- United States

- /

- Software

- /

- NasdaqGS:AUR

Is Aurora Innovation Stock Ready for a Rebound After Latest Tech Milestone in 2025?

Reviewed by Bailey Pemberton

If you’re wondering what to do with Aurora Innovation stock right now, you’re not alone. Investors have seen quite a ride lately. The share price jumped 7.1% just last week, but it has dipped 3.1% over the past month and is still down 8.5% for the year to date. What catches the eye, though, is the stock’s longer-term performance. Over the past three years, Aurora’s shares are up a staggering 157.1%. That type of growth often prompts questions about whether the company’s current market price actually matches its true value.

Recent developments in autonomous vehicle technology have been fueling excitement in the sector, putting companies like Aurora Innovation in the spotlight with each step forward in the race to commercialize self-driving solutions. As investor interest ebbs and flows, perceptions of risk and potential seem to shift with every headline, and we’ve definitely seen that reflected in Aurora’s price chart lately.

With a valuation score of 3 out of 6, meaning Aurora looks undervalued on three different checks, it’s clear that the story here is more complicated than a simple rise and fall on the charts. So how do we measure what this stock is really worth? Let’s take a closer look at the main ways analysts approach valuation, and stay tuned for an even more insightful perspective at the end of the article.

Why Aurora Innovation is lagging behind its peers

Approach 1: Aurora Innovation Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s true value by projecting its future cash flows and then discounting those figures back to today, reflecting both growth expectations and risk. In other words, it asks, “What is the business worth right now, based on the cash it will likely generate in the years ahead?”

For Aurora Innovation, recent data show a current free cash flow (FCF) of -$582.7 million, indicating heavy investment and negative cash generation as the company races to bring its technology to market. Analysts estimate FCF will remain negative for the next few years, reaching -$749.1 million in 2026 and -$625.1 million in 2027, before finally swinging positive in 2029 with an expected $362.6 million. Cash flows are projected to continue rising each year through the next decade, a trajectory that reflects optimism about commercialization success and market adoption.

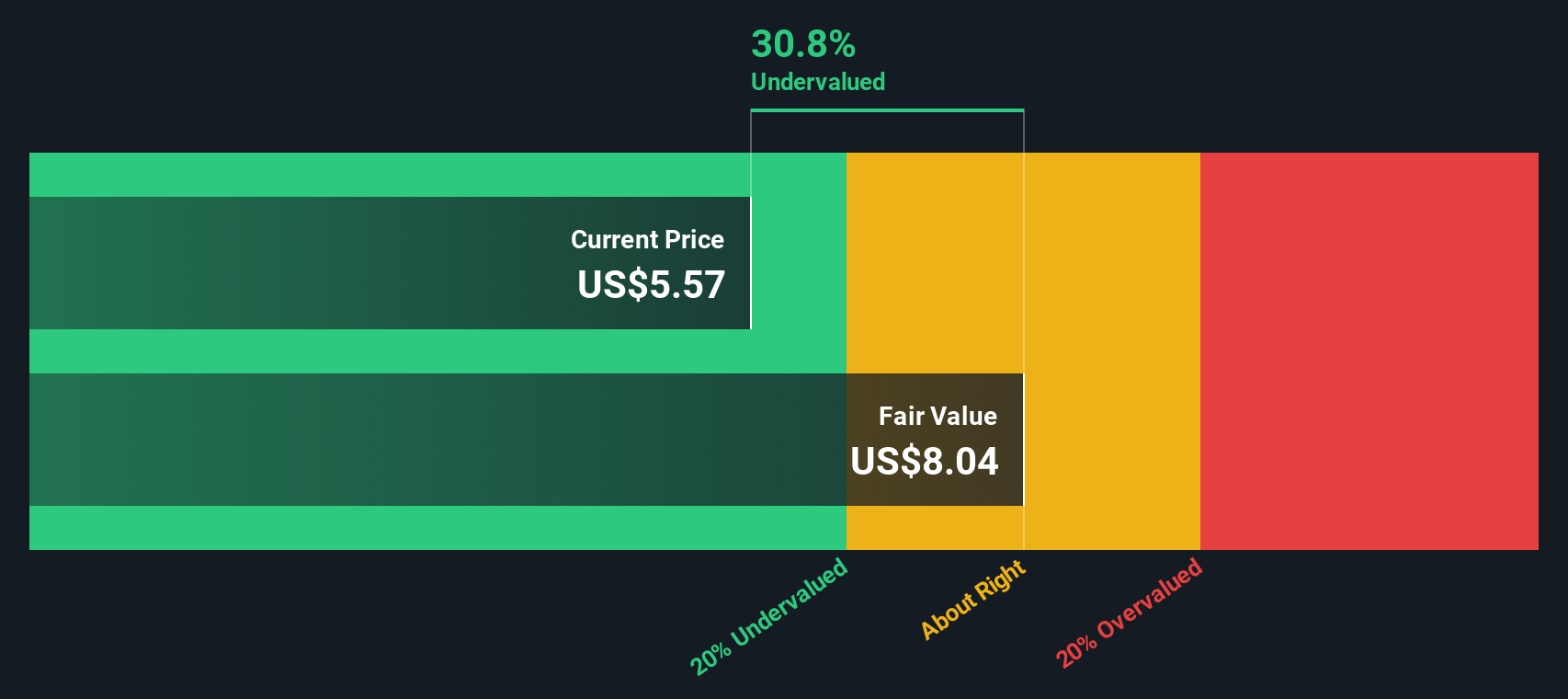

Based on these projections, the DCF model calculates an intrinsic fair value of $8.04 per share. This is about 30.6% higher than the current price, suggesting that, according to this model, Aurora Innovation stock is significantly undervalued.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Aurora Innovation is undervalued by 30.6%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Aurora Innovation Price vs Book

The price-to-book (P/B) ratio is often a reliable gauge for valuing companies that are still ramping up profitability or operate in sectors where tangible assets matter, such as Aurora Innovation in the autonomous driving space. Since Aurora does not yet generate positive earnings, the P/B ratio becomes the preferred multiple because it compares market value directly to the company’s net assets.

It is important to understand that what counts as a “normal” or “fair” ratio for a company depends heavily on expectations for future growth and the level of risk investors are willing to accept. Higher growth potential can justify a higher multiple, while greater risk typically pulls that number back down.

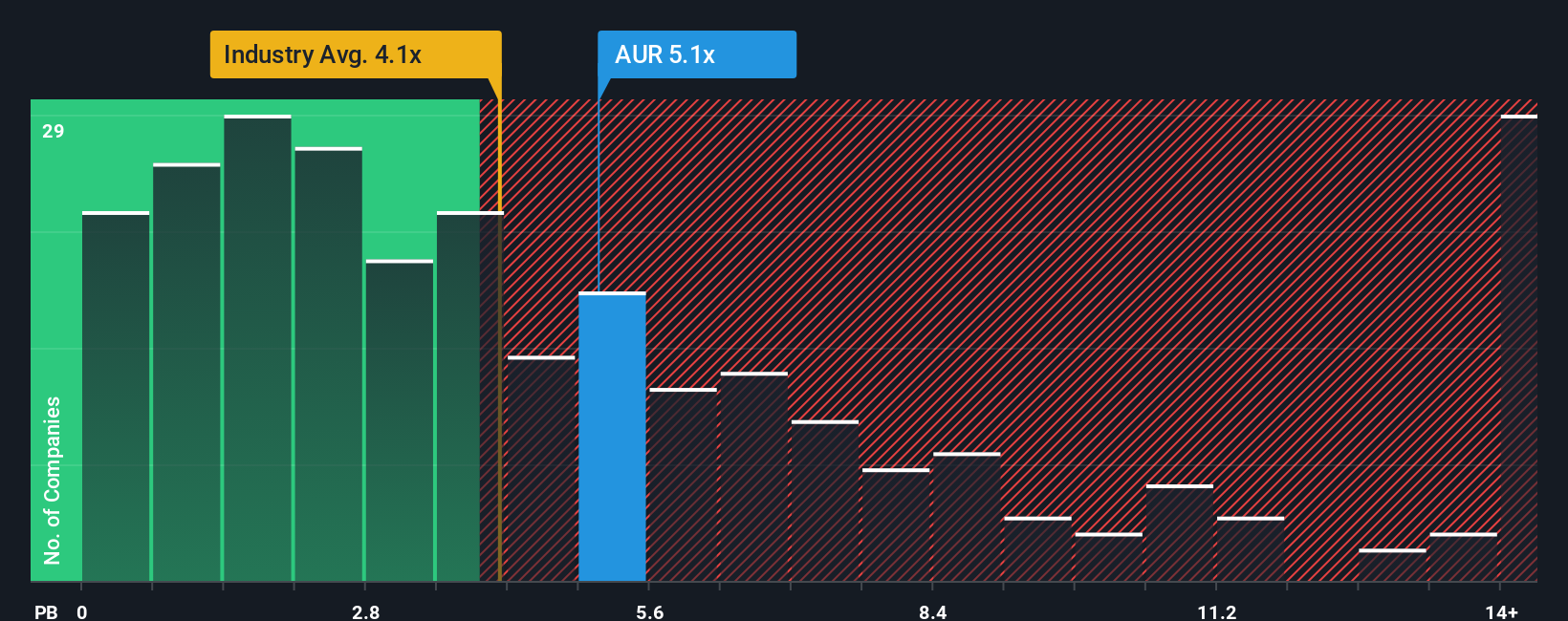

Currently, Aurora Innovation’s P/B ratio stands at 5.17x. For context, the industry average P/B is 4.19x, while its peers average 6.24x. At first glance, this puts Aurora above the sector norm but below some competitors. However, relying solely on peer or industry comparisons may not capture the full picture, especially for a company growing and innovating at Aurora’s pace.

This is where Simply Wall St’s proprietary “Fair Ratio” comes in. The Fair Ratio customizes what a reasonable P/B multiple should be for Aurora by factoring in its unique earnings trajectory, risk profile, profit margin, market cap, and industry backdrop. Unlike basic benchmarks, the Fair Ratio aims to reflect the company’s specific fundamentals and future outlook.

When we compare Aurora’s actual P/B multiple with its Fair Ratio, we find the difference is less than 0.10x. That suggests the stock is trading in line with its true intrinsic value based on the underlying business characteristics and industry dynamics.

Result: ABOUT RIGHT

PB ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Aurora Innovation Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let's introduce you to Narratives. A Narrative is your personalized story about a company, where you can define your assumptions on factors like future revenue growth, margins, and market trends. This connects the company’s journey to a concrete financial forecast and a calculated fair value.

This approach moves beyond just numbers by letting you articulate your perspective in an easy, visual way and then instantly see what your outlook means for the stock’s value. Narratives are available right on Simply Wall St’s Community page, where millions of investors connect, share, and discuss their analyses.

Narratives help guide your buy or sell decisions by showing how your Fair Value compares to the current share price. Best of all, they update dynamically as new earnings, news, or market events come in, so your investment view always stays relevant.

For example, some investors are projecting Aurora’s fair value as high as $16 based on strong future growth, while others take a cautious view, estimating closer to $5 per share. With Narratives, you can see all these perspectives side by side, helping you make more informed investment decisions.

Do you think there's more to the story for Aurora Innovation? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AUR

Aurora Innovation

Operates as a self-driving technology company in the United States.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives