- United States

- /

- Software

- /

- NasdaqGS:ADSK

Autodesk (ADSK) Stock Rises 11% Following Strong Q2 Earnings

Reviewed by Simply Wall St

Autodesk (ADSK) reported strong second quarter earnings with revenue rising to $1,763 million, accompanied by robust net income growth. The company's stock price moved 11% over the past week. This price move may have been bolstered by the latest earnings results and positive future guidance, despite a weakening labor market and modest losses in major indices like the S&P 500 and Nasdaq during the same period. The announcement of product enhancements and continued share buyback activities also provided supportive context for Autodesk's upward trajectory amidst broader market uncertainty.

Every company has risks, and we've spotted 1 warning sign for Autodesk you should know about.

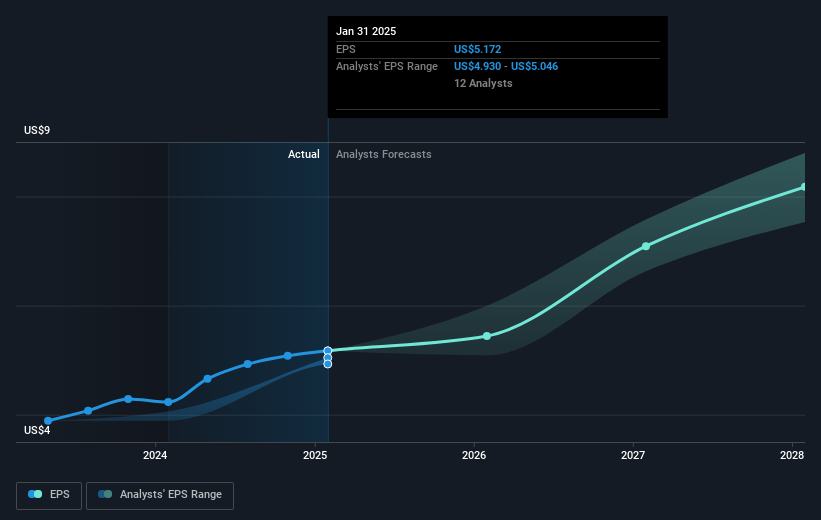

The recent earnings report for Autodesk (ADSK), with revenue climbing to US$1.76 billion and strong net income growth, has played a significant role in the company's upward stock movement of 11% over the past week. This momentum ties into the broader narrative of the company's focus on expanding cloud and AI-driven solutions, as well as its SaaS model, which are bolstering recurring revenue and margin stability. These factors contribute to analysts' future revenue growth assumptions of 12% annually over the next three years. The positive earnings report and subsequent stock movement also align with the consensus analyst price target of US$358.96, suggesting potential room for price appreciation from the current share price of US$319.93.

Over a longer period, Autodesk's total shareholder return, including share price appreciation and dividends, was 52.48% over the past three years, providing strong returns for its investors. In comparison over the past year, Autodesk's return matched the US Software Industry, which saw a 28% increase. This indicates that while Autodesk's one-year performance is on par with peers, its three-year return has been robust, driven by strategic focus on growth areas like digital transformation and sustainability. As Autodesk continues its investment in its cloud platform and product ecosystem, earnings forecasts are expected to increase, which aligns with the consensus price target, providing a context for assessing its current market valuation.

Learn about Autodesk's future growth trajectory here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ADSK

Autodesk

Provides 3D design, engineering, and entertainment technology solutions worldwide.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)