- United States

- /

- Software

- /

- NasdaqGS:CFLT

Confluent, Inc. (NASDAQ:CFLT) Stocks Shoot Up 44% But Its P/S Still Looks Reasonable

Confluent, Inc. (NASDAQ:CFLT) shares have continued their recent momentum with a 44% gain in the last month alone. The last 30 days bring the annual gain to a very sharp 28%.

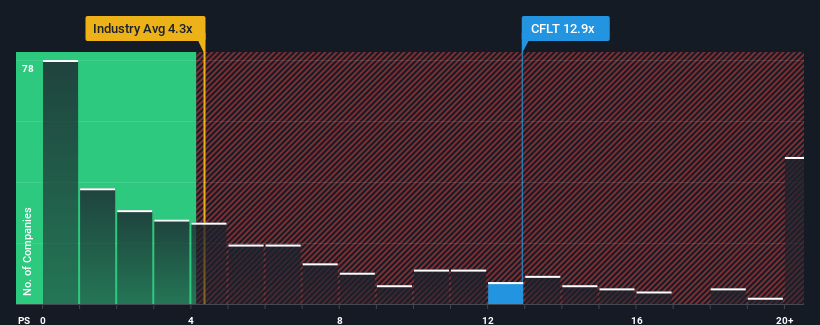

Following the firm bounce in price, Confluent's price-to-sales (or "P/S") ratio of 12.9x might make it look like a strong sell right now compared to other companies in the Software industry in the United States, where around half of the companies have P/S ratios below 4.3x and even P/S below 1.8x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

View our latest analysis for Confluent

What Does Confluent's P/S Mean For Shareholders?

Confluent certainly has been doing a good job lately as it's been growing revenue more than most other companies. The P/S is probably high because investors think this strong revenue performance will continue. If not, then existing shareholders might be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Confluent will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For Confluent?

In order to justify its P/S ratio, Confluent would need to produce outstanding growth that's well in excess of the industry.

Taking a look back first, we see that the company grew revenue by an impressive 33% last year. Pleasingly, revenue has also lifted 228% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 24% per year during the coming three years according to the analysts following the company. With the industry only predicted to deliver 17% each year, the company is positioned for a stronger revenue result.

In light of this, it's understandable that Confluent's P/S sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Final Word

The strong share price surge has lead to Confluent's P/S soaring as well. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Confluent's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless these conditions change, they will continue to provide strong support to the share price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 4 warning signs with Confluent, and understanding them should be part of your investment process.

If these risks are making you reconsider your opinion on Confluent, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:CFLT

Confluent

Operates a data streaming platform in the United States and internationally.

Excellent balance sheet and fair value.