- United States

- /

- Software

- /

- NasdaqGS:APP

AppLovin (APP) Valuation Check as Axon 2 AI Drives Analyst Confidence in Long-Term Growth Potential

Reviewed by Simply Wall St

Recent analyst commentary around AppLovin (APP) is really centered on one thing: the Axon 2 AI platform quietly reshaping its ad business across mobile apps, e commerce, connected TV, and streaming.

See our latest analysis for AppLovin.

That backdrop helps explain why, even with a recent pullback that left the latest share price at $670.67 and a 1 day share price return of minus 6.46 percent, AppLovin still shows a year to date share price return of 96.23 percent and a three year total shareholder return of 69.75 percent. This suggests momentum remains firmly positive as Axon 2 gains traction and upcoming tech conferences keep the growth narrative in focus.

If Axon 2 has you rethinking what scalable software growth can look like, it may be worth exploring high growth tech and AI stocks as potential next wave candidates.

With Axon 2 accelerating growth, Jefferies lifting its target to $860, and shares still trading below consensus, is AppLovin quietly undervalued here, or is the market already baking in years of AI driven upside?

Most Popular Narrative: 7.9% Undervalued

With the narrative fair value sitting at 728.25 dollars versus AppLovin's last close of 670.67 dollars, the story leans toward upside driven by aggressive profit expansion and premium earnings assumptions.

The future P/E multiple has fallen slightly from about 40.25 times to 39.52 times, suggesting a modest easing in the valuation premium applied to forward earnings.

Revenue growth has risen slightly from roughly 23.55 percent to 24.62 percent, indicating a small upgrade to top line expansion expectations.

Want to see what kind of earnings machine justifies that rich future multiple and upgraded growth path? The narrative leans on bold compounding and fat margins. Curious how far those assumptions really stretch valuation? Explore the full roadmap behind this fair value estimate.

Result: Fair Value of $728.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, tighter global privacy rules and intensified competition from digital ad giants could quickly compress AppLovin's margins and challenge these bullish growth assumptions.

Find out about the key risks to this AppLovin narrative.

Another View: Rich Multiples, Different Story

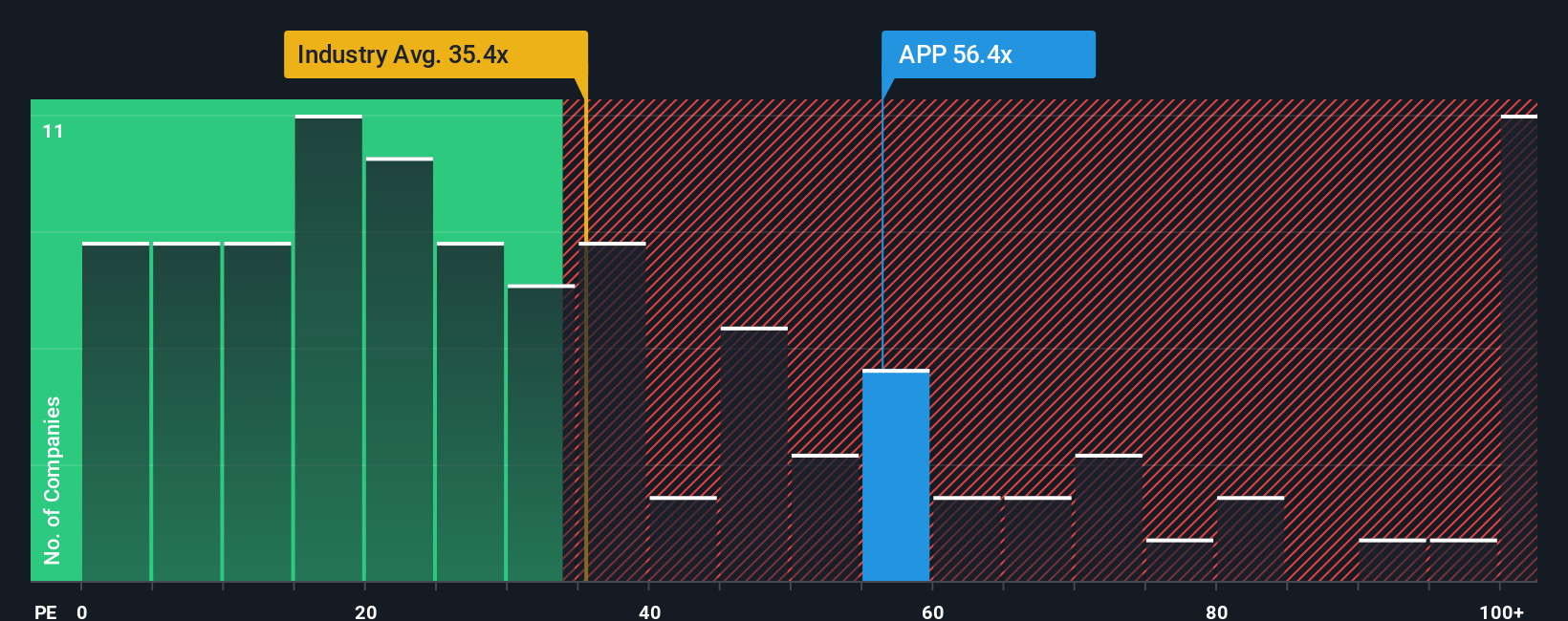

Strip out the narrative fair value and the current earnings multiple paints a tougher picture. At about 77.7 times earnings versus 32.9 times for US software peers and a 56.7 times fair ratio, the stock looks stretched. This raises the question: how much AI upside is already priced in?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own AppLovin Narrative

If these perspectives do not quite fit your view, take a closer look at the numbers and create your own narrative in just a few minutes, Do it your way.

A great starting point for your AppLovin research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next opportunities with our powerful screeners on Simply Wall St so you never leave compelling ideas on the table.

- Capitalize on value by targeting companies trading below their cash flow potential with these 908 undervalued stocks based on cash flows, which highlights mispriced opportunities.

- Ride structural shifts in automation and data with these 26 AI penny stocks, spotlighting businesses at the forefront of intelligent technology.

- Boost your income strategy using these 13 dividend stocks with yields > 3% to pinpoint companies offering reliable yields above 3 percent.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:APP

AppLovin

Engages in building a software-based platform for advertisers to enhance the marketing and monetization of their content in the United States and internationally.

Exceptional growth potential with solid track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)