- United States

- /

- Software

- /

- NasdaqGS:ADBE

3 US Stocks Trading Up To 45.6% Below Intrinsic Value Estimates

Reviewed by Simply Wall St

As the S&P 500 and Dow Jones Industrial Average close at record highs, investors are increasingly seeking opportunities in undervalued stocks that may offer significant upside potential. In this thriving market environment, identifying stocks trading well below their intrinsic value can be a strategic move for those looking to capitalize on mispriced assets.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Silicon Motion Technology (NasdaqGS:SIMO) | $54.94 | $107.87 | 49.1% |

| Heartland Financial USA (NasdaqGS:HTLF) | $57.46 | $112.68 | 49% |

| Western Alliance Bancorporation (NYSE:WAL) | $86.33 | $168.52 | 48.8% |

| Phibro Animal Health (NasdaqGM:PAHC) | $21.99 | $42.63 | 48.4% |

| KBR (NYSE:KBR) | $64.37 | $126.67 | 49.2% |

| Trustmark (NasdaqGS:TRMK) | $32.48 | $64.65 | 49.8% |

| California Resources (NYSE:CRC) | $53.44 | $104.25 | 48.7% |

| Vitesse Energy (NYSE:VTS) | $24.87 | $49.06 | 49.3% |

| EVERTEC (NYSE:EVTC) | $33.56 | $65.83 | 49% |

| Vasta Platform (NasdaqGS:VSTA) | $2.60 | $5.00 | 48% |

Let's dive into some prime choices out of the screener.

Adobe (NasdaqGS:ADBE)

Overview: Adobe Inc., with a market cap of $231.59 billion, operates as a diversified software company worldwide through its various subsidiaries.

Operations: Adobe generates revenue through three main segments: Digital Media ($12.87 billion), Digital Experience ($4.42 billion), and Publishing and Advertising ($0.77 billion).

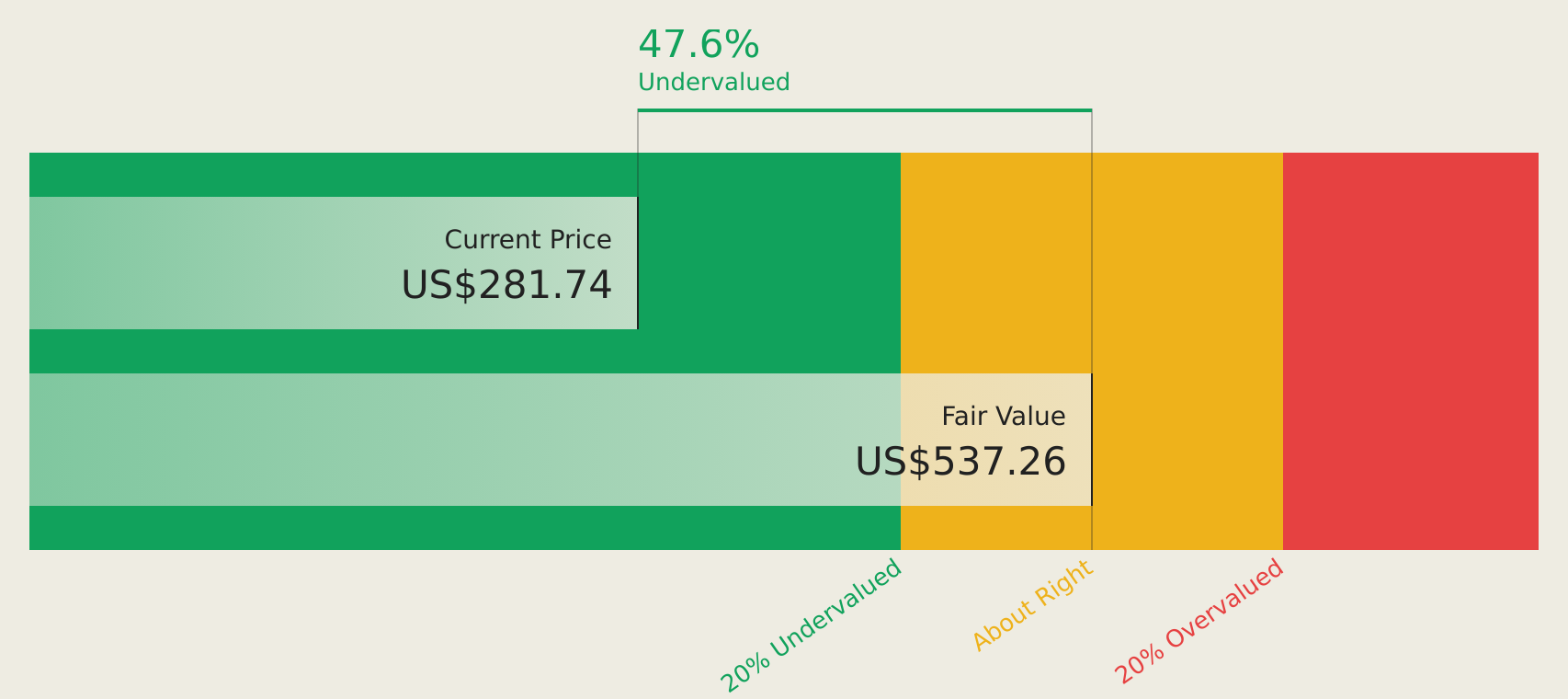

Estimated Discount To Fair Value: 28.3%

Adobe is trading at US$527.87, significantly below its estimated fair value of US$736.59, indicating it may be undervalued based on discounted cash flow analysis. Earnings are forecast to grow 16.59% annually, outpacing the broader market's 15.2%. Recent innovations in Adobe Experience Cloud and strong Q3 earnings—US$5.41 billion revenue and US$1.68 billion net income—underscore robust operational performance despite insider selling concerns and a slower-than-expected revenue growth rate of 10.1%.

- The analysis detailed in our Adobe growth report hints at robust future financial performance.

- Dive into the specifics of Adobe here with our thorough financial health report.

American Healthcare REIT (NYSE:AHR)

Overview: American Healthcare REIT, Inc. is a self-managed real estate investment trust that acquires, owns, and operates a diversified portfolio of clinical healthcare real estate properties with a market cap of $3.95 billion.

Operations: The company's revenue segments include outpatient medical buildings ($139.69 million), senior housing operating portfolio ($215.47 million), triple-net leased properties ($50.53 million), and integrated senior health campuses ($1.54 billion).

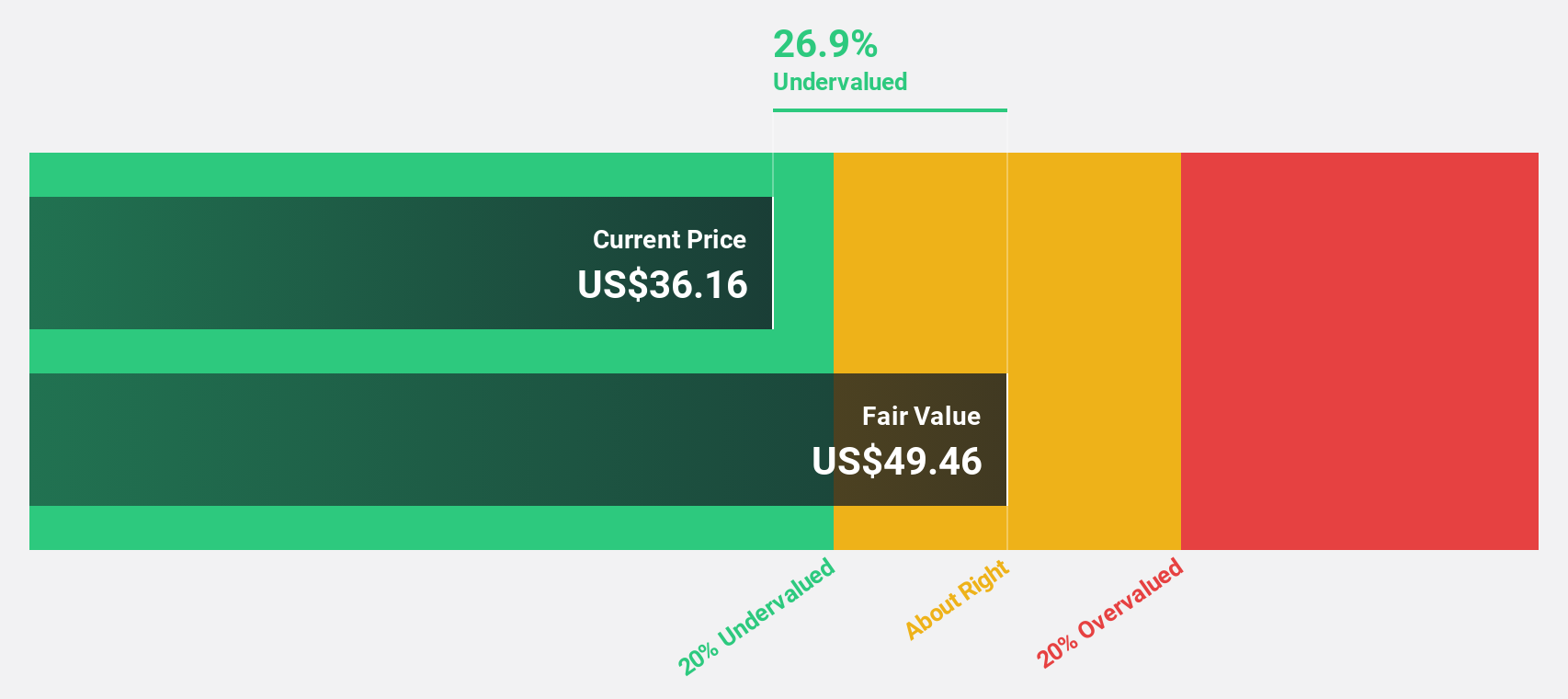

Estimated Discount To Fair Value: 28.1%

American Healthcare REIT is trading at $26.03, significantly below its estimated fair value of $36.19, making it undervalued based on discounted cash flow analysis. Revenue is forecast to grow 9.5% annually, surpassing the US market's 8.7%. Despite a low projected return on equity (1.3%) in three years and a dividend not well-covered by free cash flows, the company’s recent $409.77 million follow-on equity offering bolsters its financial position for future profitability within three years.

- The growth report we've compiled suggests that American Healthcare REIT's future prospects could be on the up.

- Click here to discover the nuances of American Healthcare REIT with our detailed financial health report.

EQT (NYSE:EQT)

Overview: EQT Corporation operates as a natural gas production company in the United States with a market cap of approximately $20.69 billion.

Operations: The company's revenue segment includes $4.43 billion from Oil & Gas - Integrated operations.

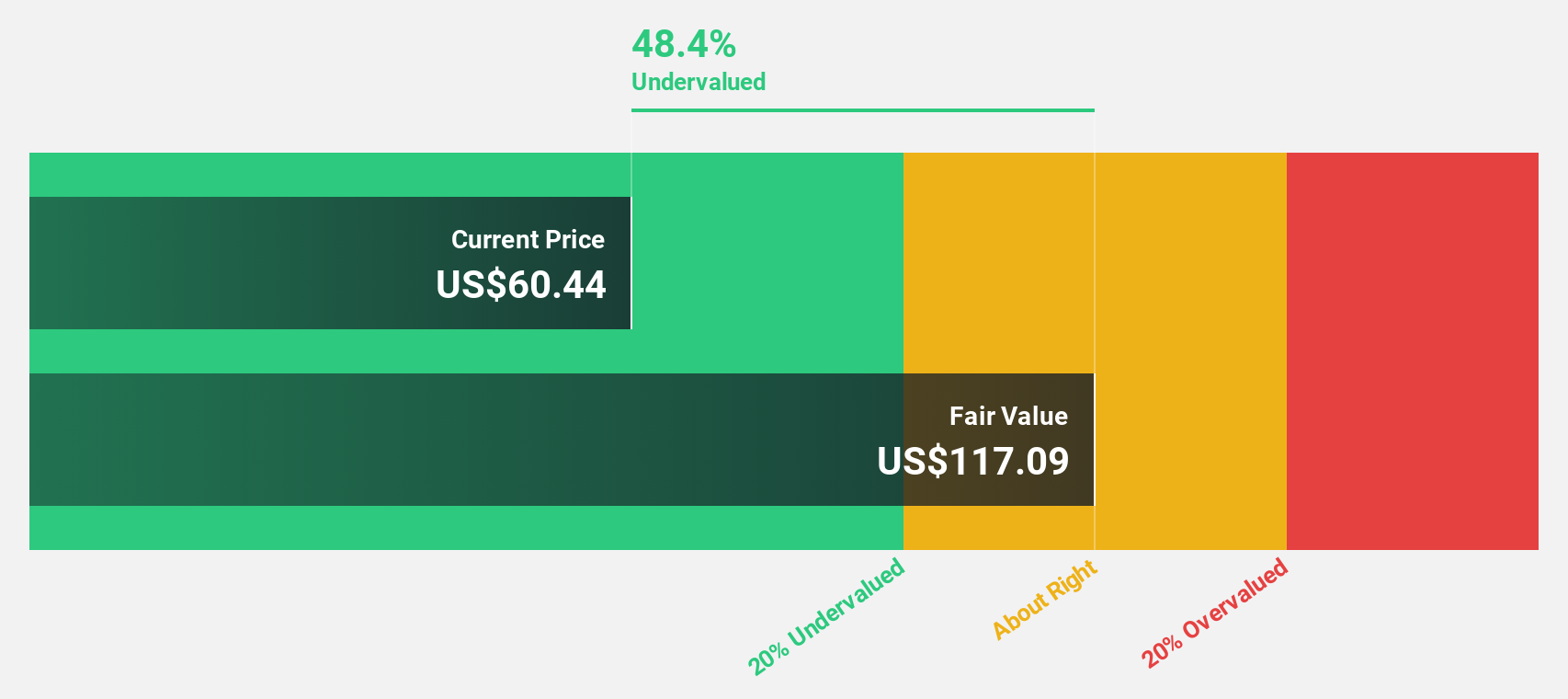

Estimated Discount To Fair Value: 45.6%

EQT Corporation, trading at US$35.96, is significantly undervalued with an estimated fair value of US$66.11 based on discounted cash flow analysis. Despite a recent decline in profit margins from 40.1% to 15.7%, earnings are forecast to grow substantially at 40.72% annually over the next three years, outpacing the broader US market's growth rate of 15.2%. Recent strategic initiatives include advancing clean hydrogen and low carbon aviation fuel projects, backed by a $30 million funding agreement with the U.S. Department of Energy.

- Our expertly prepared growth report on EQT implies its future financial outlook may be stronger than recent results.

- Click to explore a detailed breakdown of our findings in EQT's balance sheet health report.

Taking Advantage

- Explore the 190 names from our Undervalued US Stocks Based On Cash Flows screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ADBE

Very undervalued with excellent balance sheet.