- United States

- /

- Banks

- /

- NasdaqGS:TOWN

3 US Stocks That Might Be Trading Below Their Estimated Value

Reviewed by Simply Wall St

As the U.S. stock market navigates a period of volatility, with recent declines following the Federal Reserve's decision to maintain interest rates amid persistent inflation and awaiting major tech earnings, investors are keenly observing opportunities that may arise from these fluctuations. In this environment, identifying stocks that might be trading below their estimated value requires careful consideration of factors such as financial health, growth potential, and market position relative to current economic conditions.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Berkshire Hills Bancorp (NYSE:BHLB) | $28.57 | $56.67 | 49.6% |

| First National (NasdaqCM:FXNC) | $24.98 | $48.64 | 48.6% |

| Array Technologies (NasdaqGM:ARRY) | $7.15 | $14.24 | 49.8% |

| Advanced Energy Industries (NasdaqGS:AEIS) | $112.64 | $219.14 | 48.6% |

| Privia Health Group (NasdaqGS:PRVA) | $22.51 | $44.59 | 49.5% |

| Bilibili (NasdaqGS:BILI) | $16.78 | $33.06 | 49.2% |

| Verra Mobility (NasdaqCM:VRRM) | $26.39 | $51.91 | 49.2% |

| BeiGene (NasdaqGS:ONC) | $226.71 | $438.50 | 48.3% |

| Equifax (NYSE:EFX) | $271.18 | $532.03 | 49% |

| Similarweb (NYSE:SMWB) | $16.51 | $31.96 | 48.3% |

Here we highlight a subset of our preferred stocks from the screener.

Array Technologies (NasdaqGM:ARRY)

Overview: Array Technologies, Inc. manufactures and sells ground-mounting tracking systems for solar energy projects globally, with a market cap of approximately $1.01 billion.

Operations: The company's revenue is divided into two segments: STI Operations, generating $244.88 million, and Array Legacy Operations, contributing $737.31 million.

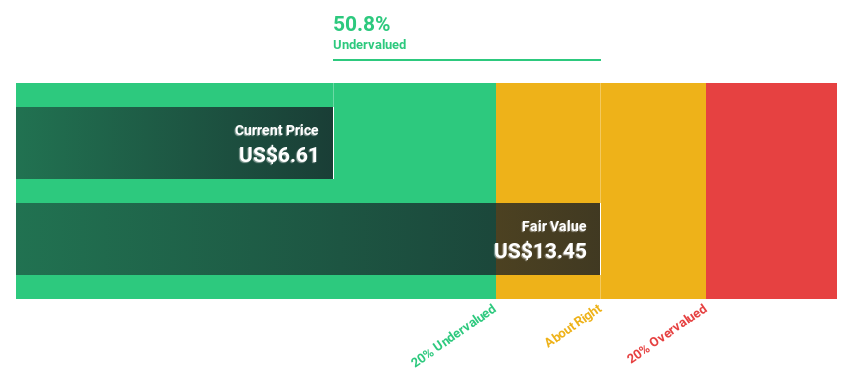

Estimated Discount To Fair Value: 49.8%

Array Technologies, Inc. is trading at a significant discount to its estimated fair value, with shares priced at US$7.15 compared to an estimated fair value of US$14.24. Despite recent financial challenges, including a net loss of US$141.35 million in Q3 2024 and lowered revenue guidance due to market softness, the company is expected to achieve profitability within three years and has strong forecasted earnings growth of 65.06% annually.

- In light of our recent growth report, it seems possible that Array Technologies' financial performance will exceed current levels.

- Unlock comprehensive insights into our analysis of Array Technologies stock in this financial health report.

Alkami Technology (NasdaqGS:ALKT)

Overview: Alkami Technology, Inc. provides cloud-based digital banking solutions in the United States and has a market cap of approximately $3.61 billion.

Operations: Alkami Technology, Inc. generates revenue of $315.56 million from its Internet Software & Services segment.

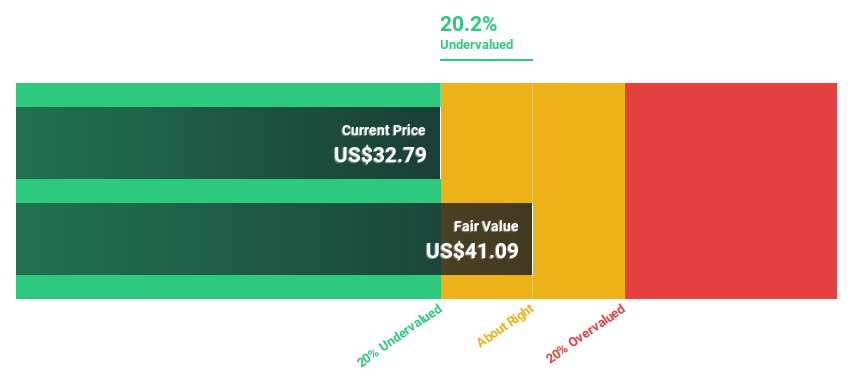

Estimated Discount To Fair Value: 18.8%

Alkami Technology is trading at US$36.26, below its estimated fair value of US$44.64, suggesting it may be undervalued based on cash flows. The company forecasts revenue growth of 22% annually, surpassing the U.S. market average and expects to achieve profitability within three years. Recent collaborations with NASA Federal Credit Union and others highlight Alkami's innovative digital banking solutions, enhancing client satisfaction and engagement while driving future revenue potential despite recent insider selling activity.

- Our comprehensive growth report raises the possibility that Alkami Technology is poised for substantial financial growth.

- Get an in-depth perspective on Alkami Technology's balance sheet by reading our health report here.

TowneBank (NasdaqGS:TOWN)

Overview: TowneBank offers retail and commercial banking services to individuals, commercial enterprises, and professionals, with a market cap of $2.68 billion.

Operations: The company's revenue segments include $490.03 million from banking, $103.85 million from realty, and $100.42 million from insurance.

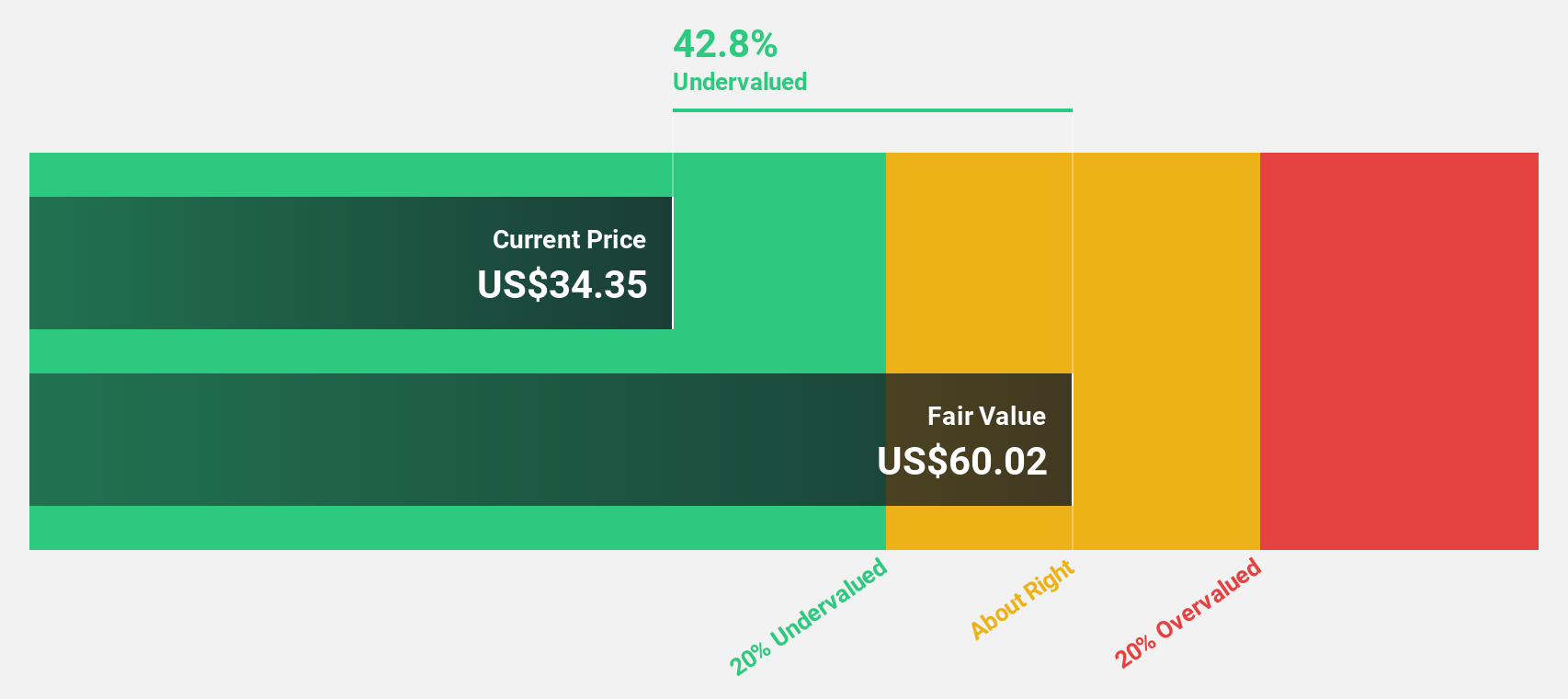

Estimated Discount To Fair Value: 25.6%

TowneBank is trading at US$35.94, significantly below its estimated fair value of US$48.28, highlighting potential undervaluation based on cash flows. Despite a slower revenue growth forecast of 11.4% annually compared to higher benchmarks, earnings are expected to grow significantly at over 20% per year. Recent earnings reports show improved net income and EPS from the previous year, while consistent dividends enhance shareholder value amidst significant insider selling activity in recent months.

- Upon reviewing our latest growth report, TowneBank's projected financial performance appears quite optimistic.

- Click to explore a detailed breakdown of our findings in TowneBank's balance sheet health report.

Where To Now?

- Access the full spectrum of 166 Undervalued US Stocks Based On Cash Flows by clicking on this link.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TowneBank might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TOWN

TowneBank

Provides retail and commercial banking services for individuals, commercial enterprises, and professionals in Virginia and North Carolina.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives