- United States

- /

- Software

- /

- NasdaqGS:ALKT

Alkami Technology (NasdaqGS:ALKT) Reports Revenue Growth And Reduced Net Loss With 2025 Guidance

Reviewed by Simply Wall St

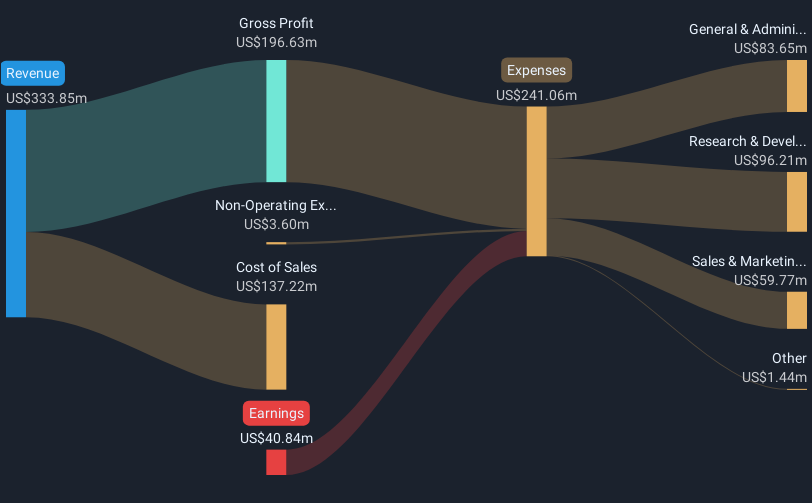

Alkami Technology (NasdaqGS:ALKT) recently announced its Q4 2024 results, showing sales of $90 million, marking a year-on-year increase, while reducing its net loss. However, despite this report and positive earnings guidance for 2025, including projected GAAP revenue for Q1 ranging between $94 million and $95 million, the company's stock saw a 9% decline over the past week. This drop coincides with broader market volatility, highlighted by a general downturn in the Nasdaq, which fell 5.5% in February, its worst month since September 2023. The recent tech selloff, partly provoked by disruptions like Nvidia's earnings miss and overarching market concerns about economic health and inflation, likely influenced ALKT's short-term share price movement despite its promising financial projections and improving operational performance. Market trends indicate ongoing uncertainty, affecting tech stocks despite easing inflation metrics, contributing to the company's recent price movement.

Dig deeper into the specifics of Alkami Technology here with our thorough analysis report.

Over the past three years, Alkami Technology's total shareholder returns have been substantial, amounting to a growth of 90.28%. This performance highlights a strong upward trajectory despite facing broader market challenges, particularly over the last year where its 16.9% return matched the overall US market. However, it notably outperformed the US Software industry, which returned 7.9% during the same period.

Significant to its long-term growth were key partnerships, such as the collaborations with NASA Federal Credit Union and Financial Center First Credit Union in early 2025, enhancing its digital banking capabilities. The company's innovative strides, like launching an Engagement AI Model in August 2024, further underpin its competitive edge. Additionally, the substantial follow-on equity offering in November 2024, raising US$281.25 million, provided liquidity to fund growth initiatives, underscoring investor confidence despite its reported net losses. These factors collectively fueled Alkami's notable returns over the specified period.

- Get the full picture of Alkami Technology's valuation metrics and investment prospects—click to explore.

- Gain insight into the risks facing Alkami Technology and how they might influence its performance—click here to read more.

- Already own Alkami Technology? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ALKT

Alkami Technology

Provides cloud-based digital banking solutions in the United States.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives