- United States

- /

- Software

- /

- NasdaqGS:AUR

Aurora Innovation (AUR): Assessing Valuation as Analyst Buy Ratings Align with Anticipated Q3 Earnings

Reviewed by Kshitija Bhandaru

Anticipation is building around Aurora Innovation (AUR) as a string of reiterated Buy ratings from major institutions lines up with the company’s upcoming third-quarter earnings announcement. Investors are watching how its autonomous tech ambitions translate to results.

See our latest analysis for Aurora Innovation.

Over the past year, Aurora Innovation’s share price has drifted lower despite big headlines, posting a 1-year total shareholder return of -11.7%. However, the stock’s remarkable 166.5% gain over the last three years highlights its long-term momentum. After some recent pullbacks, investors seem focused on whether upcoming financial results can reignite the kind of optimism that powered its prior multi-year rally.

If you're curious what else is capturing investor attention in tech and AI, now’s a great moment to discover See the full list for free.

With respected analysts piling on Buy ratings and the latest financials just ahead, investors are left wondering if AUR’s current price represents a bargain on future growth, or if the market has already factored in all the good news.

Price-to-Book Ratio of 5.1x: Is it justified?

At a price-to-book (P/B) ratio of 5.1x, Aurora Innovation’s valuation comes in slightly below the peer group average of 5.8x, but remains above the broader US software industry average of 4x. The last close price of $5.49 reflects this positioning, indicating that the market is pricing AUR in line with direct competitors, but at a noticeable premium to the wider sector.

The price-to-book ratio compares the company’s market value to its net assets, offering a snapshot of how much investors are willing to pay for each dollar of book value. For early-stage or high-growth tech companies like Aurora Innovation, this multiple is commonly used because current earnings may not be meaningful due to the company’s investment phase and unprofitable status.

AUR’s valuation suggests investors see potential in its growth story, even as profitability remains elusive. This premium price tag versus the overall industry highlights high expectations for future gains and long-term assets, partially justified by forecasts of rapid revenue growth.

However, when compared specifically to the US software industry’s average, Aurora Innovation stands out as expensive on a P/B basis. Yet it is a relative bargain against its closest peers. Investors looking for fair value should keep an eye on how market sentiment and company fundamentals shift in future reporting cycles.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book Ratio of 5.1x (ABOUT RIGHT)

However, slowing momentum in share performance and ongoing net losses could undermine confidence if growth targets fall short or if profitability remains elusive.

Find out about the key risks to this Aurora Innovation narrative.

Another View: Discounted Cash Flow Says Undervalued

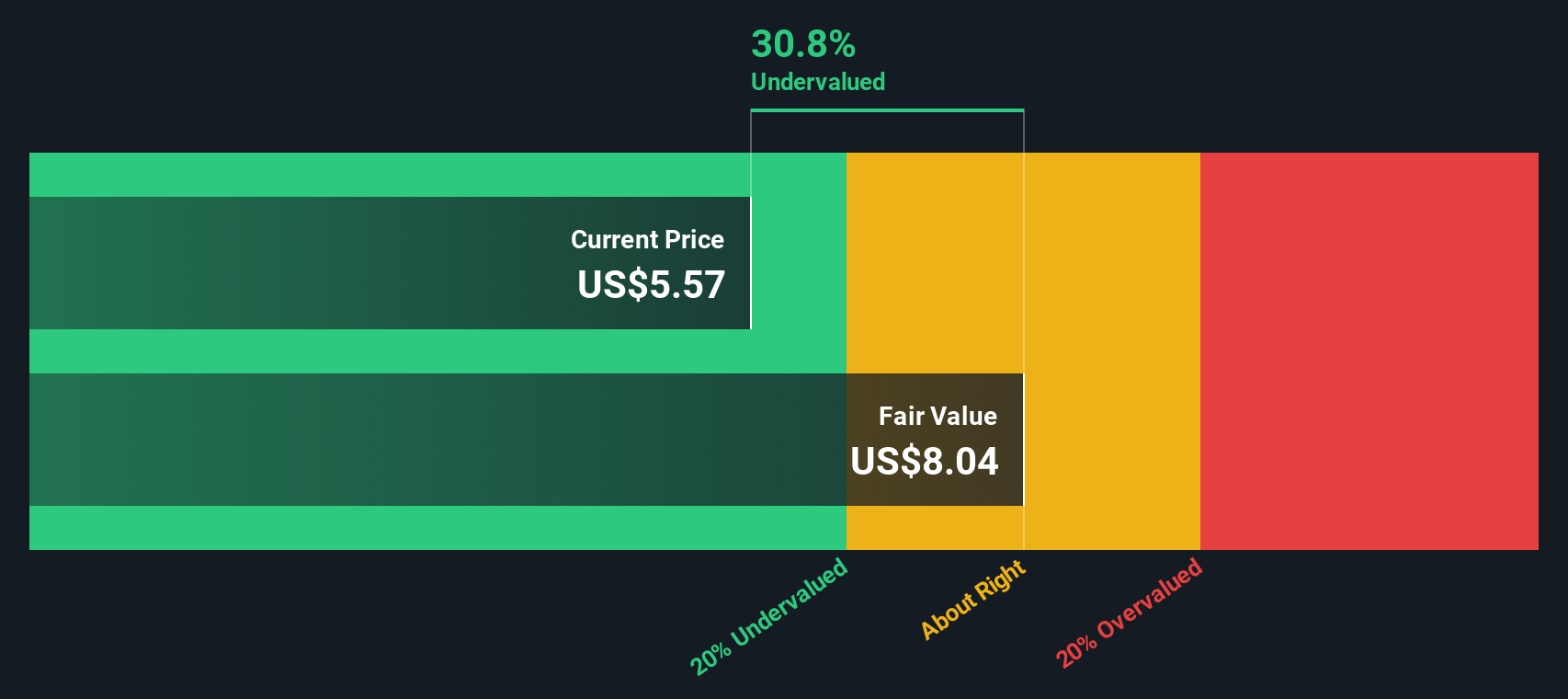

Looking at the SWS DCF model, things appear different for Aurora Innovation. The DCF approach suggests the fair value is $8.28. This makes the current share price of $5.49 appear 33.7% undervalued. Does this indicate real upside, or is it a sign the market is cautious for good reason?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Aurora Innovation for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Aurora Innovation Narrative

If you have your own take on Aurora Innovation’s story, or want a deeper dive into the numbers, feel free to shape your perspective in just a few minutes with Do it your way

A great starting point for your Aurora Innovation research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let opportunities slip by while others spot tomorrow’s winners today. Take charge and fuel your portfolio with fresh insights using these handpicked strategies:

- Capture reliable income and steady returns by checking out these 18 dividend stocks with yields > 3% with yields surpassing 3% and a track record of consistent payouts.

- Spot breakthrough innovators in medicine and biotech by starting with these 33 healthcare AI stocks. These companies are making waves in healthcare through artificial intelligence and transformative solutions.

- Accelerate your search for undervalued opportunities by reviewing these 877 undervalued stocks based on cash flows. These selections look primed for growth based on strong cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AUR

Aurora Innovation

Operates as a self-driving technology company in the United States.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives