- United States

- /

- Software

- /

- NasdaqGS:ALRM

Insiders At Alarm.com Holdings Sold US$2.3m In Stock, Alluding To Potential Weakness

A number of Alarm.com Holdings, Inc. (NASDAQ:ALRM) insiders sold their shares in the last year, which may have raised concerns among investors. When evaluating insider transactions, knowing whether insiders are buying versus if they selling is usually more beneficial, as the latter can be open to many interpretations. However, if numerous insiders are selling, shareholders should investigate more.

Although we don't think shareholders should simply follow insider transactions, we would consider it foolish to ignore insider transactions altogether.

View our latest analysis for Alarm.com Holdings

Alarm.com Holdings Insider Transactions Over The Last Year

In the last twelve months, the biggest single sale by an insider was when the CFO & Principal Accounting Officer, Steve Valenzuela, sold US$446k worth of shares at a price of US$58.48 per share. So we know that an insider sold shares at around the present share price of US$54.76. We generally don't like to see insider selling, but the lower the sale price, the more it concerns us. We note that this sale took place at around the current price, so it isn't a major concern, though it's hardly a good sign.

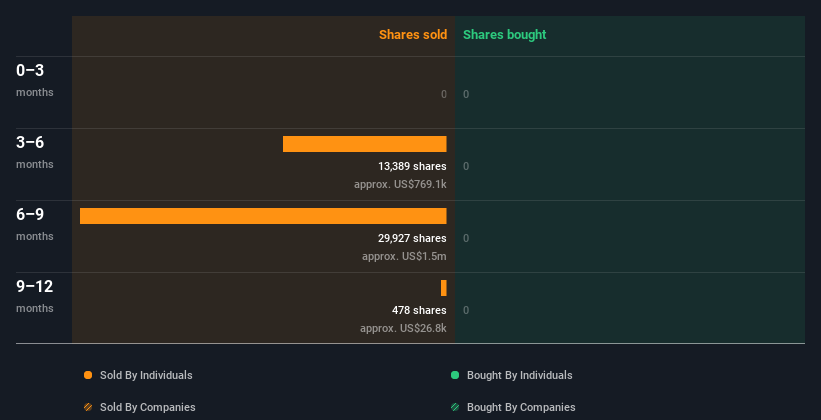

Alarm.com Holdings insiders didn't buy any shares over the last year. You can see a visual depiction of insider transactions (by companies and individuals) over the last 12 months, below. By clicking on the graph below, you can see the precise details of each insider transaction!

I will like Alarm.com Holdings better if I see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Does Alarm.com Holdings Boast High Insider Ownership?

For a common shareholder, it is worth checking how many shares are held by company insiders. Usually, the higher the insider ownership, the more likely it is that insiders will be incentivised to build the company for the long term. Alarm.com Holdings insiders own about US$132m worth of shares (which is 4.8% of the company). I like to see this level of insider ownership, because it increases the chances that management are thinking about the best interests of shareholders.

What Might The Insider Transactions At Alarm.com Holdings Tell Us?

It doesn't really mean much that no insider has traded Alarm.com Holdings shares in the last quarter. It's heartening that insiders own plenty of stock, but we'd like to see more insider buying, since the last year of Alarm.com Holdings insider transactions don't fill us with confidence. While we like knowing what's going on with the insider's ownership and transactions, we make sure to also consider what risks are facing a stock before making any investment decision. To assist with this, we've discovered 1 warning sign that you should run your eye over to get a better picture of Alarm.com Holdings.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of interesting companies, that have HIGH return on equity and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:ALRM

Alarm.com Holdings

Provides various Internet of Things (IoT) and solutions for residential, multi-family, small business, and enterprise commercial markets in North America and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives