- United States

- /

- Software

- /

- NasdaqGS:BLKB

Blackbaud (BLKB) Board Sees Change as Yogesh K. Gupta Steps Down

Reviewed by Simply Wall St

Blackbaud (BLKB) announced significant updates to its K-12 Education Management portfolio and saw executive changes with the resignation of director Yogesh K. Gupta. These developments could have influenced the company's 14.85% price increase over the last quarter. Despite Blackbaud's quarterly earnings revealing a slight decline in sales, its raised financial guidance for the full year may have positively impacted investor sentiment. Meanwhile, broader market trends, including record highs in major indexes like the Nasdaq and expectations for Federal Reserve interest rate cuts, likely played a supportive role in boosting Blackbaud's share performance.

Every company has risks, and we've spotted 2 warning signs for Blackbaud you should know about.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

The recent updates to Blackbaud's K-12 Education Management portfolio and executive changes could potentially reinforce the company's narrative of leveraging cloud-based platforms and AI-driven innovation to enhance long-term growth prospects. Although short-term fluctuations in share price reflect these developments, it's essential to weigh their impact on Blackbaud's long-term trajectory. Over the past three years, Blackbaud's total shareholder return, inclusive of share price appreciation and dividends, was 49.39%. This performance, although influenced by various factors, indicates investor confidence amid broader digital transformation trends in the nonprofit, education, and healthcare sectors.

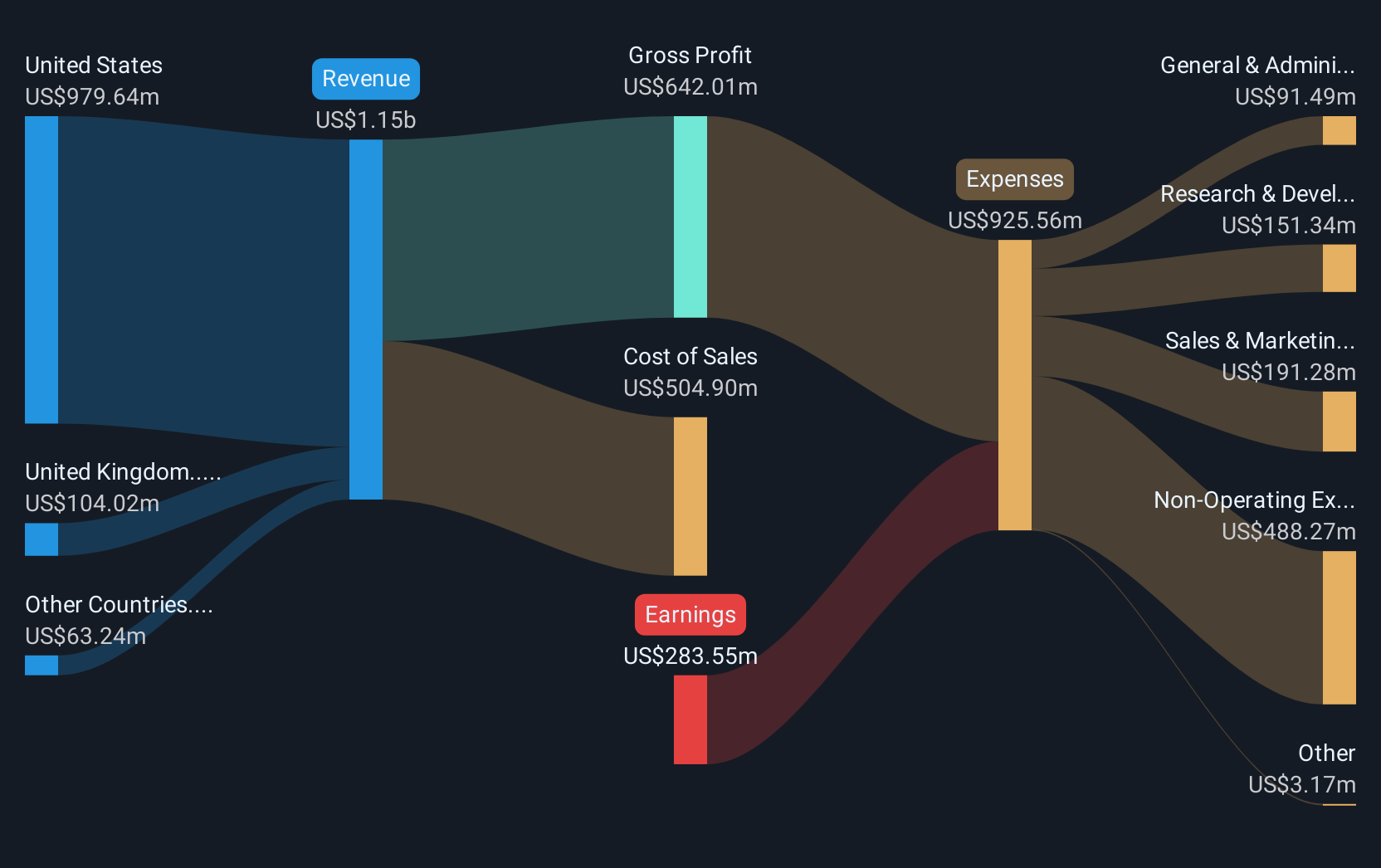

Despite a recent 14.85% rise in share price over the last quarter, Blackbaud remains behind both the US Market's and the US Software industry's returns over the past year. The raised financial guidance could positively influence future revenue and earnings, particularly as the company forecasts a shift from a loss of US$279.38 million to earnings of US$143.1 million by 2028. However, the current share price of US$69.60 remains approximately 10.39% below the consensus analyst price target of US$76.83, highlighting potential for future growth if analyst expectations are met. The forecasted advances in AI and cloud offerings and ongoing digital transformation could play a vital role in achieving the projected revenue and earnings growth, providing further impetus for share price appreciation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Blackbaud might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BLKB

Blackbaud

Engages in the provision of cloud software and services in the United States and internationally.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)