- United States

- /

- Software

- /

- NasdaqGS:CDNS

Cadence Design Systems (NasdaqGS:CDNS) Sees 5% Dip Over Past Month Amid Market Volatility

Reviewed by Simply Wall St

Cadence Design Systems (NasdaqGS:CDNS) experienced a monthly price decline of 5%, amidst a backdrop of executive shuffles, shareholder activism, and partnerships expansion with NVIDIA aimed at faster computing solutions. These developments perhaps countered the broader market downturn driven by heightened trade tensions after the U.S. imposed tariffs and China retaliated. Such macroeconomic factors led to 12% market drops, overshadowing Cadence's innovative tech collaborations and strategic governance efforts. While the company advanced in AI and computing capabilities, these moves didn't significantly avert its shares from following the downward market trend, reflecting the overarching volatility impacting tech and broader industries alike.

Cadence Design Systems' recent developments, including executive changes, shareholder involvement, and strategic partnerships, could potentially offer a buffer against macroeconomic challenges like trade tensions. These initiatives align with the company's long-term narrative of expanding AI-driven solutions, which is expected to drive significant growth in revenue and earnings, particularly through partnerships with NVIDIA, Qualcomm, and Marvell. While the recent monthly price move reflects broader market volatility, the company's sustained focus on AI and hardware solutions could influence future revenue and earnings projections positively, depending on execution and market dynamics.

For context, Cadence Design Systems achieved a substantial total return of 203.49% over five years, illustrating robust growth. However, the company underperformed the US Software industry over the past year, where it registered a 1.4% earnings growth compared to an industry growth of 25.4%. This longer-term performance underscores potential resilience despite recent challenges. The share price decline in the short term contrasts with strong historical returns, highlighting the need for careful investment consideration based on both current conditions and future prospects.

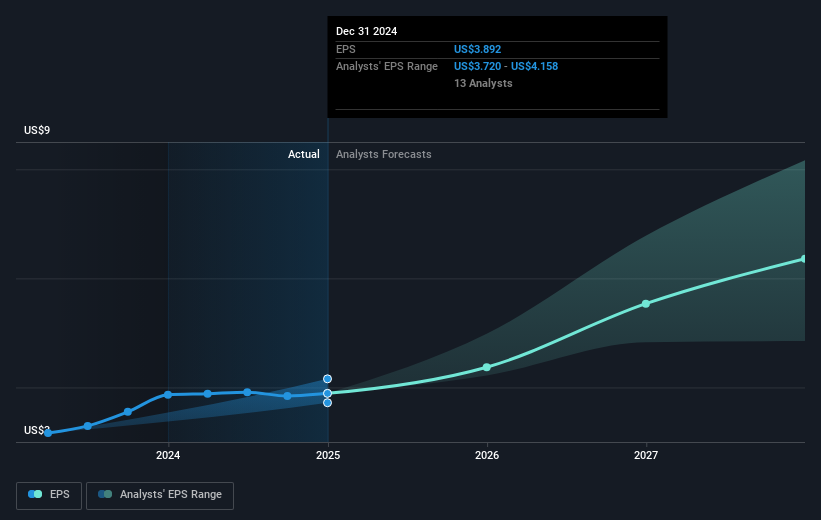

The company's current share price of US$258.79 is below the consensus analyst price target of US$317.85, indicating a significant potential upside if forecasted growth materializes. Analysts project revenue to grow at an annual rate of 12.1%, with earnings reaching US$1.7 billion by 2028. The current market challenges and potential changes in expense dynamics, however, could impact these forecasts. Investors may find Cadence's pricing relative to its growth expectations warrants attention, given the heightened forecast and market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CDNS

Cadence Design Systems

Provides software, hardware, and other services worldwide.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)