- United States

- /

- Software

- /

- NasdaqGS:CDNS

Cadence Design Systems (CDNS): Reassessing Valuation After Earnings Beat, Guidance Hike, and China Regulatory Boost

Reviewed by Simply Wall St

If you own shares of Cadence Design Systems (CDNS) or are considering a position, last week likely caught your attention. The company’s stock surged nearly 10% in a single session after Cadence reported second quarter earnings that outpaced Wall Street’s expectations and offered an upbeat outlook for the rest of the year. With revenue and profit both coming in stronger than predicted, plus news that US export curbs were lifted and renewed sales to China were unlocked, investors suddenly had a lot more to factor into their calculations.

This event adds to a run of upward momentum for Cadence. Over the past year, the stock has climbed 39%, comfortably ahead of the broader tech sector, with a powerful 15% jump in the past three months alone. Management’s raised guidance, coupled with regulatory tailwinds in China and consistent double-digit annual growth in both revenue and net income, paint a picture of a business firing on multiple cylinders.

After a rally like this, investors are left to wonder: is Cadence Design Systems now trading above its true value, or are markets still underestimating its long-term growth story?

Most Popular Narrative: 5.0% Undervalued

According to the most widely followed valuation narrative, Cadence Design Systems is currently seen as trading nearly 5% below its fair value. Analysts arrive at this calculation by weighing long-term growth in AI-driven design tools, strategic partnerships, and financial performance against sector risks.

Cadence's strategic investments in AI-driven design and verification tools are expected to drive future revenue growth. The company reports increasing adoption of its AI-enabled offerings, such as the Cadence Cerebrus AI solution and SimAI, which have shown significant performance improvements for customers.

Want to know the numbers powering that undervalued status? The narrative leans on bold forecasts for future earnings, revenue, and profit margins to justify the price target. Are these projections aggressive or achievable? The math behind this fair value might surprise you.

Result: Fair Value of $369.57 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, even with this optimism, potential trade tensions with China and heavy reliance on key partners like NVIDIA could pose unexpected challenges for Cadence’s outlook.

Find out about the key risks to this Cadence Design Systems narrative.Another View: Is Cadence Expensive?

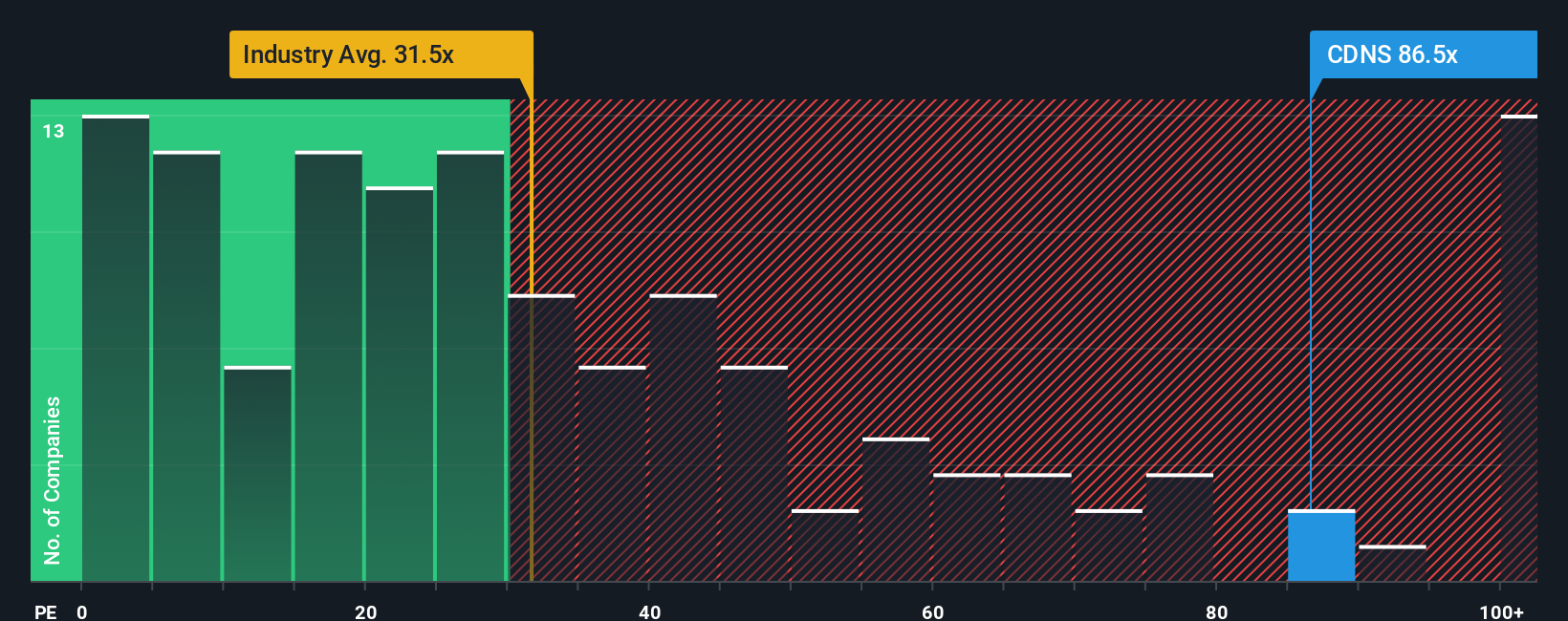

Looking through a different lens, Cadence appears expensive compared to the industry when using earnings multiples. This suggests some skepticism remains, even as growth expectations are high. Could the market be overreaching?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Cadence Design Systems Narrative

If you want to dig deeper or question these perspectives, you can dive into the numbers yourself and create an independent view in just minutes. Do it your way.

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Cadence Design Systems.

Looking for more investment ideas?

Opportunities abound if you know where to look. Stay a step ahead by targeting promising sectors and fresh trends before others catch on and prices move.

- Unlock high growth potential by reviewing undervalued stocks based on cash flows that show strong fundamentals but are trading at attractive prices.

- Catch the next wave of innovation and tap into the future with AI penny stocks making strides in artificial intelligence breakthroughs.

- Generate stable income and benefit from reliable cash flows by checking out dividend stocks with yields > 3% consistently delivering yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NasdaqGS:CDNS

Cadence Design Systems

Provides software, hardware, and other services worldwide.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)