- United States

- /

- Diversified Financial

- /

- NasdaqGS:AFRM

Affirm (NASDAQ:AFRM) set a Low Bar for its Q4 Report. Here is What Will Actually Drive High Growth

Affirm Holdings ( NASDAQ:AFRM ) is a young FinTech growth company that has garnered a lot of attention since its IPO in January 2021. Affirm is offering a payment platform where people can buy products and pay in 1 to 48 monthly installments. Before Thursday's Q4 Earnings report, we are going to do a quick overview of the company and see what can investors expect from Affirm in the future.

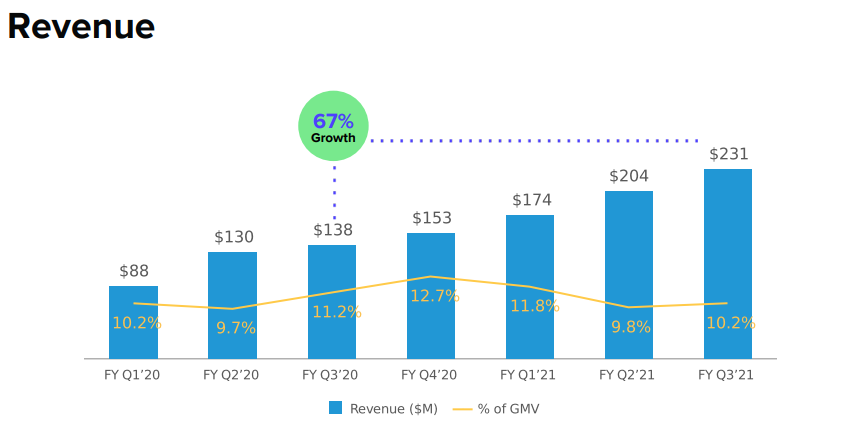

Affirm had trailing twelve-month revenues to Q3 (ending March 2021) at US$762m, and issued guidance for the full fiscal year 2021 of revenue between US$824m to US$834m. The problem with this number is that is sets a very low bar for growth. The Q4 estimate of $225m is no bigger than the Q3 $231m result. Which leaves us wondering, if the company is peaking in growth, or it has set the bar so low, that when the actual result hits, all the headlines will print that they have achieved a growth surprise.

Just in case, we have calculated our own revenue growth estimate, based on their historical quarterly growth as seen in the picture below:

From the chart, we can calculate that Affirm grew quarterly by an average rate of 12.2%. From that, we can extract and come up with a new Q4 estimate of around US$259m plus/minus $10m (4%, derived from the standard deviation). There also doesn't seem to be expressed seasonality in the business yet, so that cannot be cited as a reason for a decline in growth.

This means Affirm might be quite conservative with its guidance.

It is also concerning, why a growth company would post guidance which is less than the average quarterly revenue growth rate. In the aforementioned guidance, Affirm frequently mentions a deduction of revenues stemming from Peleton's ( NASDAQ:PTON ) product pullback. It is possible that this will be cited as a cause for a reduced growth rate in the next report.

Moving on to some really good news.

On the 30th of August, Affirm announced that they will be partnering with Amazon ( NASDAQ:AMZN ) to deliver a Pay-Over-Time Option at checkout.

This is currently being tested, and customers should have the option to split the total cost of purchases of $50 or more into simple monthly payments by using Affirm. It will probably take a good year for this option to be well integrated into Amazon's platform, but once set in motion, this can be very powerful in delivering future growth.

In fact, Amazon posted a quarterly revenue for their North American segment of US$67.6b. If we want to be a bit speculative, we can assume that 10% of that will turn into Gross Merchandise Value for Affirm next year, and we will come up with an added revenue of US$6.7b next year (based on the rough conversion of GMV to revenue in the chart above). Now keep in mind, that anyone that works with Amazon will have to commit to some kind of trade-off, and it is usually market for margins. That is why it would be safer to go with a lower estimate, probably around US$3b in revenues from Amazon as a revenue stream.

In a nutshell, this means that getting the projection right from the Amazon deal will be worth way more than any quarterly result in the near term. Investors may even benefit if the price drops because of bad current performance, which may give room to enter at a cheaper level.

The Amazon deal was clearly a stock-moving event for Affirm. Now, the majority of the risk lies in getting the future right and hopefully not over-estimating the expected growth rates. Keep in mind that Affirm has significant transaction costs, and will be spending a good deal of time advertising and developing its platform before breaking a profit - So we can't expect to see profits any time soon.

The expected margins are also a huge contributor to the change in value for the company. A 1% change in EBIT margins from a baseline of 10%, accounts for US$1.9 to $2b change in value for the company. Considering that it is too early to have a good estimate of the profit margins for Affirm, the company's stock price could be highly volatile in the coming months!

See our latest analysis for Affirm Holdings

Also, it seems that multiple competitors are hopping on the "buy now, pay later" train, and this will result in some pressure on margins. These companies include Apple, Inc. ( NASDAQ:AAPL ), Goldman Sachs Group ( NYSE:GS ), Square ( NYSE:SQ ), Microsoft ( NASDAQ:MSFT ) and others.

It is clearly a highly intense race, and not everyone will emerge as a market leader.

Key Takeaways

Investors should be careful in the next earnings release, as the guidance for revenues has been set at a low bar of US$225m, while an expected Q4 revenue based on quarterly growth thus may be closer to US$259m. The real quarterly surprise would be anything in excess of this number.

Affirm recently struck a large deal with Amazon, which will open up their delayed payment services to a large US consumer base. This has the potential to turn into a very high growth rate once people get comfortable with the delayed payment option.

The company has some heavy qualitative risk factors, and it is very important to keep them in mind. Specifically, a multitude of competitors are adopting delayed payment options, which will put pressure on margins. The company has a lot of transaction costs associated with its service, and we still cannot know how well will it translate revenues into profits, or more importantly, cash flows. The estimate for profitability is very important, since a change in EBIT margins may lead to billions added or subtracted from the valuation.

The company will probably have a place in the market, and seems to have a great business model, it is however unclear if investors are going in too early at the current market capitalization of US$18.6b.

Check out these 2 quantitative risk factors for Affirm Holdings when doing your analysis.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About NasdaqGS:AFRM

Affirm Holdings

Operates payment network in the United States, Canada, and internationally.

Reasonable growth potential with low risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PRME remains a long shot but publication in the New England Journal of Medicine helps.

This one is all about the tax benefits

Estimated Share Price is $79.54 using the Buffett Value Calculation

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026