- United States

- /

- Software

- /

- NasdaqGS:ADSK

What Autodesk (ADSK)'s Flow Studio Price Cut and Free Tier Mean for Shareholders

Reviewed by Simply Wall St

- Earlier this month, Autodesk launched new and more affordable pricing for Flow Studio, its AI-powered animation and VFX suite, introducing a free tier and halving the Lite plan's cost to US$10 in an effort to make advanced creative tools widely accessible.

- This expansion marks the first anniversary of Autodesk's Wonder Dynamics acquisition and fully integrates Flow Studio into the Autodesk ecosystem, opening professional-grade AI animation and VFX capabilities to a broader audience.

- We'll explore how Flow Studio's global rollout and accessible pricing could impact Autodesk’s investment narrative and future customer growth potential.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Autodesk Investment Narrative Recap

To be a shareholder in Autodesk, you need to believe in the company’s long-term strategy to lead in cloud and AI-powered design, engineering, and entertainment tools for professionals and creators. The recent move to globalize and lower Flow Studio pricing should help attract new users, but its direct impact on the upcoming earnings report, the key near-term catalyst, is likely limited. The biggest risk continues to be customer hesitancy in a challenging economic environment, which could delay new business and impact revenue growth in the short term.

Among recent announcements, Autodesk’s new integration with Buildots is an interesting step that could strengthen its Construction Cloud offering. This partnership allows teams to sync and act on project issues more effectively, potentially enhancing the value proposition to construction clients and supporting Autodesk’s efforts to drive recurring revenue from strategic growth areas.

However, while Flow Studio's accessible pricing aims to lower barriers for creators, investors should consider the ongoing uncertainty around…

Read the full narrative on Autodesk (it's free!)

Autodesk's narrative projects $8.8 billion revenue and $1.8 billion earnings by 2028. This requires 11.4% yearly revenue growth and an $0.8 billion earnings increase from $1.0 billion today.

Uncover how Autodesk's forecasts yield a $341.72 fair value, a 18% upside to its current price.

Exploring Other Perspectives

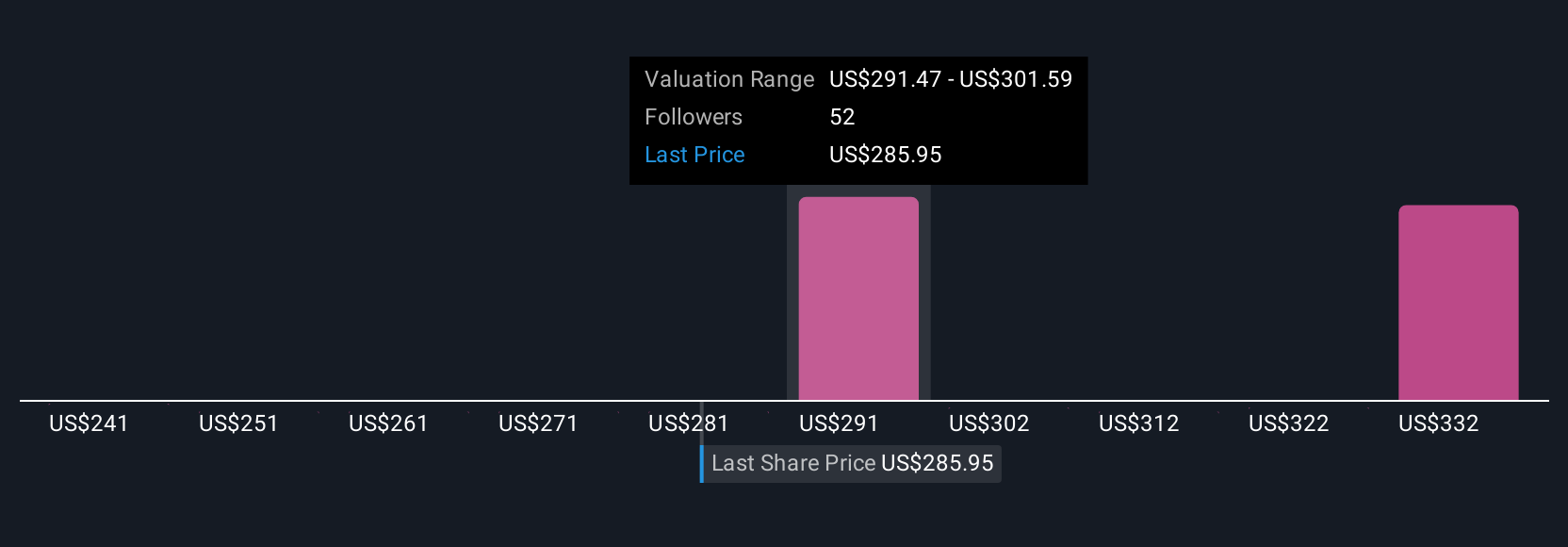

Six recent fair value estimates from the Simply Wall St Community range from US$240.87 to US$341.72 per share. With such a spread, keep in mind that revenue growth uncertainty is top of mind for many, which may help explain why opinions differ so widely about Autodesk’s performance outlook.

Explore 6 other fair value estimates on Autodesk - why the stock might be worth 17% less than the current price!

Build Your Own Autodesk Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Autodesk research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Autodesk research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Autodesk's overall financial health at a glance.

Ready For A Different Approach?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Explore 23 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ADSK

Autodesk

Provides 3D design, engineering, and entertainment technology solutions worldwide.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)