- United States

- /

- Software

- /

- NasdaqGS:AVPT

A Look at AvePoint (AVPT) Valuation Following AgentPulse Launch for Enterprise AI Governance

Reviewed by Simply Wall St

AvePoint (AVPT) just rolled out AgentPulse, a new AI agent registry designed to help businesses boost security, manage risk, and rein in AI-related costs as agent proliferation grows. The move comes at a time when organizations are navigating increasing challenges related to AI governance and compliance.

See our latest analysis for AvePoint.

This launch caps a volatile year for AvePoint, whose share price has slipped by 21.8% year-to-date, with a 26.4% total shareholder return loss over the past 12 months. However, looking further back, the company delivered a strong 164% total shareholder return in the last three years. This suggests that the recent product announcements may be part of a long-term strategy to recapture momentum as investor sentiment shifts.

If AvePoint’s focus on next-generation AI governance piques your interest, you might enjoy discovering See the full list for free.

With shares still trading at a significant discount to analyst price targets, and growth themes gaining momentum, investors may wonder whether AvePoint offers an undervalued entry or if the market is already anticipating stronger days ahead.

Most Popular Narrative: 32.3% Undervalued

The prevailing narrative places AvePoint’s fair value at $19.19, which is substantially above its last closing price of $13. Despite recent volatility, the narrative suggests a compelling case for upside. This sets the stage for a closer look at the drivers behind this perspective.

The expansion of AvePoint's offerings into adjacent cloud platforms (Google Workspace, Salesforce) and the early-stage rollout of Governance-as-a-Service beyond Microsoft 365 open up significant new addressable markets and revenue channels. These developments are expected to contribute to long-term top-line growth and diversification.

Want the inside scoop on what’s fueling this valuation? There is a forecast for revenue increases and profit improvements, underpinned by strategic expansion initiatives that are not widely anticipated. Unlock the narrative to find out what’s behind the valuation outlook and the factors that could set AvePoint apart.

Result: Fair Value of $19.19 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy reliance on Microsoft and challenges expanding into other cloud platforms could limit AvePoint’s growth and put pressure on its long-term revenue potential.

Find out about the key risks to this AvePoint narrative.

Another View: What Do Sales Ratios Say?

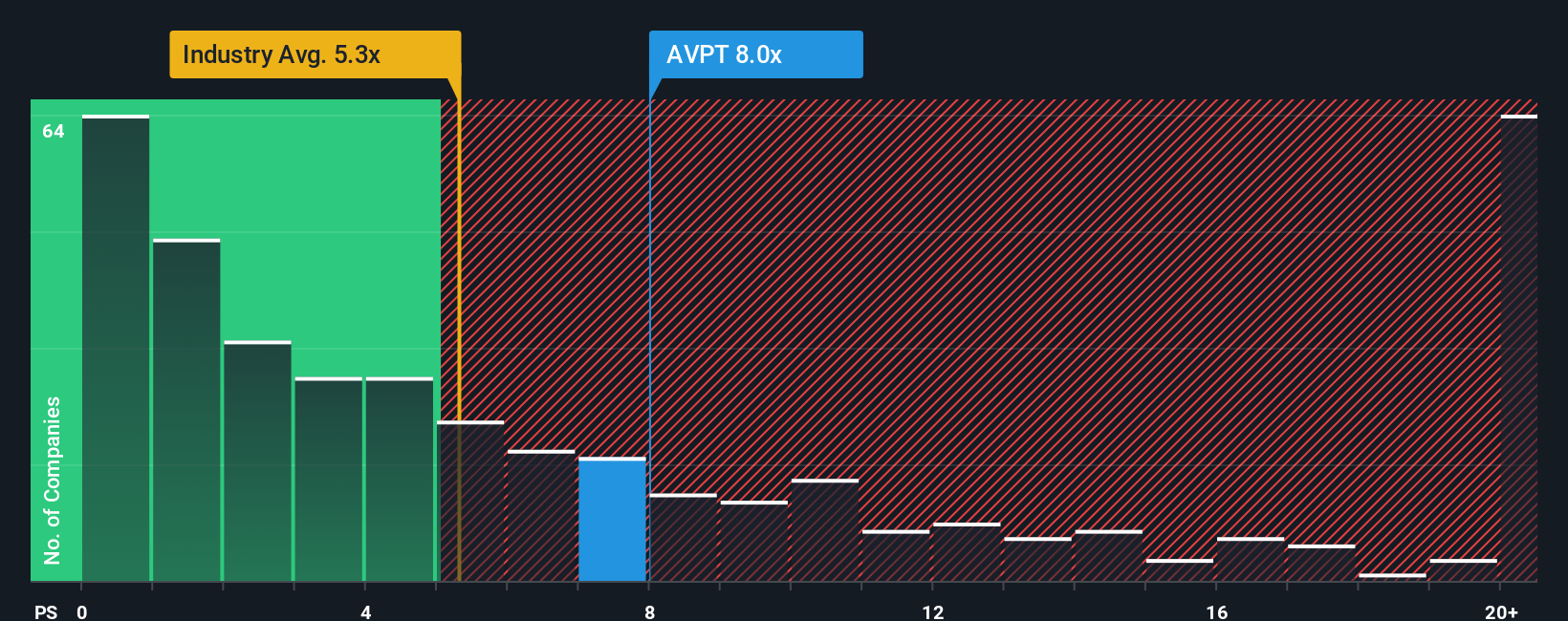

Looking at AvePoint’s valuation through its price-to-sales ratio reveals a different story. At 7.1x sales, the company trades at a premium to both the US software industry average of 4.9x and the peer average of 4.4x. It is also above its fair ratio of 5.7x. This suggests the market is already baking in a good deal of optimism, increasing valuation risk for new investors. Could the narrative-based upside actually be outweighed by stretched comparables?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own AvePoint Narrative

If you would rather dig into the numbers and shape your own conclusions, you can easily create a personalized narrative in just a few minutes. Do it your way.

A great starting point for your AvePoint research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors always stay ahead of the curve by scouting new opportunities. Check out these handpicked stock themes you might not have on your radar yet.

- Maximize your yield and boost portfolio income by tapping into these 15 dividend stocks with yields > 3% with generous returns and proven staying power.

- Expand your horizons with these 30 healthcare AI stocks, which promises to revolutionize patient care and drive long-term industry growth.

- Capitalize on the next wave of innovation by checking out these 25 AI penny stocks, delivering real-world impact as artificial intelligence transforms countless sectors.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AVPT

AvePoint

Provides cloud-native data management software platform in North America, Europe, the Middle East, Africa, and the Asia Pacific.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion