- United States

- /

- Software

- /

- NasdaqGM:APPF

Taking a Fresh Look at AppFolio (APPF) Valuation After UBS Initiates Coverage With a Buy Rating

Reviewed by Simply Wall St

AppFolio (APPF) just caught fresh attention after UBS kicked off coverage with a Buy call. The firm highlighted steady customer spending and limited competitive pressure, a backdrop that helps frame the stock’s recent pullback.

See our latest analysis for AppFolio.

That upbeat call lands after a choppy stretch, with the share price at $231.43 posting a 30 day share price return of negative 6.67 percent and a 1 year total shareholder return of negative 12.22 percent, even as the three year total shareholder return sits above 100 percent. This suggests that long term momentum is intact, while nearer term enthusiasm has cooled.

If AppFolio’s setup has you thinking about where else strong software style growth and sentiment might be brewing, it is a good moment to explore high growth tech and AI stocks.

With revenue still growing double digits and Wall Street targets sitting well above the current price, investors now face a key question: Is AppFolio still trading below its true potential, or is future growth already fully priced in?

Most Popular Narrative Narrative: 27% Undervalued

Against AppFolio’s last close of $231.43, the most popular narrative pegs fair value materially higher, implying the market is discounting its long term potential.

Analysts are assuming AppFolio's revenue will grow by 17.7% annually over the next 3 years.

Analysts assume that profit margins will shrink from 23.5% today to 13.7% in 3 years time.

Want to understand why slowing margins can still support a much higher valuation? The narrative leans on powerful revenue compounding and a bold earnings multiple. Curious which assumptions really drive that upside case and how sensitive they are to execution? Read on to see the framework behind this fair value call.

Result: Fair Value of $317.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upside case could falter if the U.S. market saturates faster than expected or rivals quickly match AppFolio’s AI-driven capabilities.

Find out about the key risks to this AppFolio narrative.

Another Lens On Valuation

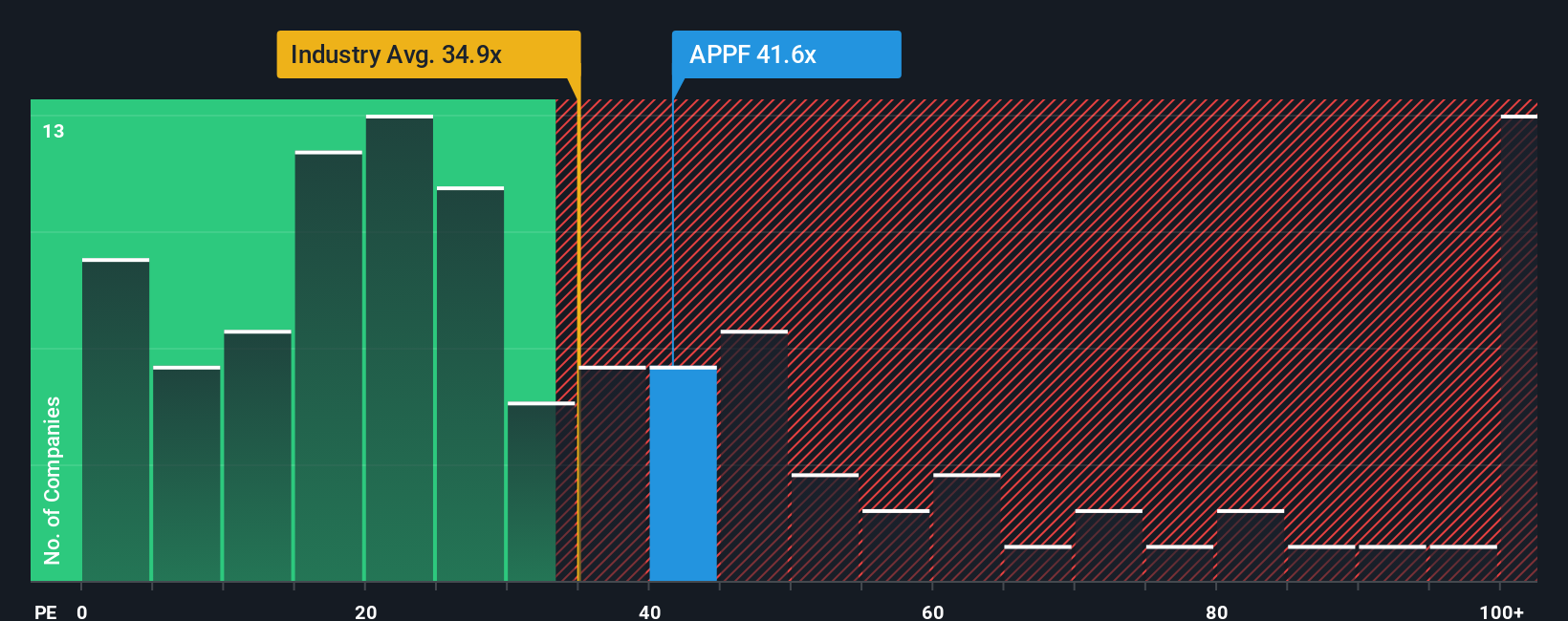

While the narrative points to upside, our valuation using the price to earnings ratio paints a tougher picture. AppFolio trades at 40.8 times earnings, which is well above peers at 24.8 times, the US software sector at 32.9 times, and a fair ratio of 27.3 times.

This gap suggests investors are already paying up for execution, leaving less room for error if growth slows or margins disappoint. Could today’s premium become tomorrow’s drag if sentiment turns?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own AppFolio Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a tailored view in just minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding AppFolio.

Looking for more investment ideas?

Do not leave your next move to chance. Use the Simply Wall Street Screener to pinpoint opportunities that match your strategy before the crowd catches on.

- Capitalize on underpriced quality by scanning these 901 undervalued stocks based on cash flows that the market has not fully recognized yet.

- Ride powerful thematic growth by targeting these 26 AI penny stocks at the center of the AI transformation.

- Strengthen your income stream by focusing on these 13 dividend stocks with yields > 3% that can help support long term returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:APPF

AppFolio

Provides cloud-based platform for the real estate industry in the United States.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)