- United States

- /

- Software

- /

- NasdaqGS:ADSK

Autodesk (NasdaqGS:ADSK) Stock Up 8% Over Last Quarter

Reviewed by Simply Wall St

Autodesk (NasdaqGS:ADSK) is reportedly considering acquiring PTC Inc., an engineering software provider with a $25 billion market cap, sparking interest and potential shifts in industry competition. This development coincides with an 8% rise in Autodesk's stock over the last quarter. The addition of Jeff Epstein and Christie Simons to its Board, both financial experts, underscores a focus on governance improvement. Additionally, Autodesk's reported Q1 earnings revealed a revenue increase but a decrease in net income. These elements contribute to the company's recent stock performance, aligning with broader market trends that have remained steady in recent weeks.

We've discovered 1 possible red flag for Autodesk that you should be aware of before investing here.

The potential acquisition of PTC Inc. by Autodesk could significantly impact the company's long-term trajectory, aligning with its investments in cloud and AI. Such a move might expand Autodesk's customer ecosystem and enhance growth prospects, echoing the narrative that highlights investments in these sectors to support revenue expansion. However, challenges like economic uncertainties and restructuring could affect the realization of these benefits. Over the past three years, Autodesk's total shareholder return, including share price and dividends, was 59.12%, providing a longer-term context that contrasts with its recent underperformance against the US Software industry and market in the past year.

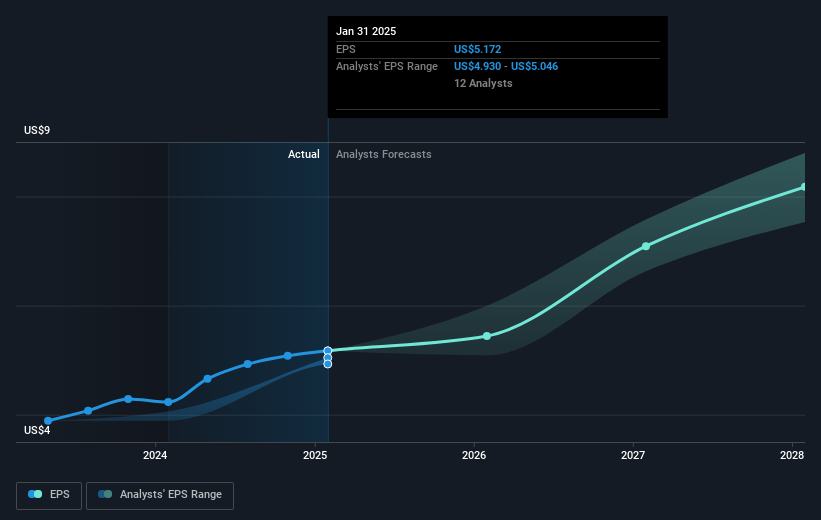

Autodesk's recent share price increase, accompanied by governance enhancements, reflects market confidence. Yet, with shares currently priced at US$278.64, the gap to the consensus analyst price target of approximately US$320.15 suggests a potential upside of about 13%. This news could influence revenue and earnings forecasts, particularly if the acquisition fuels better integration and efficiency. Although analysts predict Autodesk's revenue to grow by 11.2% annually over three years, pressures from economic conditions and go-to-market shifts could sway these expectations.

Upon reviewing our latest valuation report, Autodesk's share price might be too pessimistic.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ADSK

Autodesk

Provides 3D design, engineering, and entertainment technology solutions worldwide.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives