- United States

- /

- Software

- /

- NasdaqGS:CFLT

Confluent, Inc. (NASDAQ:CFLT) Stocks Shoot Up 28% But Its P/S Still Looks Reasonable

Confluent, Inc. (NASDAQ:CFLT) shareholders are no doubt pleased to see that the share price has bounced 28% in the last month, although it is still struggling to make up recently lost ground. Notwithstanding the latest gain, the annual share price return of 9.6% isn't as impressive.

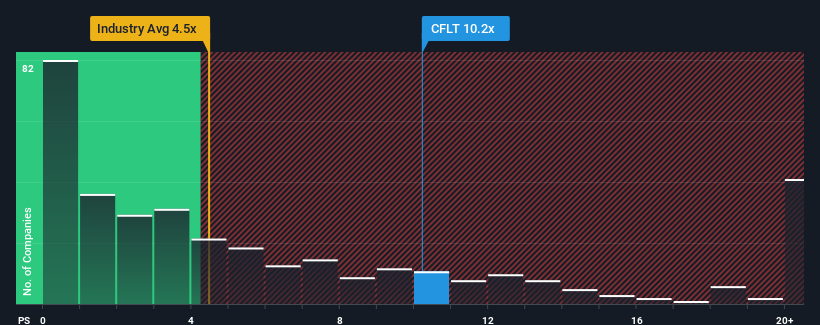

After such a large jump in price, Confluent may be sending strong sell signals at present with a price-to-sales (or "P/S") ratio of 10.2x, when you consider almost half of the companies in the Software industry in the United States have P/S ratios under 4.5x and even P/S lower than 1.8x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

Check out our latest analysis for Confluent

What Does Confluent's Recent Performance Look Like?

Recent times have been advantageous for Confluent as its revenues have been rising faster than most other companies. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think Confluent's future stacks up against the industry? In that case, our free report is a great place to start.How Is Confluent's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as steep as Confluent's is when the company's growth is on track to outshine the industry decidedly.

Retrospectively, the last year delivered an exceptional 36% gain to the company's top line. Pleasingly, revenue has also lifted 210% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenue over that time.

Turning to the outlook, the next three years should generate growth of 24% each year as estimated by the analysts watching the company. That's shaping up to be materially higher than the 17% each year growth forecast for the broader industry.

With this in mind, it's not hard to understand why Confluent's P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

The strong share price surge has lead to Confluent's P/S soaring as well. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Confluent's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

You always need to take note of risks, for example - Confluent has 4 warning signs we think you should be aware of.

If you're unsure about the strength of Confluent's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:CFLT

Confluent

Operates a data streaming platform in the United States and internationally.

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives