- United States

- /

- Software

- /

- NasdaqGS:ADSK

Autodesk (ADSK) Valuation Check as Shares Cool Despite Ongoing Double-Digit Growth

Reviewed by Simply Wall St

Autodesk stock steadies as long term performance diverges

Autodesk (ADSK) shares have cooled off recently, with the stock down over the past 3 months even as the company continues to grow revenue and earnings at a healthy double digit clip.

See our latest analysis for Autodesk.

Over the past year, Autodesk’s share price return has been roughly flat while its three year total shareholder return of about 55% still speaks to solid long term momentum. This suggests recent weakness reflects cooler sentiment rather than a broken growth story.

If Autodesk’s latest moves have you reassessing the software space, it is a good time to explore other innovative names through high growth tech and AI stocks.

With revenue still growing at a double digit pace and the stock sitting roughly 23 percent below the average analyst target, the key question now is whether Autodesk is undervalued or if markets have already priced in its future growth.

Most Popular Narrative: 18.5% Undervalued

With Autodesk closing at $297.64 against a narrative fair value near $365, the gap reflects ambitious assumptions on growth, margins, and future multiples.

Continued innovation and integration of AI driven tools (e.g., generative design, AutoConstrain) and industry specific foundation models are boosting customer productivity and differentiating Autodesk's offerings, supporting premium pricing and driving margin expansion and long term earnings growth.

Curious how steady double digit growth, rising margins, and a rich future earnings multiple can all coexist in one story? Unpack the forecasts behind this fair value call.

Result: Fair Value of $365.14 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the story could wobble if macro sensitive construction spending slows or if faster moving AI rivals erode Autodesk’s pricing power and competitive moat.

Find out about the key risks to this Autodesk narrative.

Another Take on Valuation

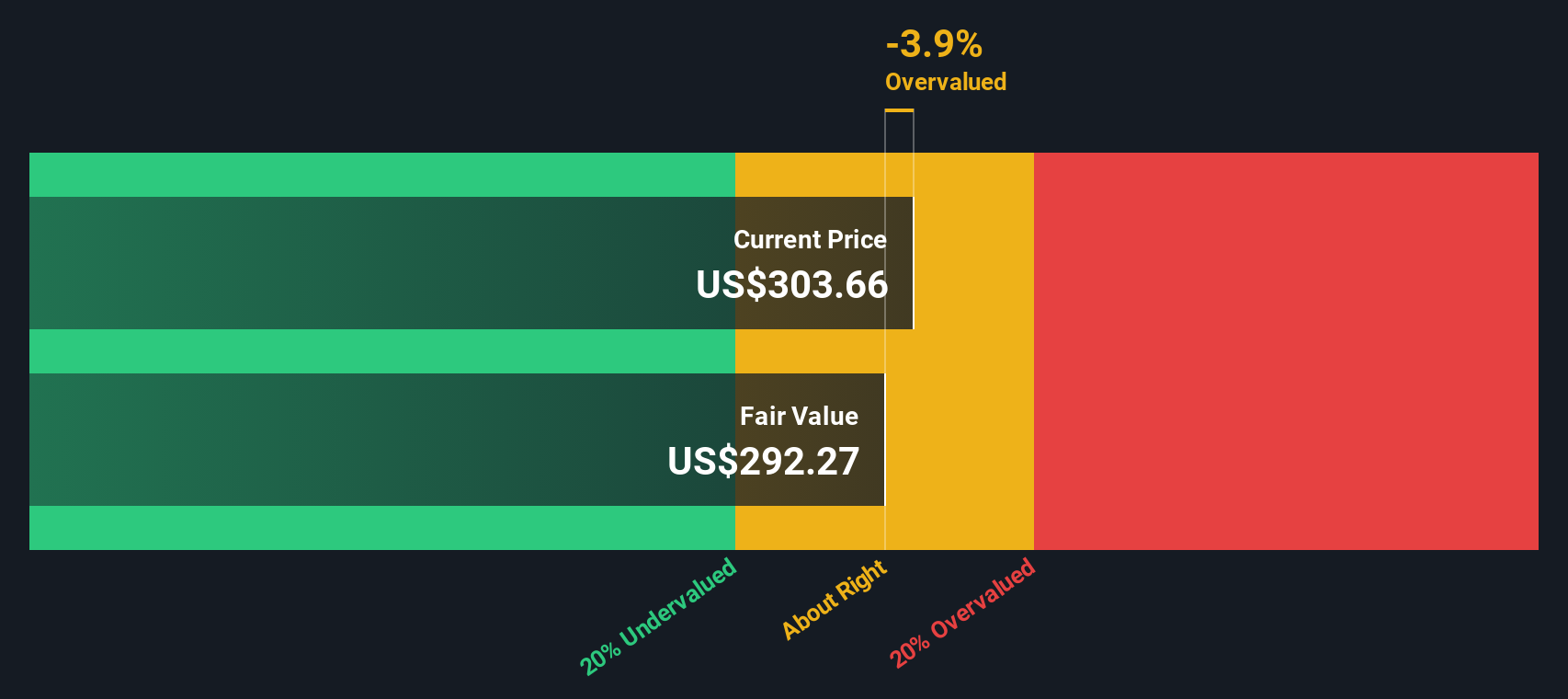

Our DCF model is less generous than the narrative fair value and puts Autodesk’s worth near $286 per share, slightly below today’s price. That suggests a mildly overvalued stock rather than an 18.5 percent discount and raises the question of which growth path you trust more.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Autodesk for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Autodesk Narrative

If this outlook does not quite fit your view or you prefer hands on research, you can build a personalized Autodesk narrative in minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Autodesk.

Ready for your next investing edge?

Do not stop at Autodesk. Use the Simply Wall St Screener to pinpoint fresh opportunities before the crowd and keep your portfolio working harder every day.

- Secure more resilient income by targeting companies on these 13 dividend stocks with yields > 3% that combine meaningful yields with dependable business models and balance sheets.

- Capitalize on innovation at the frontier of computing by tracking potential market leaders among these 27 quantum computing stocks poised to benefit from long term breakthroughs.

- Position yourself ahead of major technological shifts by following these 80 cryptocurrency and blockchain stocks shaping payments, infrastructure, and the broader digital asset ecosystem.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ADSK

Autodesk

Provides 3D design, engineering, and entertainment technology solutions worldwide.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)