- United States

- /

- Software

- /

- NasdaqGS:ADSK

Does the Recent Price Dip Make Autodesk Attractive in 2025?

Reviewed by Simply Wall St

Approach 1: Autodesk Cash Flows

A Discounted Cash Flow (DCF) model helps estimate a company’s true value by projecting its future free cash flows and discounting those back to today’s dollars. This approach gives investors a sense of what the business is worth if growth matches expectations.

For Autodesk, current Free Cash Flow stands at $1.60 billion, reflecting strong annual increases. Analysts see that figure climbing steadily, with projections reaching $5.17 billion by 2035. This robust growth supports a two-stage DCF analysis, which calculates an estimated fair value for Autodesk at $313.53 per share.

With the stock recently trading at $288.63, Autodesk appears about 7.9% undervalued compared to this DCF-based intrinsic value. This suggests the market price is largely in line with long-term cash flow potential, leaving neither a significant bargain nor clear overpricing.

Result: ABOUT RIGHT

Approach 2: Autodesk Price vs Earnings

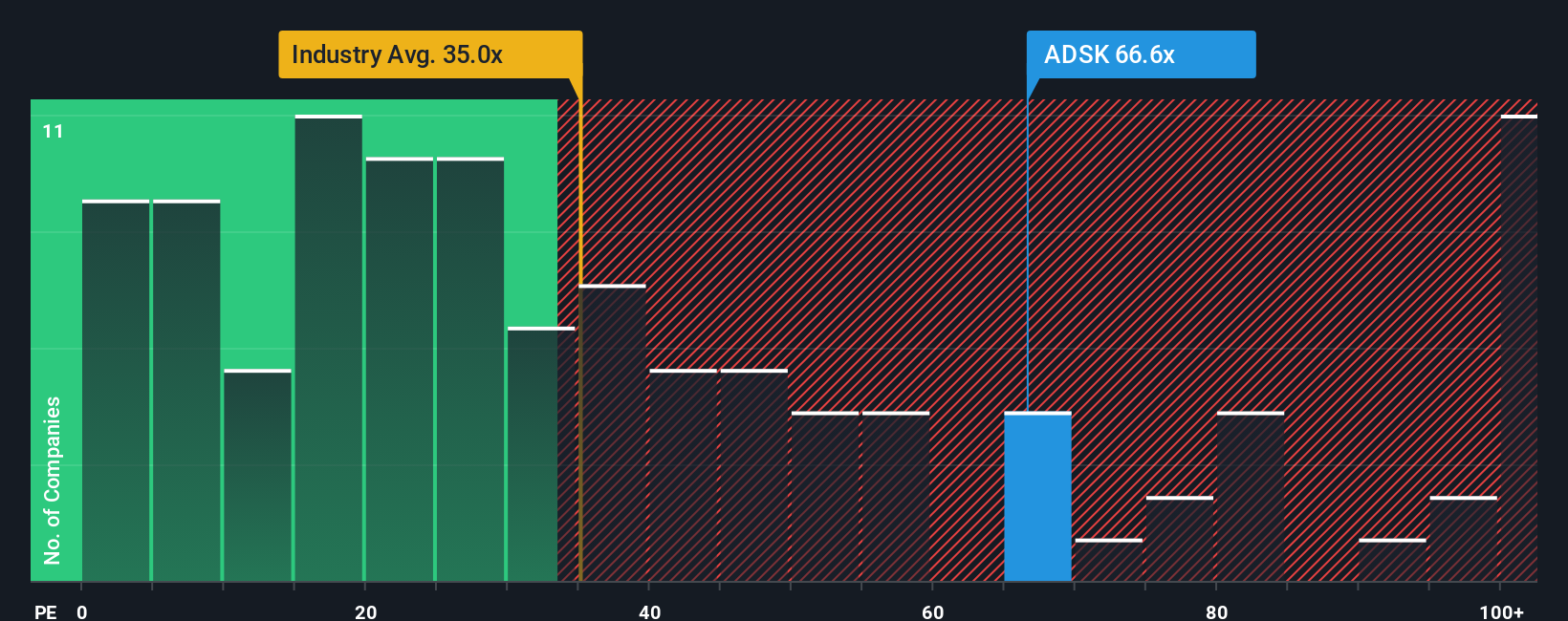

For profitable companies like Autodesk, the Price-to-Earnings (PE) ratio is a popular tool because it connects a company’s stock price directly to its actual earnings. This gives investors a straightforward sense of how the market values each dollar of profit. Higher growth expectations or lower perceived risk can justify a higher “normal” PE ratio, as investors are often willing to pay more for future potential and stability.

Currently, Autodesk trades at a PE ratio of 61.0x. This is notably higher than the Software industry average of 36.7x, but below the peer group average of 84.5x. Elevated multiples like this sometimes reflect optimism about a company's unique market position or superior growth prospects, but also attract added scrutiny from value-focused investors.

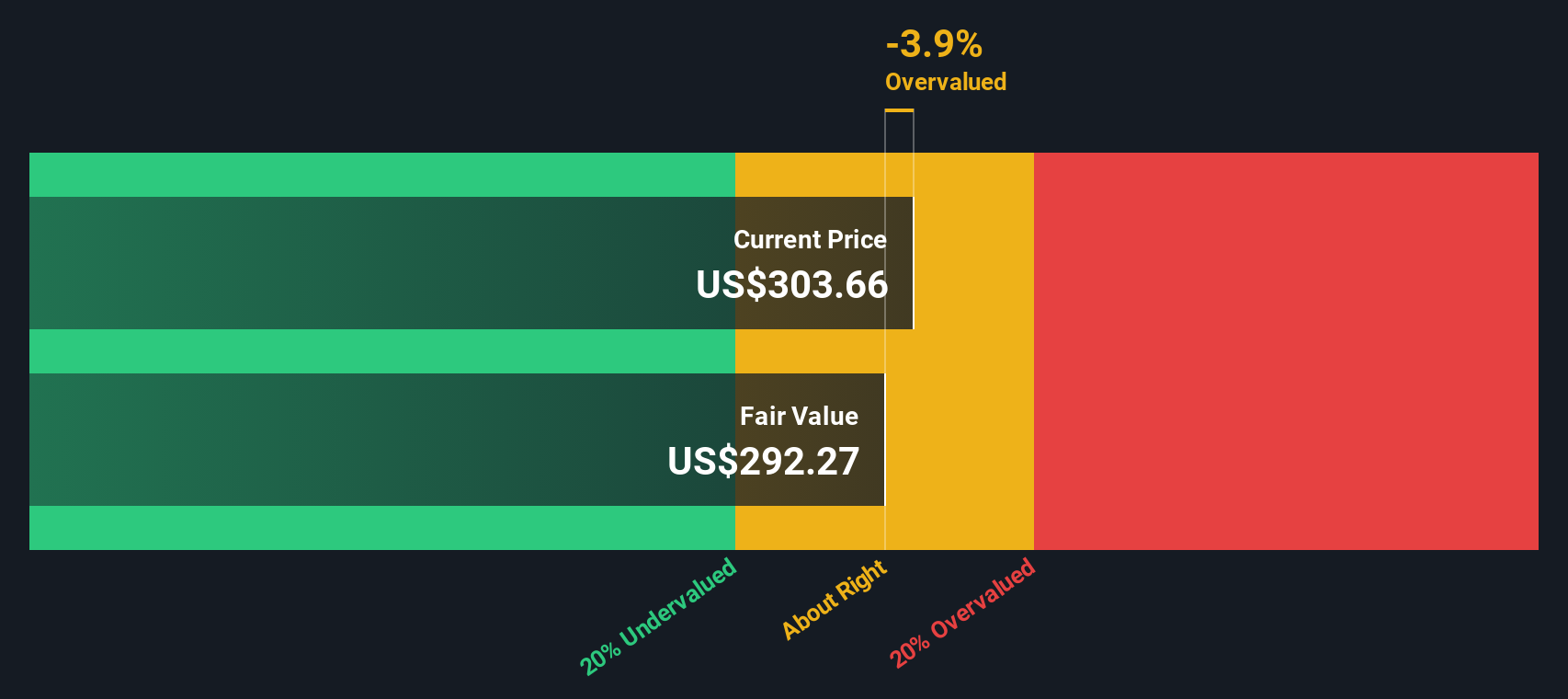

Looking at the Fair PE Ratio, a proprietary benchmark designed to account for Autodesk’s earnings growth, profitability, industry, and market cap, the fair value multiple is 40.5x. Comparing this to the actual PE of 61.0x suggests Autodesk’s shares are priced higher than what these fundamentals might justify. While its growth story is compelling, the current premium places the stock in OVERVALUED territory by this metric.

Result: OVERVALUED

Upgrade Your Decision Making: Choose your Autodesk Narrative

A Narrative is your personal story or perspective about a company, combining what you know about its business with your own assumptions for future revenue, profit margins, and a fair value. Rather than just relying on stock charts or valuation ratios, Narratives allow you to connect the dots by linking Autodesk’s ongoing transformation and its financial potential into a single picture that guides your investment decisions.

On Simply Wall St, Narratives are simple to create and easy to update. They help millions of investors put their view into numbers, then compare their estimated fair value to the current share price to see if a stock is attractive or not. Since Narratives are updated dynamically as new information, like earnings or news, is released, you always have an up-to-date forecast that truly reflects your view of Autodesk’s future.

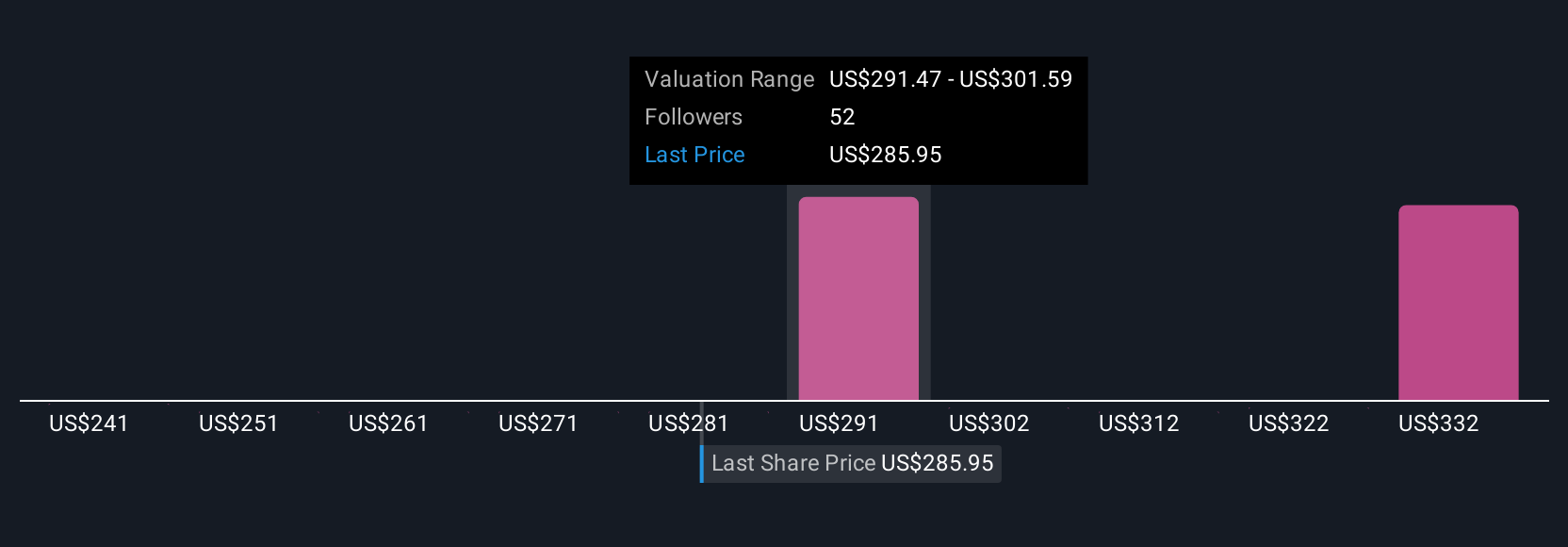

For example, the most optimistic Narrative for Autodesk expects a price target of $430.00 based on strong cloud and AI growth, while the most cautious sees it at $270.97, reflecting more measured expectations amidst industry risks. Narratives put you in control, letting you decide whether the market price fits your story and if it is time to buy, hold, or sell.

Do you think there's more to the story for Autodesk? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ADSK

Autodesk

Provides 3D design, engineering, and entertainment technology solutions worldwide.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives