- United States

- /

- Software

- /

- NasdaqGS:ADSK

A Look at Autodesk's (ADSK) Valuation After Raised Guidance and Strong Q2 Results Driven by AI Demand

Reviewed by Simply Wall St

If you are watching Autodesk (ADSK) after this week’s wave of headlines, you are not alone. The company just dropped second-quarter results that beat profit and sales forecasts, thanks largely to surging demand tied to AI data centers and a big spike in billings. What really made investors sit up, and shares jump 8% in a day, was management raising full-year revenue and earnings guidance. This signaled that they are confident this momentum is not just a flash in the pan.

The news follows a year of steady gains for Autodesk, where optimism has been fueled by growth in its key design software and new client integrations, such as recent moves with GoFormz in construction tech. The stock is now up around 22% over the past year, with positive momentum building on the back of these upbeat results and healthy forward-looking updates. Compared to many software peers, Autodesk seems to have caught a fresh tailwind as the AI build-out continues.

With all this in mind, is the market offering a genuine buying opportunity here, or is Autodesk already pricing in the next wave of growth?

Most Popular Narrative: 11.7% Undervalued

According to the most widely followed narrative, Autodesk appears undervalued by over 11%, signaling analyst optimism for future performance and long-term earnings potential underpinned by its current strategy.

Autodesk's go-to-market optimization phase emphasizes increasing sales and marketing efficiency through enhanced digital self-service and closer channel partner integration. This approach is projected to improve non-GAAP operating margins in fiscal '25 and fiscal '27. Investments in cloud, platform, and AI leadership are intended to drive revenue growth by delivering connected solutions and supporting an expanded customer ecosystem, which is seen as critical for future growth beyond fiscal '26.

Want to know which bold financial goals justify this sky-high valuation? The big bet is on sharper margins, accelerating revenue, and rising profits from transforming how Autodesk goes to market. Which specific projections are behind the analysts’ bullish fair value? Explore the full narrative to discover the surprising assumptions powering these future price targets.

Result: Fair Value of $356.55 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing macroeconomic uncertainty and disruptions from restructuring efforts could undermine Autodesk’s projected growth if customers hesitate or if operational efficiency falters.

Find out about the key risks to this Autodesk narrative.Another View: What Do Earnings Multiples Suggest?

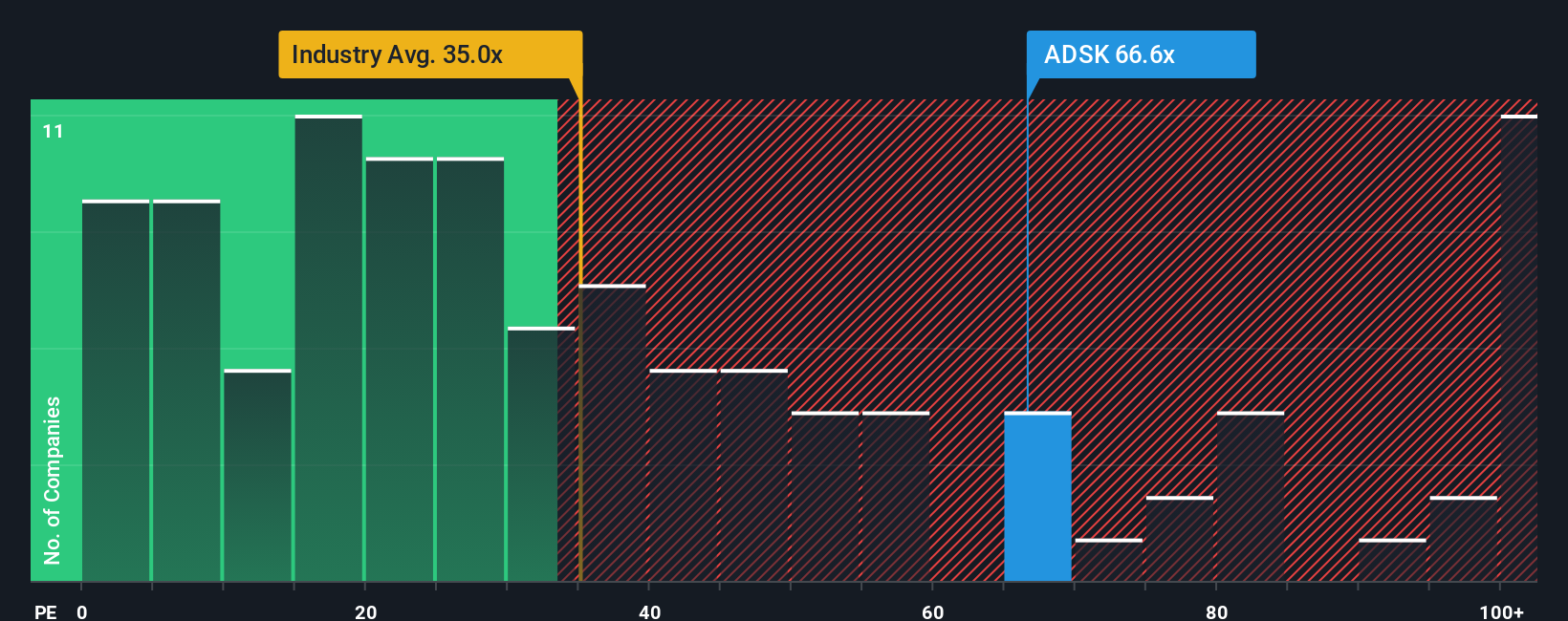

Looking at Autodesk from an earnings perspective paints a different picture. Compared to the broader US software industry, the company trades at a much steeper valuation. This raises questions about whether optimism has gone too far. Is the market overlooking key risks, or is there more growth to come?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Autodesk Narrative

If you want to dig into the numbers for yourself or approach Autodesk’s outlook from another angle, building your own narrative takes just a few minutes. Do it your way.

A great starting point for your Autodesk research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Don't let a great stock slip through your fingers when there are so many other exciting ideas available. Take the next step and enhance your portfolio with strategies tailored to your goals using our favorite screeners:

- Unlock potential value by targeting stocks that show strong financials but may be flying under the radar with our undervalued stocks based on cash flows approach.

- Tap into the future of medicine and innovation by focusing on breakthroughs through our unique spotlight on healthcare AI stocks companies.

- Kickstart your search for tomorrow’s hidden gems with robust growth prospects among penny stocks with strong financials showing exceptional financial strength.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NasdaqGS:ADSK

Autodesk

Provides 3D design, engineering, and entertainment technology solutions worldwide.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)