- United States

- /

- Banks

- /

- NasdaqGS:CNOB

3 Stocks Estimated To Be Up To 29.0% Below Intrinsic Value Offering Investment Opportunities

Reviewed by Simply Wall St

As the U.S. stock market experiences a period of optimism with major indexes like the S&P 500 and Nasdaq reaching record highs, investors are keenly focused on strong corporate earnings and economic resilience despite ongoing tariff uncertainties. In this environment, identifying stocks that are trading below their intrinsic value can offer compelling opportunities for investors looking to capitalize on potential market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| WesBanco (WSBC) | $30.51 | $58.39 | 47.8% |

| Valley National Bancorp (VLY) | $9.39 | $18.32 | 48.7% |

| RXO (RXO) | $15.44 | $30.14 | 48.8% |

| Peoples Financial Services (PFIS) | $48.45 | $93.66 | 48.3% |

| Pennant Group (PNTG) | $22.57 | $44.18 | 48.9% |

| Gogo (GOGO) | $16.43 | $32.45 | 49.4% |

| Definitive Healthcare (DH) | $4.00 | $7.86 | 49.1% |

| Camden National (CAC) | $37.11 | $72.87 | 49.1% |

| BioLife Solutions (BLFS) | $21.82 | $42.15 | 48.2% |

| AGNC Investment (AGNC) | $9.60 | $18.61 | 48.4% |

Let's review some notable picks from our screened stocks.

AvePoint (AVPT)

Overview: AvePoint, Inc. offers a cloud-native data management software platform across multiple regions including North America, Europe, the Middle East, Africa, and the Asia Pacific with a market cap of approximately $3.97 billion.

Operations: The company's revenue primarily comes from its Software & Programming segment, which generated $349.01 million.

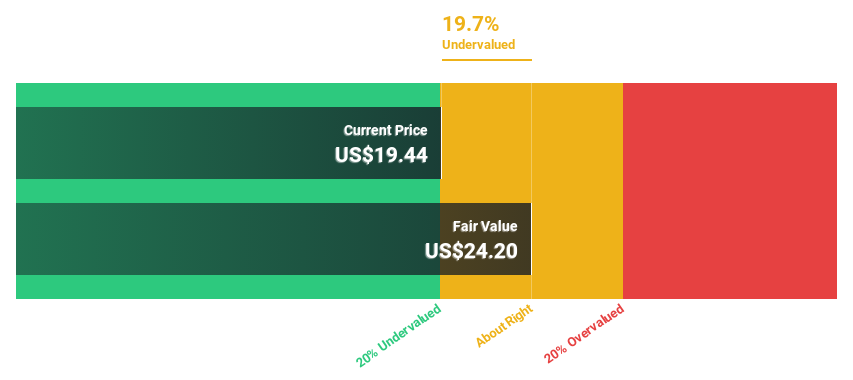

Estimated Discount To Fair Value: 29.0%

AvePoint's recent product updates, such as the Optimization and ROI Command Center, aim to enhance efficiency and reduce costs for organizations. The stock is trading 29% below its estimated fair value of US$27.19, suggesting potential undervaluation based on cash flows. Despite being dropped from several indices recently, AvePoint's revenue is projected to grow faster than the US market at 18.1% annually. However, significant insider selling in recent months may be a concern for investors.

- Upon reviewing our latest growth report, AvePoint's projected financial performance appears quite optimistic.

- Click here to discover the nuances of AvePoint with our detailed financial health report.

ConnectOne Bancorp (CNOB)

Overview: ConnectOne Bancorp, Inc. is the bank holding company for ConnectOne Bank, offering commercial banking products and services to small and mid-sized businesses, local professionals, and individuals in the United States, with a market cap of approximately $1.18 billion.

Operations: ConnectOne Bancorp generates revenue through its provision of commercial banking products and services tailored to small and mid-sized businesses, local professionals, and individuals across the United States.

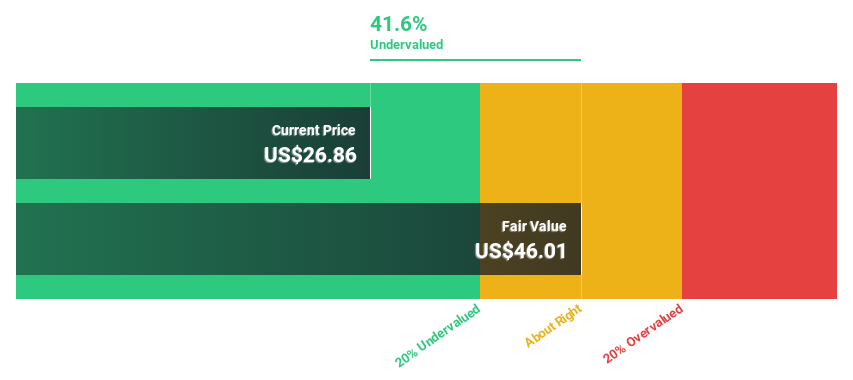

Estimated Discount To Fair Value: 24.7%

ConnectOne Bancorp is trading 24.7% below its estimated fair value of US$30.94, pointing to potential undervaluation based on cash flows. Despite a net loss in the recent quarter, earnings are forecast to grow significantly at 104% annually, outpacing the US market's growth rate. The company maintains a reliable dividend yield of 3.09%. However, profit margins have declined from last year and shareholders faced substantial dilution over the past year due to large one-off items impacting financial results.

- The growth report we've compiled suggests that ConnectOne Bancorp's future prospects could be on the up.

- Navigate through the intricacies of ConnectOne Bancorp with our comprehensive financial health report here.

Constellium (CSTM)

Overview: Constellium SE, along with its subsidiaries, is involved in the design, manufacture, and sale of rolled and extruded aluminum products across various sectors including aerospace, packaging, automotive, commercial transportation, general industrial, and defense markets; it has a market cap of approximately $2.10 billion.

Operations: Constellium's revenue is derived from its operations in designing, manufacturing, and selling rolled and extruded aluminum products for sectors such as aerospace, packaging, automotive, commercial transportation, general industrial, and defense.

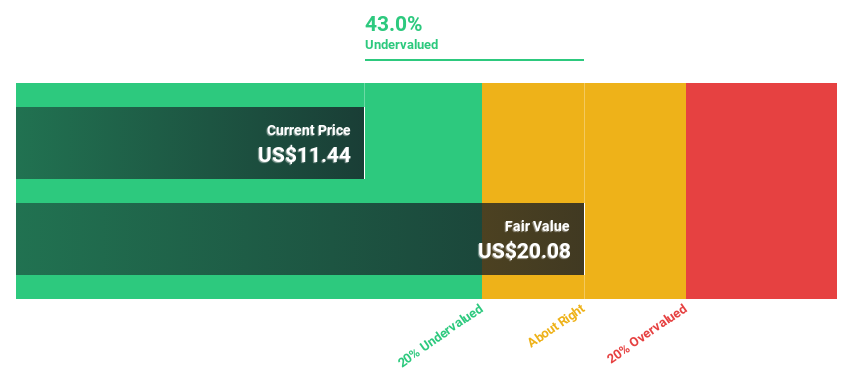

Estimated Discount To Fair Value: 13.5%

Constellium is trading at US$14.76, 13.5% below its estimated fair value of US$17.06, indicating potential undervaluation based on cash flows. Although profit margins have decreased from last year, earnings are expected to grow significantly at 64.7% annually over the next three years, surpassing the US market's growth rate. Recent share buybacks and strategic partnerships in aerospace and automotive sectors enhance long-term prospects despite lower net income in recent quarters compared to a year ago.

- Our expertly prepared growth report on Constellium implies its future financial outlook may be stronger than recent results.

- Click to explore a detailed breakdown of our findings in Constellium's balance sheet health report.

Seize The Opportunity

- Click this link to deep-dive into the 170 companies within our Undervalued US Stocks Based On Cash Flows screener.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CNOB

ConnectOne Bancorp

Operates as the bank holding company for ConnectOne Bank that provides commercial banking products and services for small and mid-sized businesses, local professionals, and individuals in the United States.

Flawless balance sheet with high growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives