- United States

- /

- Software

- /

- NasdaqGS:AVPT

Is AvePoint’s Multi-SaaS Data Protection Upgrade Shifting the Investment Outlook for AVPT?

Reviewed by Sasha Jovanovic

- Earlier this week, AvePoint announced significant enhancements to its Confidence Platform, introducing expanded multi-SaaS data protection, new support for Google GCP Virtual Machines, and deeper Copilot Studio Agent governance, alongside the launch of an Operational Efficiency Command Center.

- These developments address the rising need for centralized data protection and visibility as organizations juggle hundreds of SaaS applications within increasingly complex multi-cloud environments.

- We'll examine how AvePoint's rollout of new multi-SaaS data protection and governance features could influence its investment narrative and growth potential.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

AvePoint Investment Narrative Recap

At its core, the AvePoint investment story depends on the company’s ability to expand data governance solutions beyond the Microsoft ecosystem, diversify revenue across multiple clouds, and capitalize on fast-growing demand for unified SaaS data management. This week’s Confidence Platform updates respond directly to these industry pressures, but do not immediately shift the key near-term catalysts or the principal risk: AvePoint’s heavy reliance on Microsoft remains the most important consideration, particularly as industry giants enhance their own platforms.

The launch of expanded multi-SaaS data protection, now covering Monday.com, DocuSign, Smartsheet, Okta and Confluence, directly supports the narrative that AvePoint is moving beyond Microsoft-only dependence. This expanded coverage may help the company address its most critical risk, supporting efforts to reach new market segments and diversify cloud revenue sources, both of which are closely watched by investors as signals of long-term growth sustainability.

However, for investors, it’s important to remember that with broadening platform reach comes the potential for...

Read the full narrative on AvePoint (it's free!)

AvePoint's narrative projects $658.7 million revenue and $76.4 million earnings by 2028. This requires 20.9% yearly revenue growth and an $84.8 million earnings increase from the current -$8.4 million.

Uncover how AvePoint's forecasts yield a $21.89 fair value, a 55% upside to its current price.

Exploring Other Perspectives

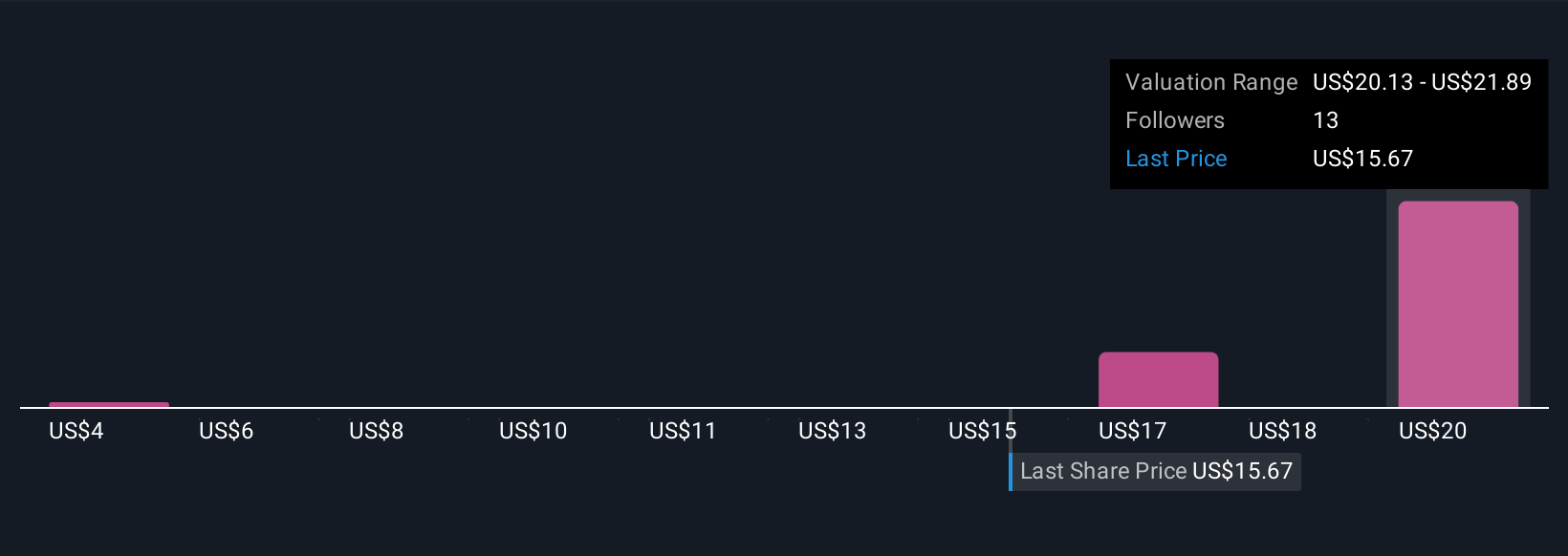

Simply Wall St Community members estimate AvePoint’s fair value from as low as US$4.27 to as high as US$21.89, showing a wide spread across three unique perspectives. While some expect upside on expanding into new cloud ecosystems, others highlight how persistent Microsoft dependence could limit the company’s longer-term performance, be sure to compare a range of these views before deciding where you stand.

Explore 3 other fair value estimates on AvePoint - why the stock might be worth as much as 55% more than the current price!

Build Your Own AvePoint Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your AvePoint research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free AvePoint research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate AvePoint's overall financial health at a glance.

Searching For A Fresh Perspective?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AVPT

AvePoint

Provides cloud-native data management software platform in North America, Europe, the Middle East, Africa, and the Asia Pacific.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

The "Sleeping Giant" Stumbles, Then Wakes Up

Swiped Left by Wall Street: The BMBL Rebound Trade

Duolingo (DUOL): Why A 20% Drop Might Be The Entry Point We've Been Waiting For

Ferrari's Intrinsic and Historical Valuation

Recently Updated Narratives

Adobe - A Fundamental and Historical Valuation

Probably the best stock I've seen all year.

Hims & Hers Health aims for three dimensional revenue expansion

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Trending Discussion