- United States

- /

- Software

- /

- NasdaqGS:ALKT

Hanscom Federal Credit Union Partnership Could Be a Game Changer for Alkami Technology (ALKT)

Reviewed by Sasha Jovanovic

- Hanscom Federal Credit Union recently announced a partnership with Alkami Technology to launch a proprietary mobile banking app featuring gamified financial wellness tools and enhanced online banking infrastructure.

- This collaboration highlights a growing industry focus on personalized digital engagement as credit unions adopt new technology to meet evolving member expectations.

- We'll explore how Alkami's role in delivering customized digital experiences for financial institutions could influence its investment narrative going forward.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Alkami Technology Investment Narrative Recap

To be a shareholder in Alkami Technology, you'd need to believe that growing demand for digital transformation among credit unions will drive continued customer wins and recurring revenue growth. The Hanscom Federal Credit Union partnership showcases Alkami's ability to support next-generation banking apps, but it does not materially shift the near-term catalyst of platform adoption rates. The biggest risk remains sector concentration, as dependence on regional credit unions could magnify the impact of any industry downturn or consolidation.

The recent expansion with Red Rocks Credit Union, which adopted Alkami's Digital Banking Solution and Data & Marketing Solution, echoes the trend seen in the Hanscom partnership, financial institutions seeking to deepen digital engagement. Both events reinforce the importance of broadening Alkami's client base to sustain growth and defend against the risk of increasing consolidation among smaller banks and credit unions.

At the same time, investors should be aware that heavy sector concentration could leave Alkami exposed if ...

Read the full narrative on Alkami Technology (it's free!)

Alkami Technology's outlook projects $743.3 million in revenue and $62.2 million in earnings by 2028. This assumes a 24.5% annual revenue growth rate and a $100.7 million increase in earnings from the current level of -$38.5 million.

Uncover how Alkami Technology's forecasts yield a $38.44 fair value, a 65% upside to its current price.

Exploring Other Perspectives

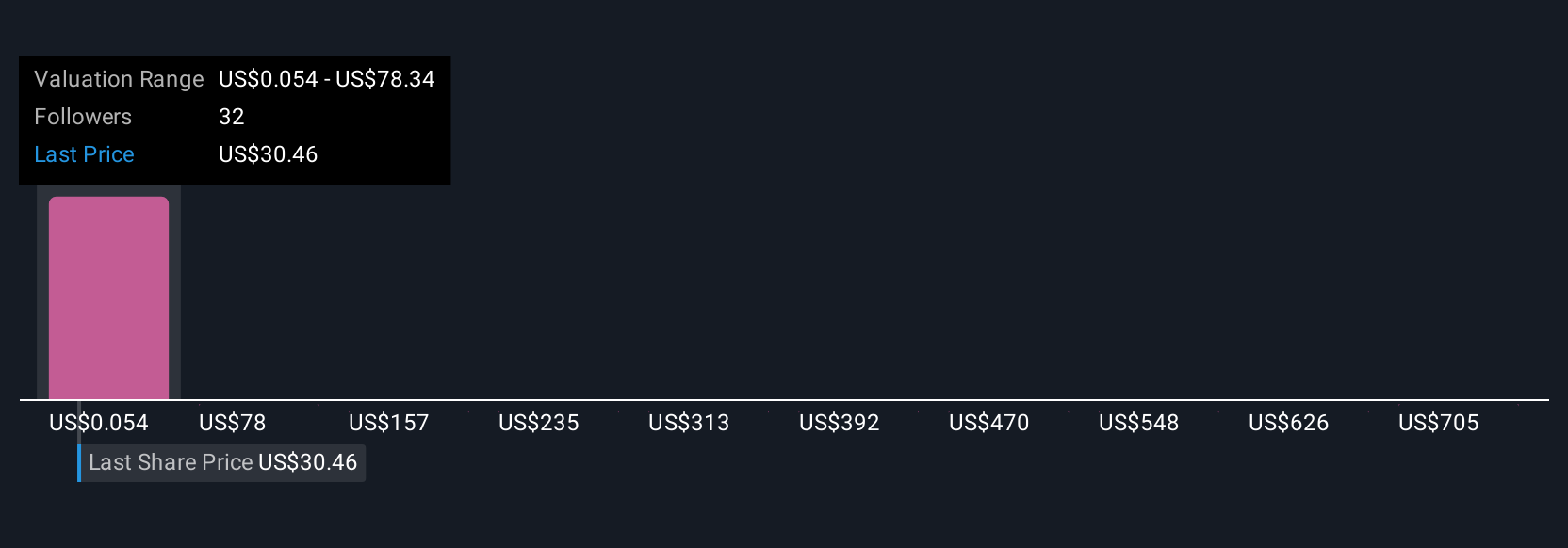

Ten members of the Simply Wall St Community provided fair value estimates for Alkami ranging from US$16.54 to US$122.14, highlighting widely differing expectations. While new client partnerships hint at further revenue growth potential, you can explore how sharply opinions on future performance can diverge among investors here.

Explore 10 other fair value estimates on Alkami Technology - why the stock might be worth over 5x more than the current price!

Build Your Own Alkami Technology Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Alkami Technology research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Alkami Technology research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Alkami Technology's overall financial health at a glance.

Seeking Other Investments?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ALKT

Alkami Technology

Provides cloud-based digital banking solutions in the United States.

Exceptional growth potential and fair value.

Similar Companies

Market Insights

Community Narratives