- United States

- /

- Software

- /

- NasdaqGS:ACIW

Investing in ACI Worldwide (NASDAQ:ACIW) a year ago would have delivered you a 26% gain

It's always best to build a diverse portfolio of shares, since any stock business could lag the broader market. But if you're going to beat the market overall, you need to have individual stocks that outperform. ACI Worldwide, Inc. (NASDAQ:ACIW) has done well over the last year, with the stock price up 26% beating the market return of 26% (not including dividends). Unfortunately the longer term returns are not so good, with the stock falling 18% in the last three years.

Now it's worth having a look at the company's fundamentals too, because that will help us determine if the long term shareholder return has matched the performance of the underlying business.

Check out our latest analysis for ACI Worldwide

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the last year, ACI Worldwide actually saw its earnings per share drop 10%.

So we don't think that investors are paying too much attention to EPS. Therefore, it seems likely that investors are putting more weight on metrics other than EPS, at the moment.

Revenue was pretty stable on last year, so deeper research might be needed to explain the share price rise.

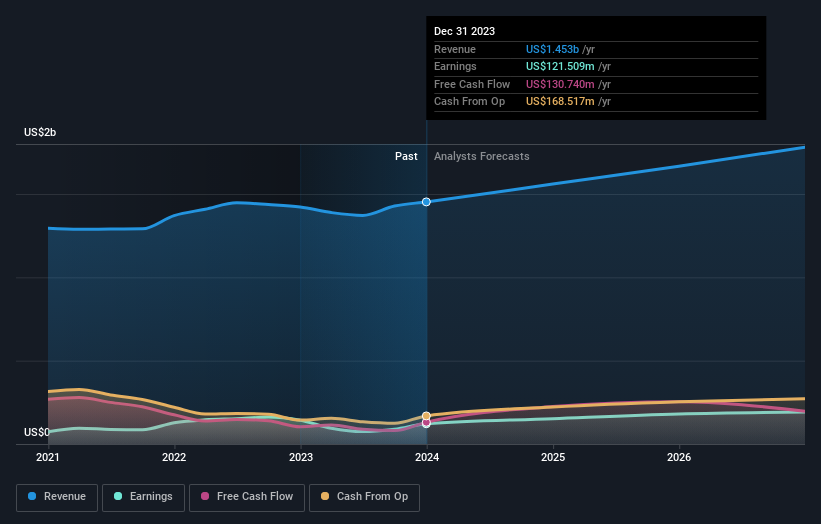

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. So it makes a lot of sense to check out what analysts think ACI Worldwide will earn in the future (free profit forecasts).

A Different Perspective

ACI Worldwide's TSR for the year was broadly in line with the market average, at 26%. The silver lining is that the share price is up in the short term, which flies in the face of the annualised loss of 0.8% over the last five years. While 'turnarounds seldom turn' there are green shoots for ACI Worldwide. It's always interesting to track share price performance over the longer term. But to understand ACI Worldwide better, we need to consider many other factors. To that end, you should be aware of the 1 warning sign we've spotted with ACI Worldwide .

ACI Worldwide is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:ACIW

ACI Worldwide

Develops, markets, installs, and supports software products and services for facilitating electronic payments in the United States and internationally.

Very undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives