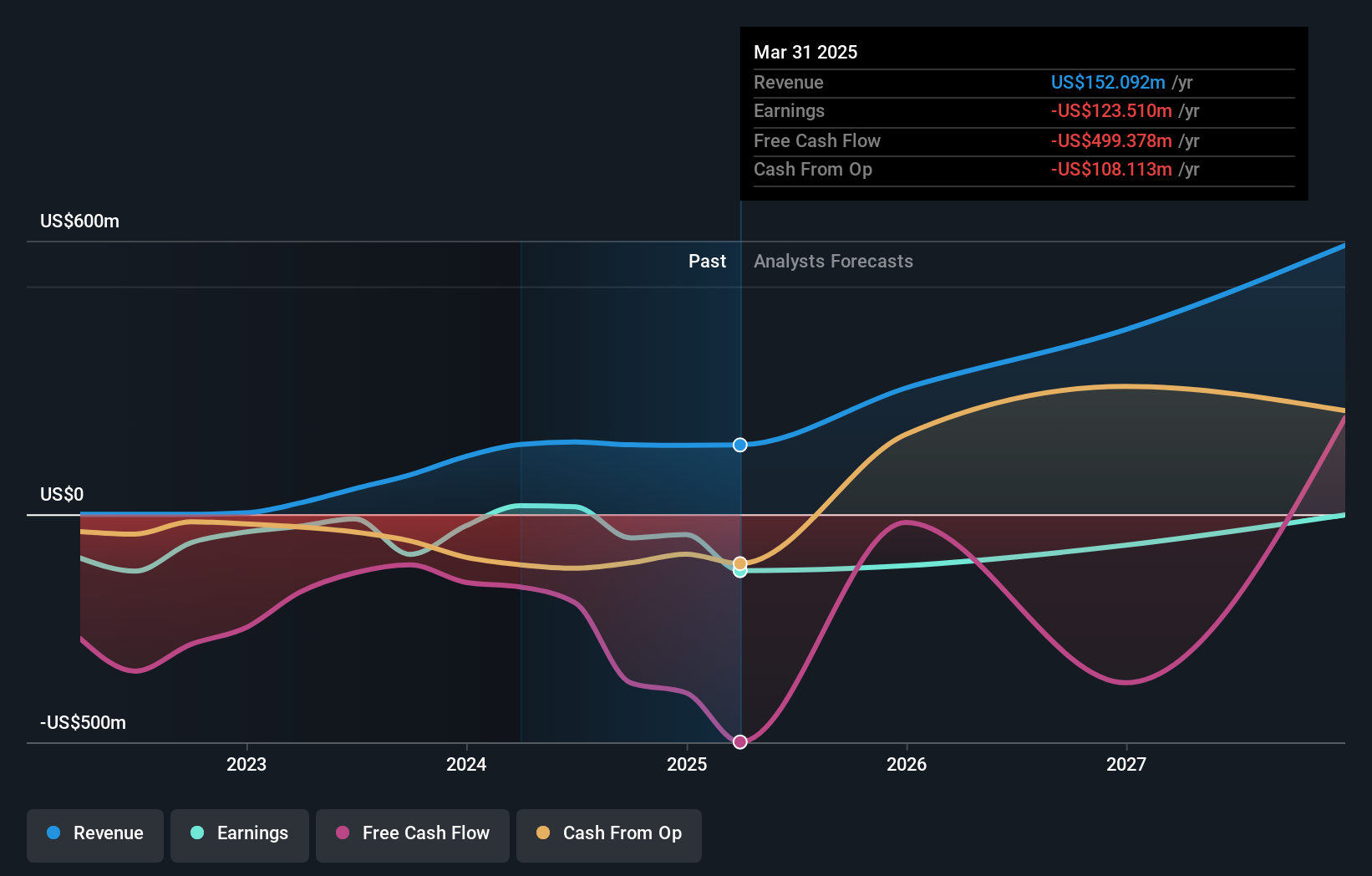

Cipher Mining (NasdaqGS:CIFR)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Cipher Mining Inc. operates industrial-scale bitcoin mining data centers in the United States and has a market cap of approximately $2.03 billion.

Operations: The company's revenue segment includes data processing, generating $152.47 million.

Insider Ownership: 16.9%

Revenue Growth Forecast: 60.1% p.a.

Cipher Mining has demonstrated significant growth potential with forecasted revenue increases of 60.1% annually, outpacing the US market average. However, the company has experienced high share price volatility and substantial shareholder dilution recently. Despite this, insider ownership remains high with more shares bought than sold in recent months. Recent strategic moves include a private placement raising nearly US$50 million and acquiring a new site in Texas to expand capacity by up to 100 MW.

- Click here to discover the nuances of Cipher Mining with our detailed analytical future growth report.

- According our valuation report, there's an indication that Cipher Mining's share price might be on the cheaper side.

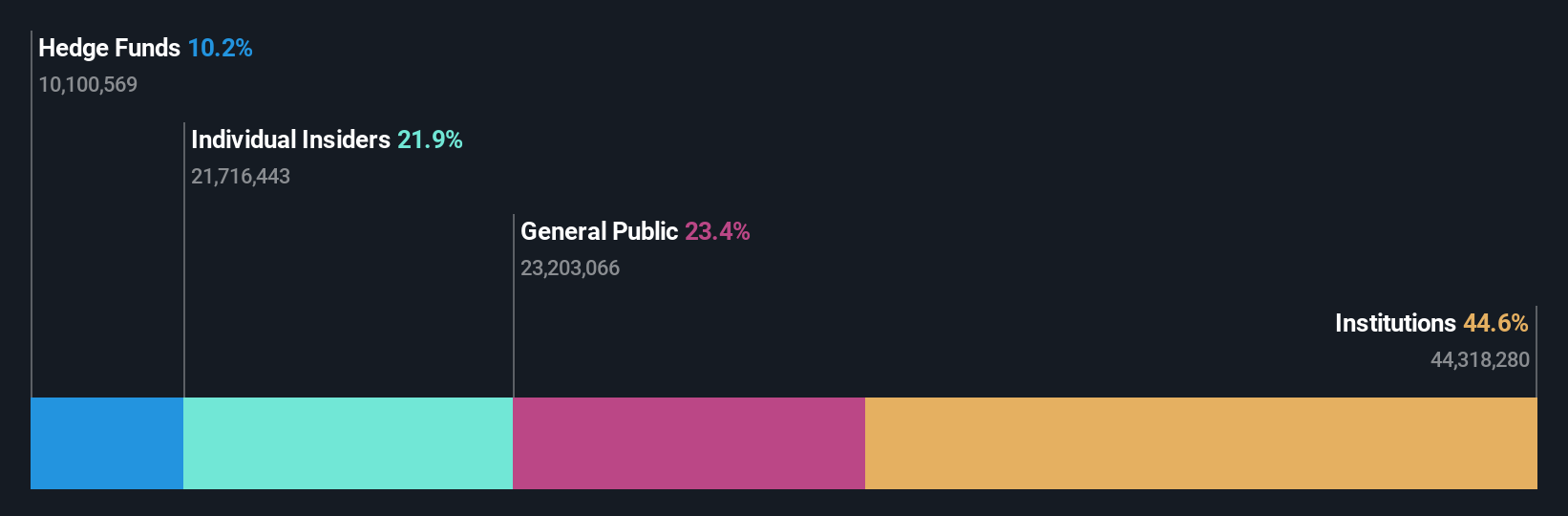

Sable Offshore (NYSE:SOC)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Sable Offshore Corp. is involved in oil and gas exploration and development activities in the United States, with a market cap of $2.18 billion.

Operations: Revenue Segments (in millions of $): null

Insider Ownership: 24.3%

Revenue Growth Forecast: 103.1% p.a.

Sable Offshore is poised for substantial growth, with revenue expected to increase by 103.1% annually, surpassing market averages. Despite a volatile share price and significant shareholder dilution over the past year, the company trades at 61.1% below its estimated fair value. Recent legal developments regarding the Santa Ynez Unit have not impacted operations, which hold resources valued over $10 billion. However, Sable reported increased losses in recent earnings results compared to the previous year.

- Dive into the specifics of Sable Offshore here with our thorough growth forecast report.

- According our valuation report, there's an indication that Sable Offshore's share price might be on the expensive side.

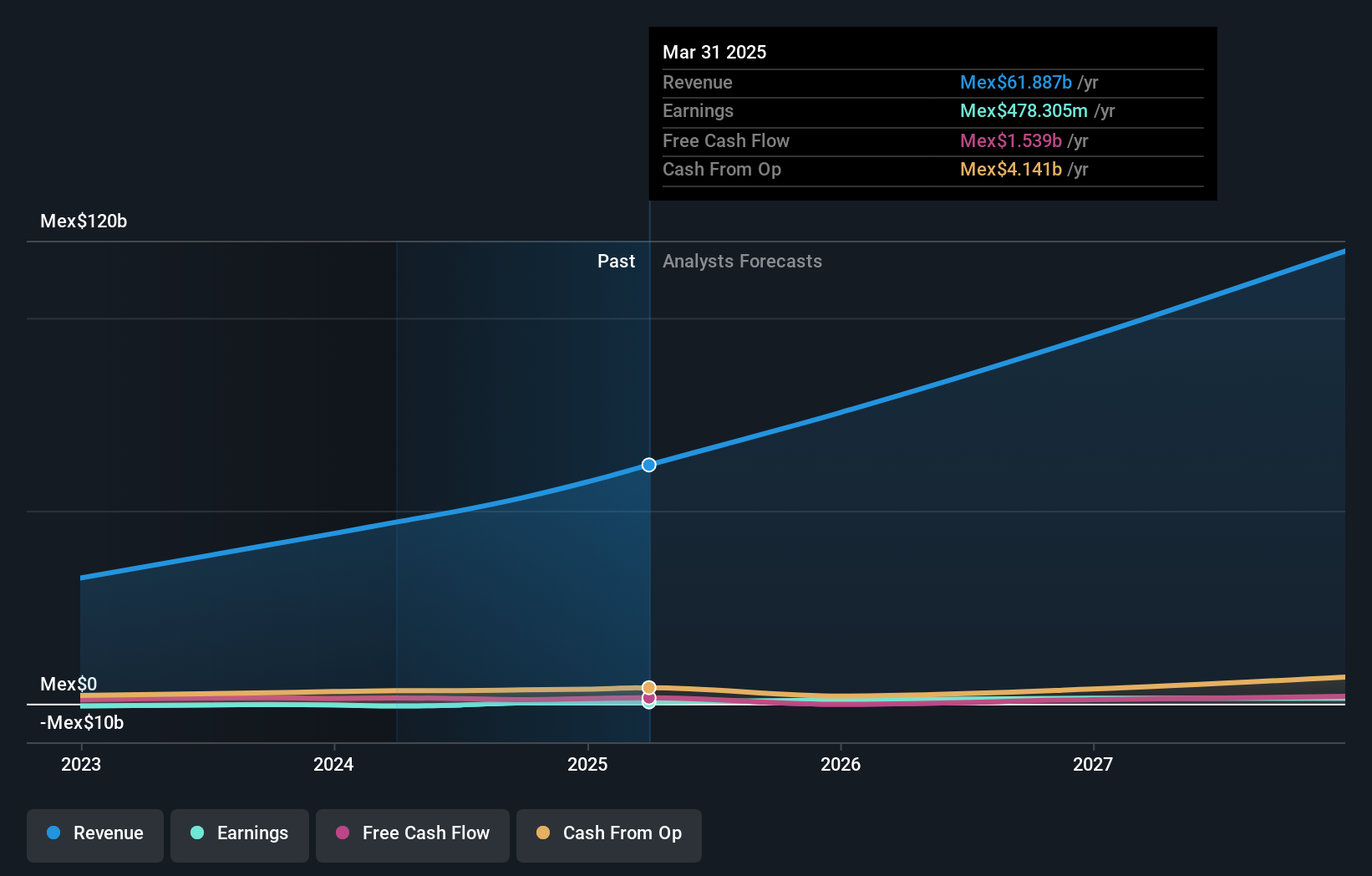

BBB Foods (NYSE:TBBB)

Simply Wall St Growth Rating: ★★★★★★

Overview: BBB Foods Inc. operates a chain of grocery retail stores in Mexico through its subsidiaries and has a market cap of $3.15 billion.

Operations: The company's revenue segment for the sale, acquisition, and distribution of all types of products and consumer goods totals MX$53.41 billion.

Insider Ownership: 16.5%

Revenue Growth Forecast: 21.7% p.a.

BBB Foods demonstrates strong growth potential, with earnings forecasted to increase significantly at 41.1% annually, outpacing the US market. Recent financial results show a turnaround to profitability, with net income reaching MXN 257.6 million in Q3 2024 from a loss the previous year. The company recently completed a $593.25 million equity offering, bolstering its financial position for future expansion while trading at 60.5% below estimated fair value.

- Click here and access our complete growth analysis report to understand the dynamics of BBB Foods.

- The analysis detailed in our BBB Foods valuation report hints at an deflated share price compared to its estimated value.

Summing It All Up

- Take a closer look at our Fast Growing US Companies With High Insider Ownership list of 196 companies by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CIFR

Cipher Mining

Develops and operates industrial-scale data centers in the United States.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives