- United States

- /

- Software

- /

- NasdaqCM:BTDR

Is Bitdeer Technologies Group Well Priced After 44% Surge Amid Bitcoin Rally?

Reviewed by Bailey Pemberton

Trying to figure out what to do with Bitdeer Technologies Group stock? You are definitely not alone. Plenty of investors are eyeing this cryptocurrency mining powerhouse, especially after a string of surprising moves in the stock’s price. If you had stepped in a week ago, you would be looking at a 13.3% gain already. Dig deeper, and the numbers only get more striking. Over the past month, Bitdeer has shot up 44.0%, and if you measure from a year ago, the stock is up 190.4%. Even with a year-to-date performance still in the red at -12.8%, the long-term trajectory is hard to ignore.

What is powering these moves? Recent surges in Bitcoin prices and a wave of fresh interest in the sector have reshaped risk perceptions for companies like Bitdeer. As institutional investors start dipping their toes back into crypto-related stocks, market sentiment around mining technology has shifted, with Bitdeer right in the spotlight. Still, all this momentum leads to the big question: how much value is actually built into the stock’s current price?

On that note, Bitdeer’s valuation score sits at 2 out of 6, meaning it only appears undervalued by two out of six commonly used checks. But traditional number crunching can sometimes miss the full story. Up next, we will break down the major valuation methods investors usually rely on, and you will see where Bitdeer stands. But there is an even better way to put today’s valuation in context, so be sure to stick around until the end.

Bitdeer Technologies Group scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Bitdeer Technologies Group Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and then discounting those back to today's value. This approach helps investors get a sense of what the business may be worth, based on fundamentals rather than market hype.

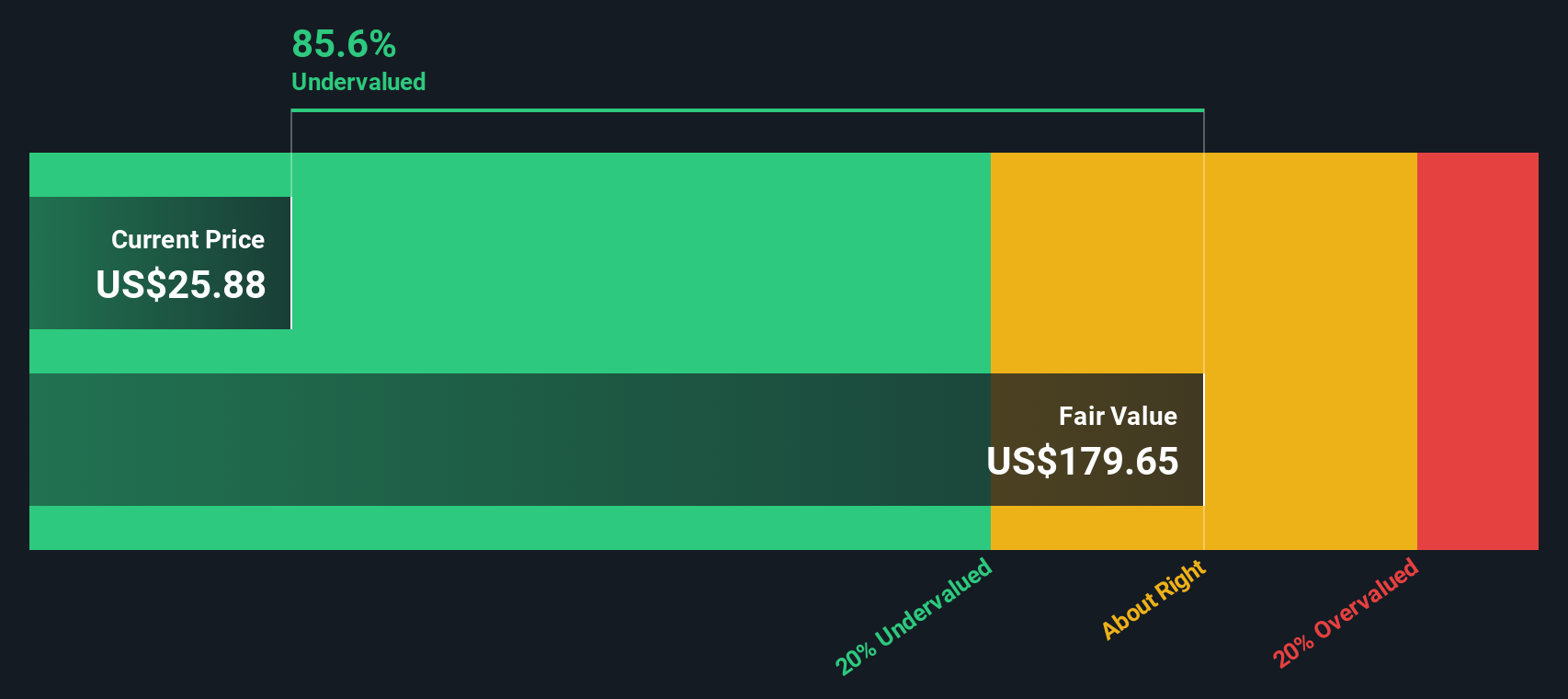

For Bitdeer Technologies Group, the DCF model uses the 2 Stage Free Cash Flow to Equity method. At present, Bitdeer's last twelve months free cash flow stands at -$1.17 Billion, reflecting ongoing investments and cash outflows as the company builds its mining operations. Looking ahead, analysts estimate free cash flow could reach $415 Million by 2027. Projections go beyond five years, with Simply Wall St extrapolating growth to over $3.1 Billion by 2035.

All of these future cash flows are discounted back to today’s terms, leading to an estimated intrinsic value of $175.43 per share. According to this model, the current Bitdeer share price is trading at an 88.6% discount to its intrinsic value. This suggests the stock is significantly undervalued.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Bitdeer Technologies Group is undervalued by 88.6%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Bitdeer Technologies Group Price vs Sales

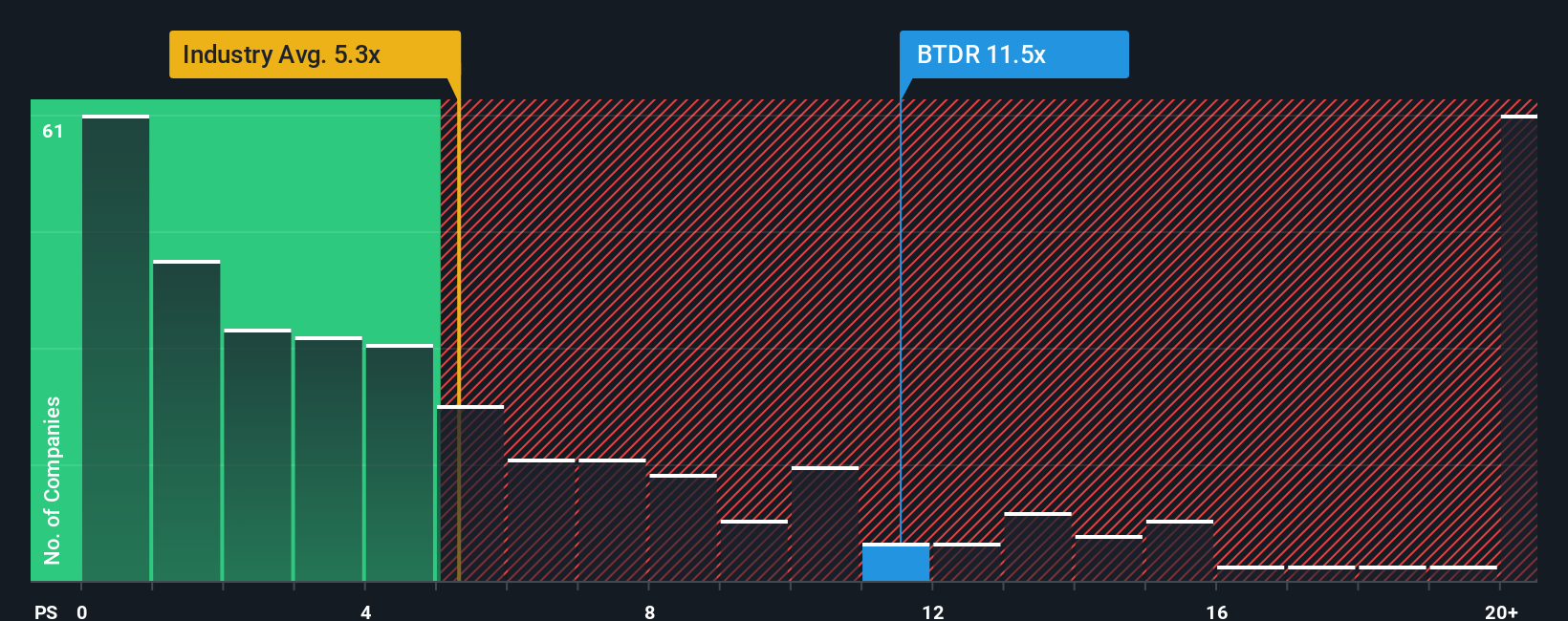

For companies like Bitdeer Technologies Group that are still building toward steady profitability, the price-to-sales (P/S) ratio is often the best way to gauge valuation. This metric is helpful because it sidesteps the noise from short-term earnings swings and focuses on how much investors are paying for each dollar of revenue. When growth expectations are high or risk is elevated, investors may accept a higher P/S ratio. Typically, a “fair” P/S for a stock reflects the market’s consensus on its growth potential, profit margins, and risk profile.

Bitdeer's current P/S ratio is 11.8x, which is noticeably higher than the software industry average of 5.3x and the peer average of 6.3x. At first glance, this might suggest the stock is expensive compared to its sector. However, Simply Wall St’s proprietary "Fair Ratio" for Bitdeer stands at 11.6x. The Fair Ratio is designed to capture more of the company’s unique story, including its specific growth outlook, profitability, industry, risk factors, and market cap. This makes it a more tailored benchmark than simple peer or industry comparisons.

Since Bitdeer's actual P/S ratio and its Fair Ratio are very closely aligned, the stock's current pricing seems to be just about right based on fundamentals as well as the risk and opportunity in this market segment.

Result: ABOUT RIGHT

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Bitdeer Technologies Group Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply the story or perspective you bring to a company, built around your own assumptions about its future, such as expected fair value, revenue growth, earnings, and profit margins, rather than just accepting one consensus number. Narratives link a company’s unique story directly to a dynamic financial forecast, which in turn generates a fair value for the stock. Best of all, Narratives are easy to use and available to everyone on Simply Wall St’s Community page, trusted by millions of investors.

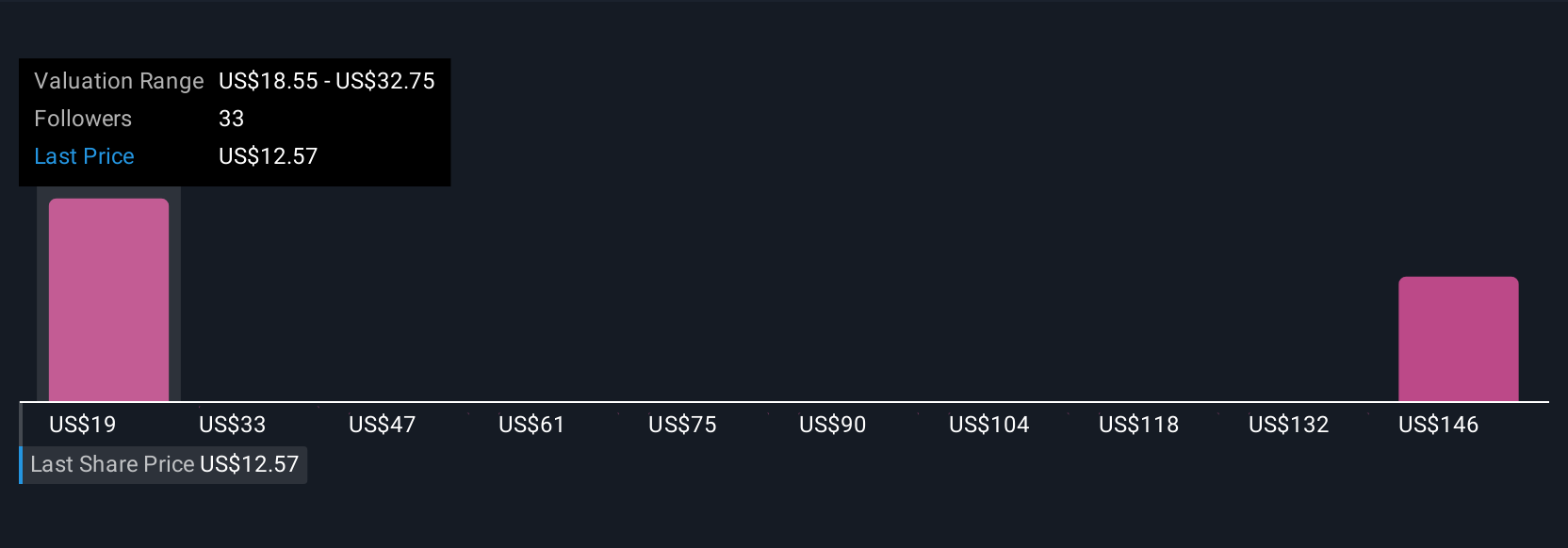

By creating or exploring Narratives, you can see and update in real time how the latest news or earnings surprise may shift Bitdeer’s outlook. This means investors can quickly compare their fair value to the current market price, making more informed decisions about when to buy or sell. For example, regarding Bitdeer Technologies Group, some investors believe its proprietary ASIC technology and power plant expansion will lead to long-term dominance and set a bullish price target as high as $33.6, while more cautious voices, focused on recent earnings volatility and execution risks, expect a fair value closer to $17.0. Narratives allow you to test these perspectives yourself and back your investment with your own story and numbers.

Do you think there's more to the story for Bitdeer Technologies Group? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Bitdeer Technologies Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:BTDR

Bitdeer Technologies Group

Operates as a technology company for blockchain and high-performance computing (HPC) in Singapore, the United States, Bhutan, and Norway.

Exceptional growth potential and fair value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)