- United States

- /

- Software

- /

- NasdaqGM:APPF

AppFolio (APPF) Margin Expansion Challenges Concerns on Sustainability Despite Premium Valuation

Reviewed by Simply Wall St

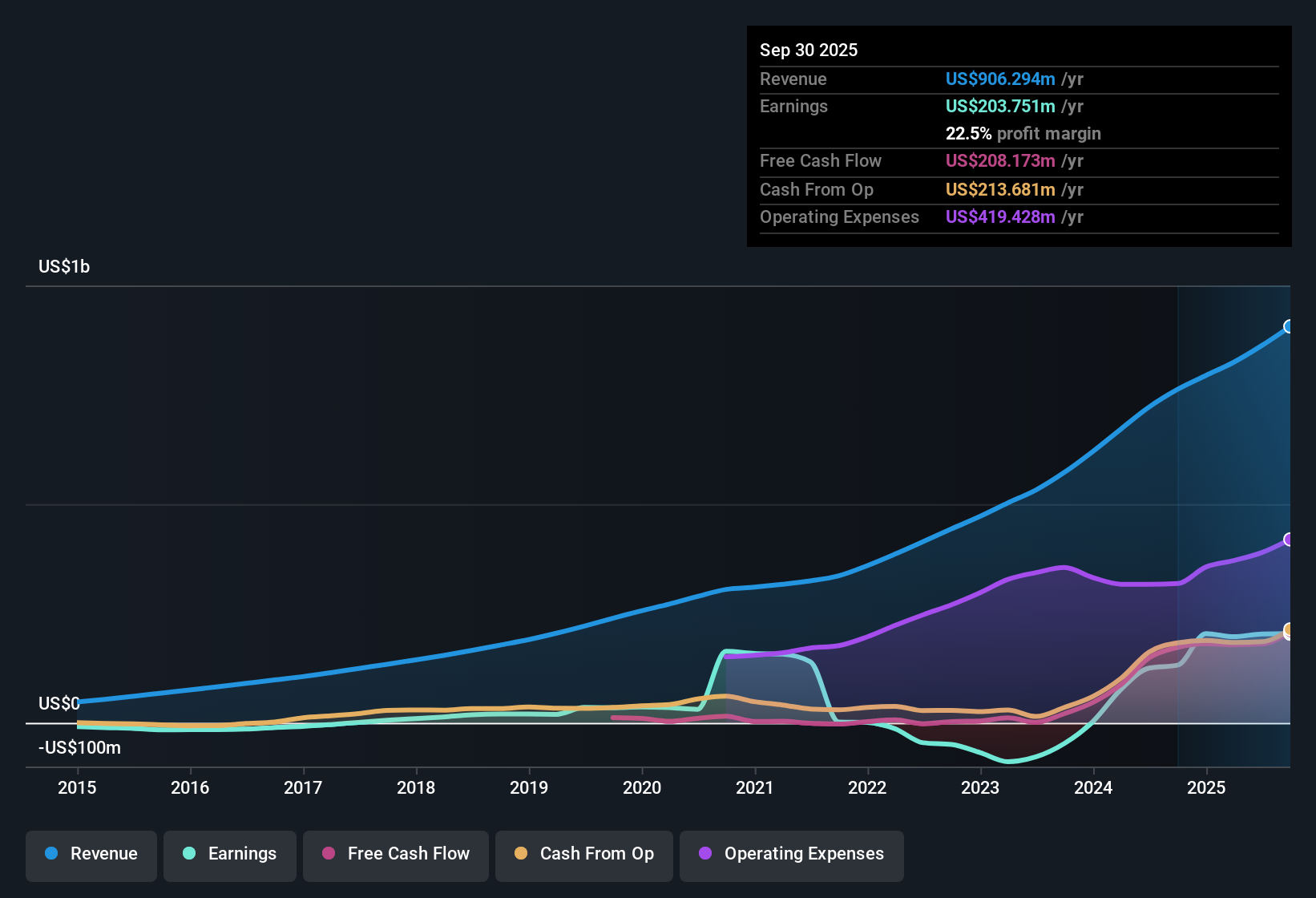

AppFolio (APPF) delivered another quarter of standout growth, with EPS climbing at an annual rate of 17.6% over the past five years and jumping 54.8% in the last year. Net profit margin now sits at 22.5%, up from 17.3% a year ago, and revenue is forecast to rise 17% per year, outpacing the US market. While the company’s topline and profitability metrics are strong, investors are likely weighing future earnings growth, which is expected to slow to 4.4% annually, and the premium valuation in the current share price of $254.43.

See our full analysis for AppFolio.Next up, we will see how these headline results compare against the prevailing narratives, looking at where the numbers confirm expectations and where they might change perspectives.

See what the community is saying about AppFolio

Margin Expansion Defies Industry Norms

- Net profit margin has increased from 17.3% to 22.5%, outpacing the U.S. software industry where average profit margins remain lower.

- Analysts' consensus view highlights AppFolio's investment in high-margin services, like advanced screening and payment processing, as a key reason margins have grown faster than peers.

- This platform-first approach, with more integrated ecosystem partnerships, drives stickiness and recurring revenue. This reinforces the view that AppFolio can sustain margin leadership even as broader market competition intensifies.

- Consensus narrative notes that increased operational efficiency and value-added services strengthen recurring cash flow, suggesting resilience if external conditions tighten.

- See how earnings momentum fits the bigger market story. Find the full Consensus Narrative for AppFolio.

Growth Outpaces Market, But Guidance Points to Slowdown

- AppFolio's revenue is projected to grow at 17% annually, ahead of the U.S. market's 10.3% forecast, but future earnings growth is guided to just 4.4% per year compared to the U.S. average of 15.9%.

- Analysts' consensus narrative flags that while AI-powered automation and ecosystem partnerships are fueling rapid customer adoption now, competition and rising costs could constrain future revenue and pressure margins.

- Competitive pressures from similar SaaS providers risk commoditizing the property management segment, which could give customers more bargaining power and lower pricing over time.

- Heavy, ongoing investment in R&D and innovation is necessary to maintain differentiation but could shrink profit margins if competitors catch up technologically.

Premium Valuation Versus Peers and DCF Fair Value

- Shares trade at $254.43, yielding a price-to-earnings ratio of 44.8x, which is higher than both the U.S. software industry average (34.1x) and peer average (16.8x). This is currently above the DCF fair value of $205.86.

- Analysts' consensus view sees the premium as justified by superior growth and margin expansion, but notes that in order to reach the consensus price target of $320.20, investors must expect sustained earnings momentum and be comfortable paying an even higher future PE ratio of 79.3x.

- Bears question whether high growth and profitability trends can continue in a more competitive, innovation-heavy landscape, especially as revenue and margin guidance point to slower expansion.

- The gap between the current price and both fair value and industry norms increases the required conviction that AppFolio can maintain its lead and justify an elevated multiple.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for AppFolio on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different take on the results? Bring your own perspective to life and shape your narrative in just minutes with Do it your way.

A great starting point for your AppFolio research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

While AppFolio’s impressive growth and margins stand out, slowing earnings guidance and a premium valuation compared to fair value raise concerns about future upside.

If paying top dollar for slower growth feels risky, compare with these 834 undervalued stocks based on cash flows and discover companies trading at more attractive valuations right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:APPF

AppFolio

Provides cloud-based platform for the real estate industry in the United States.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)