- United States

- /

- Software

- /

- NYSE:SEMR

Exploring Three High Growth Tech Stocks In The United States

Reviewed by Simply Wall St

The United States market has been flat in the last week but is up 23% over the past year, with earnings expected to grow by 15% per annum over the next few years. In this context, identifying high growth tech stocks involves looking for companies that demonstrate strong innovation potential and robust financial health to capitalize on these favorable conditions.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 24.32% | 25.15% | ★★★★★★ |

| AsiaFIN Holdings | 51.75% | 82.69% | ★★★★★★ |

| Ardelyx | 21.09% | 55.29% | ★★★★★★ |

| AVITA Medical | 33.20% | 51.87% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.62% | 56.70% | ★★★★★★ |

| TG Therapeutics | 29.48% | 45.20% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Clene | 61.16% | 59.11% | ★★★★★★ |

| Travere Therapeutics | 30.94% | 61.73% | ★★★★★★ |

| Lumentum Holdings | 21.25% | 118.58% | ★★★★★★ |

Click here to see the full list of 233 stocks from our US High Growth Tech and AI Stocks screener.

Here's a peek at a few of the choices from the screener.

Adeia (NasdaqGS:ADEA)

Simply Wall St Growth Rating: ★★★★☆☆

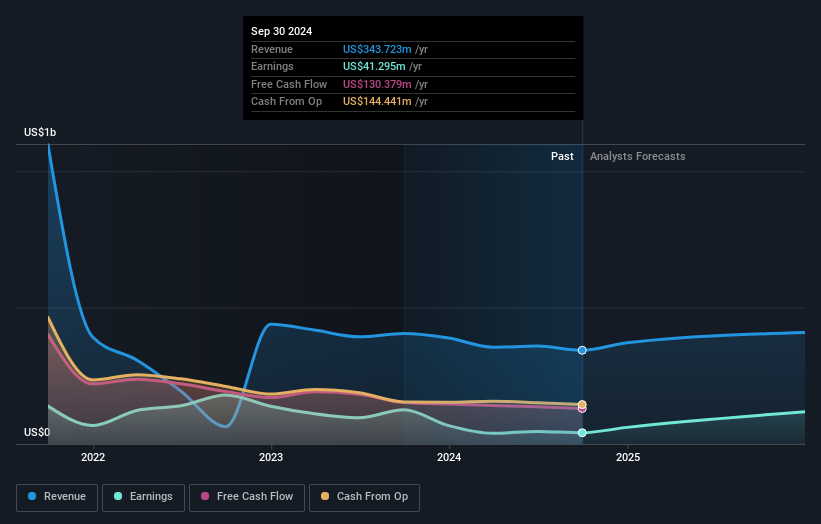

Overview: Adeia Inc. is a media and semiconductor intellectual property licensing company with global operations, and it has a market cap of approximately $1.42 billion.

Operations: The company generates revenue primarily through its intellectual property licensing segment, which accounts for approximately $343.72 million.

Adeia, a trailblazer in the digital entertainment technology sector, has recently fortified its market position through strategic licensing agreements with industry giants like Fetch TV and Roku. These partnerships underscore Adeia's pivotal role in shaping the future of media consumption through its robust IP portfolio. With a commendable annual revenue growth rate of 12.7% and an impressive projected earnings surge of 81.9% per year, Adeia is not just keeping pace but setting the tempo for innovation in its field. Furthermore, the company's commitment to research and development is evident from its recent re-negotiation of debt terms which will save approximately $2.4 million annually, allowing more resources to be funneled into pioneering new technologies that enhance consumer digital experiences worldwide.

- Click here to discover the nuances of Adeia with our detailed analytical health report.

Assess Adeia's past performance with our detailed historical performance reports.

DoubleVerify Holdings (NYSE:DV)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: DoubleVerify Holdings, Inc. offers a software platform for digital media measurement and data analytics globally, with a market cap of approximately $3.71 billion.

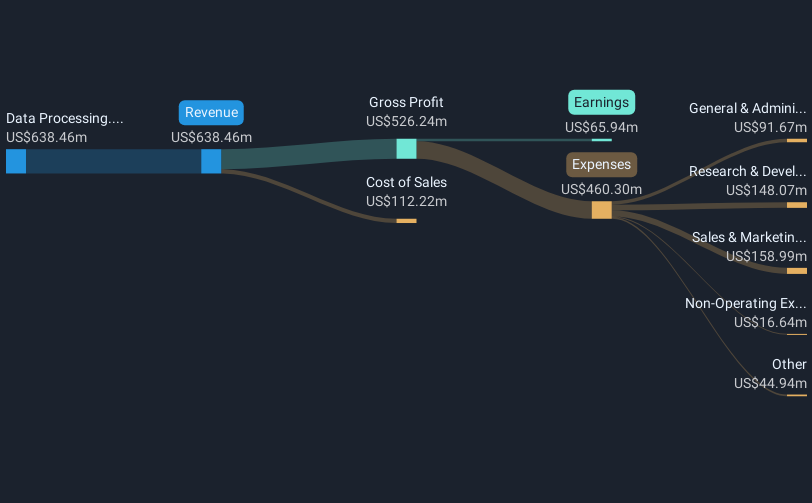

Operations: DoubleVerify generates revenue primarily through its data processing services, which accounted for $638.46 million. The company's software platform focuses on digital media measurement and analytics across various markets.

DoubleVerify Holdings, Inc. is carving a niche in the digital advertising space with its innovative AI-driven solutions, such as the recently launched GenAI Website Avoidance & Detection tool. This technology addresses the challenges posed by low-quality, AI-generated content, ensuring brand safety online—a concern for 54% of marketers as per DV's 2024 Global Insights Trends Report. Additionally, DoubleVerify's collaboration with EDO introduces a groundbreaking approach to optimize Connected TV advertising using real-time engagement data. These strategic moves are underpinned by a robust financial performance; DV has witnessed earnings growth of 21.3% annually and anticipates revenue increases at 12.4% yearly, outpacing the US market average of 8.8%. This trajectory is supported by substantial R&D investments that enhance their technological offerings and competitive edge in an evolving industry landscape.

- Get an in-depth perspective on DoubleVerify Holdings' performance by reading our health report here.

Semrush Holdings (NYSE:SEMR)

Simply Wall St Growth Rating: ★★★★★☆

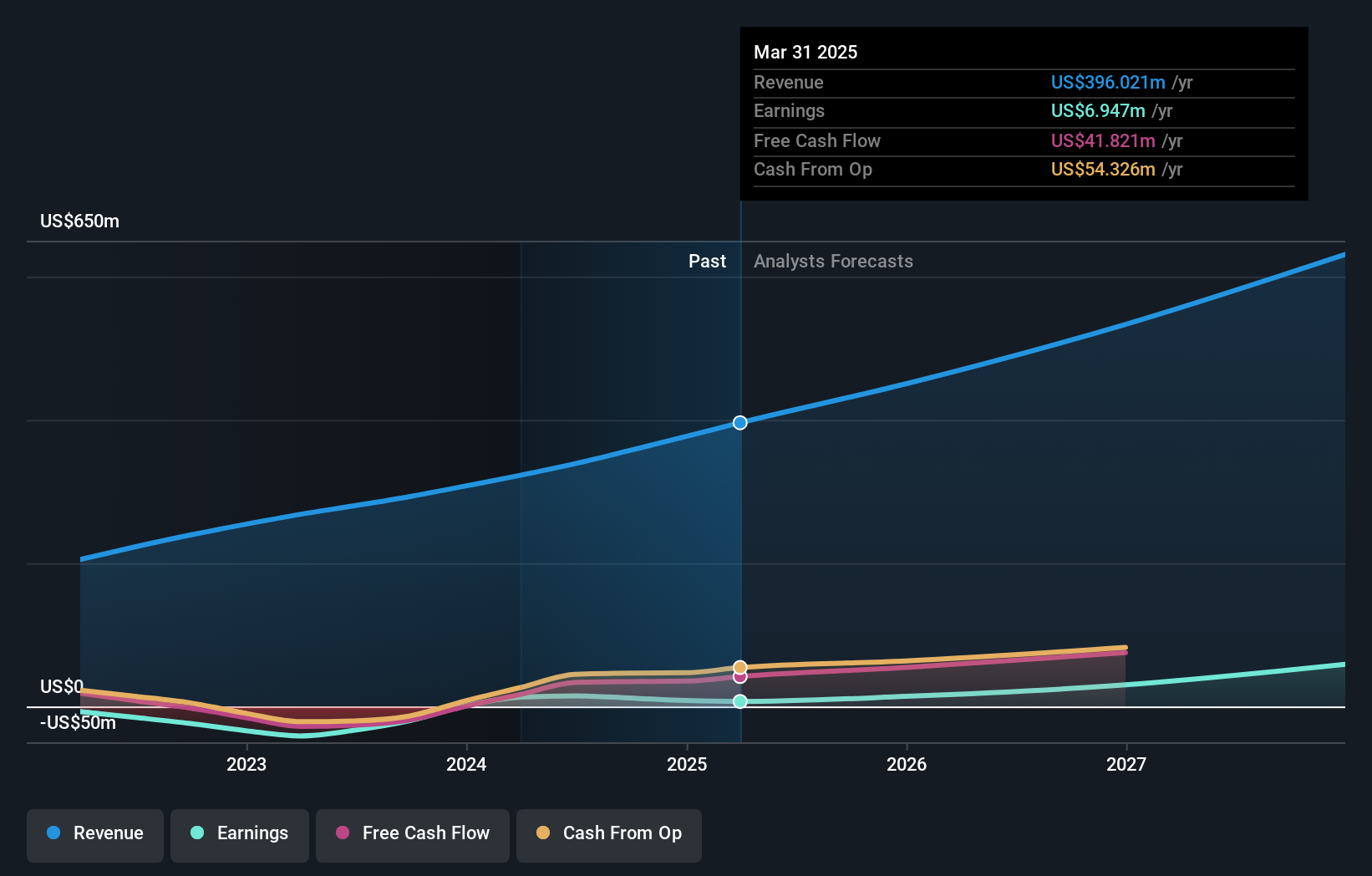

Overview: Semrush Holdings, Inc. provides an online visibility management software-as-a-service platform operating in the United States, the United Kingdom, and internationally with a market capitalization of approximately $2.69 billion.

Operations: The company generates revenue primarily through its software and programming segment, which accounts for $357.57 million.

Semrush Holdings, showcased at the 27th Annual Needham Growth Conference, is making significant strides in the tech landscape with its robust revenue and earnings projections. The company's revenue is expected to surge by 19.4% annually, outstripping the US market average of 8.8%, while its earnings growth forecast at an impressive 56.1% per annum highlights a potential for substantial financial expansion compared to a market norm of 14.6%. This growth trajectory is bolstered by Semrush's transition to profitability this year, positioning it well within a competitive software industry where innovation and strategic foresight are key drivers of success.

- Navigate through the intricacies of Semrush Holdings with our comprehensive health report here.

Evaluate Semrush Holdings' historical performance by accessing our past performance report.

Seize The Opportunity

- Investigate our full lineup of 233 US High Growth Tech and AI Stocks right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SEMR

Semrush Holdings

Develops an online visibility management software-as-a-service platform in the United States, the United Kingdom, and internationally.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives