- United States

- /

- Software

- /

- NasdaqGM:AWRE

Aware And 2 Other US Penny Stocks To Consider

Reviewed by Simply Wall St

As 2024 concludes, the U.S. stock market has shown a mix of strength and volatility, with major indices like the Dow Jones and S&P 500 experiencing significant fluctuations despite overall yearly gains. In this context, penny stocks—often representing smaller or newer companies—offer investors an intriguing opportunity to explore growth potential at lower price points. While the term "penny stocks" may seem outdated, these investments continue to present viable opportunities when backed by strong financial fundamentals.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.77 | $6.03M | ★★★★★★ |

| Inter & Co (NasdaqGS:INTR) | $4.22 | $1.84B | ★★★★☆☆ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $111.43M | ★★★★★★ |

| Kiora Pharmaceuticals (NasdaqCM:KPRX) | $3.30 | $9.9M | ★★★★★★ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.29 | $10.49M | ★★★★★★ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.94 | $97.13M | ★★★★★☆ |

| Imperial Petroleum (NasdaqCM:IMPP) | $3.01 | $93.12M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| BTCS (NasdaqCM:BTCS) | $2.47 | $43.38M | ★★★★★★ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.31 | $24.65M | ★★★★★☆ |

Click here to see the full list of 735 stocks from our US Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Aware (NasdaqGM:AWRE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Aware, Inc. is an authentication company that offers biometrics software products and solutions to government agencies and commercial entities globally, with a market cap of $34.14 million.

Operations: The company's revenue is derived entirely from its Software & Programming segment, totaling $16.97 million.

Market Cap: $34.14M

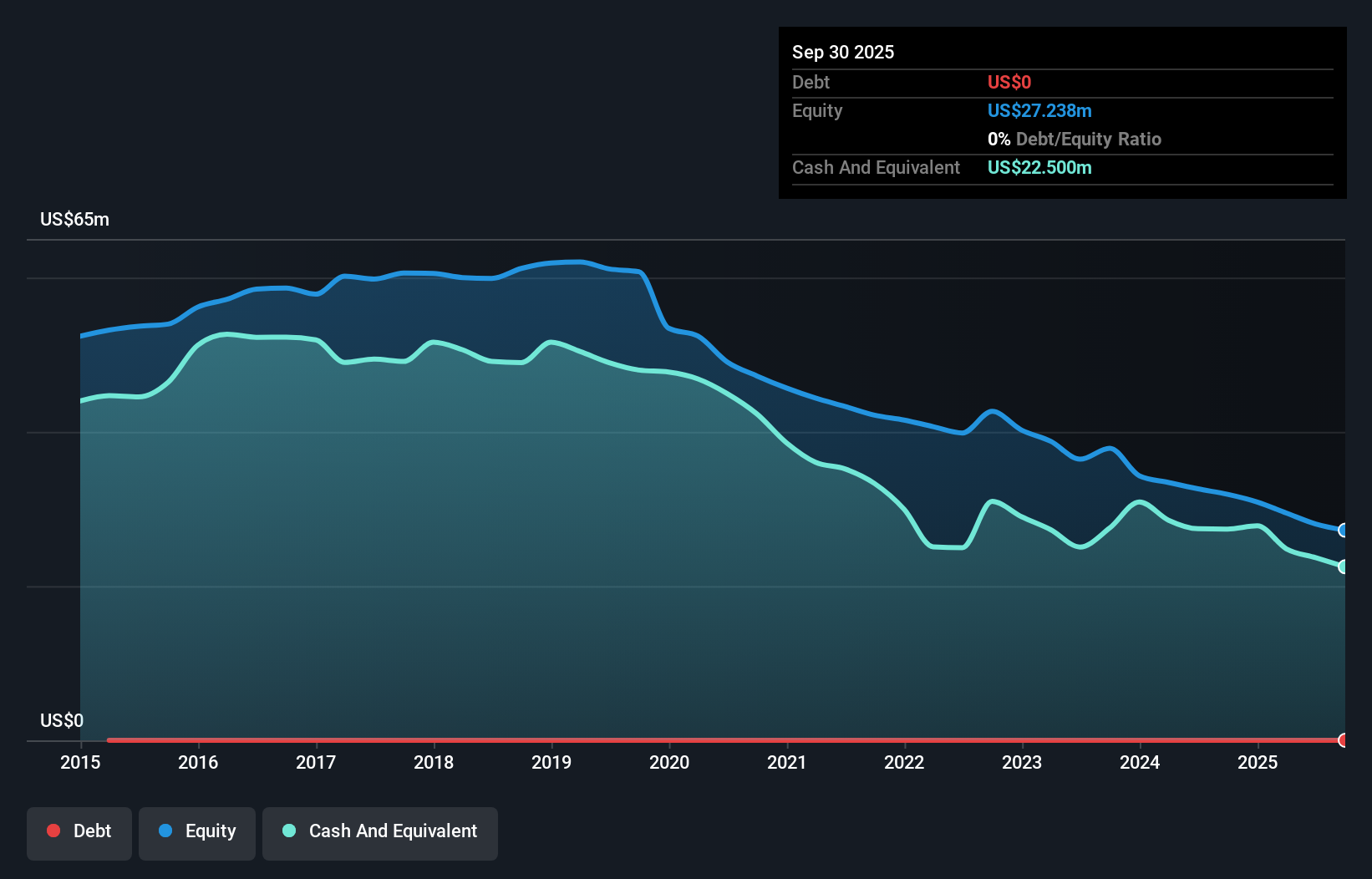

Aware, Inc., with a market cap of US$34.14 million, is navigating the challenges typical for penny stocks, marked by high volatility and an unprofitable status. Despite a recent decline in revenue to US$3.85 million for Q3 2024 from US$6.38 million the previous year and a net loss of US$1.17 million, Aware maintains financial stability with short-term assets exceeding liabilities and no long-term debt. Its strategic focus on expanding its cloud-based biometric authentication platform through WordPress integration highlights potential growth avenues, although the company's management team lacks extensive experience with an average tenure of 1.2 years.

- Navigate through the intricacies of Aware with our comprehensive balance sheet health report here.

- Assess Aware's previous results with our detailed historical performance reports.

CarParts.com (NasdaqGS:PRTS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: CarParts.com, Inc. operates as an online provider of aftermarket auto parts and accessories in the United States and the Philippines, with a market cap of $58.55 million.

Operations: The company generates revenue primarily from its Base USAP segment, amounting to $611.71 million.

Market Cap: $58.55M

CarParts.com, Inc., with a market cap of US$58.55 million, is a penny stock facing profitability challenges, reporting a net loss of US$10.02 million in Q3 2024. Despite this, the company maintains financial health with short-term assets exceeding liabilities and no debt burden. Recent partnerships with Extend and SimpleTire enhance its product offerings and customer experience by introducing shipping protection and expanding into the tire market. These strategic moves aim to bolster its position in the automotive eCommerce space while offering value to customers amidst ongoing revenue pressures due to external factors like hurricanes impacting sales forecasts.

- Get an in-depth perspective on CarParts.com's performance by reading our balance sheet health report here.

- Gain insights into CarParts.com's outlook and expected performance with our report on the company's earnings estimates.

Mammoth Energy Services (NasdaqGS:TUSK)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Mammoth Energy Services, Inc. is an energy services company operating in the United States, Canada, and internationally with a market cap of $133.79 million.

Operations: The company's revenue is primarily derived from its Infrastructure segment at $109.74 million, followed by Well Completion at $36.63 million, Sand at $18.40 million, and Drilling at $3.43 million.

Market Cap: $133.79M

Mammoth Energy Services, Inc., with a market cap of US$133.79 million, faces profitability challenges as it reported a substantial net loss of US$24.04 million in Q3 2024, compared to a loss of US$1.09 million the previous year. Despite this, the company maintains financial stability with short-term assets at US$255.2 million exceeding both short-term and long-term liabilities combined. The recent CEO transition may bring strategic shifts as Phil Lancaster takes over leadership in January 2025 amidst ongoing revenue pressures and an unprofitable status that complicates growth comparisons within the energy services industry.

- Click here to discover the nuances of Mammoth Energy Services with our detailed analytical financial health report.

- Evaluate Mammoth Energy Services' historical performance by accessing our past performance report.

Next Steps

- Click here to access our complete index of 735 US Penny Stocks.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:AWRE

Aware

A biometric identity platform company, provides biometrics software products and services for government agencies and commercial entities in the United States, the United Kingdom, and internationally.

Flawless balance sheet and overvalued.

Similar Companies

Market Insights

Community Narratives