- United States

- /

- Software

- /

- NasdaqGS:ACIW

ACI Worldwide, Inc. (NASDAQ:ACIW): Time For A Financial Health Check

Stocks with market capitalization between $2B and $10B, such as ACI Worldwide, Inc. (NASDAQ:ACIW) with a size of US$3.7b, do not attract as much attention from the investing community as do the small-caps and large-caps. While they are less talked about as an investment category, mid-cap risk-adjusted returns have generally been better than more commonly focused stocks that fall into the small- or large-cap categories. This article will examine ACIW’s financial liquidity and debt levels to get an idea of whether the company can deal with cyclical downturns and maintain funds to accommodate strategic spending for future growth. Don’t forget that this is a general and concentrated examination of ACI Worldwide’s financial health, so you should conduct further analysis into ACIW here.

View our latest analysis for ACI Worldwide

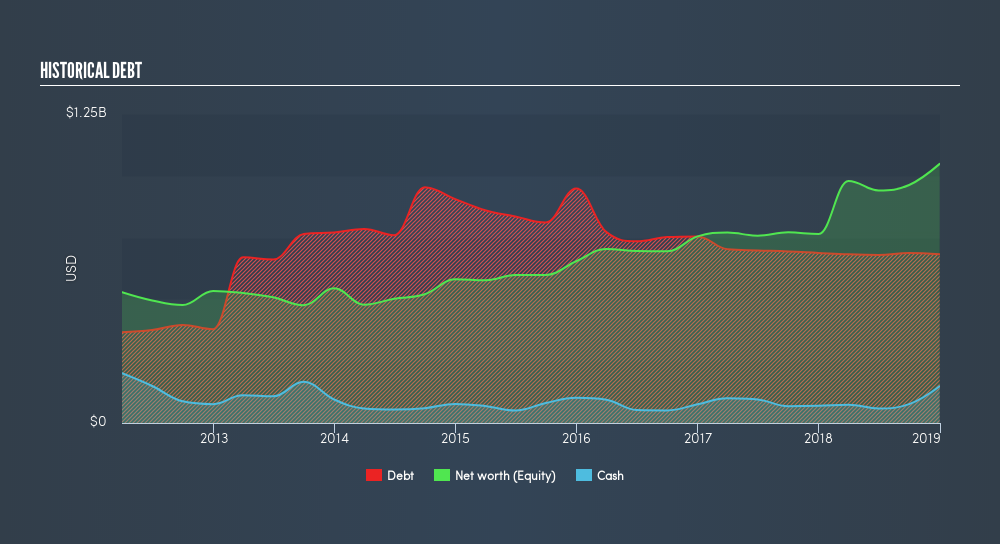

Does ACIW Produce Much Cash Relative To Its Debt?

ACIW has sustained its debt level by about US$682m over the last 12 months – this includes long-term debt. At this current level of debt, the current cash and short-term investment levels stands at US$149m , ready to be used for running the business. Moreover, ACIW has produced US$184m in operating cash flow during the same period of time, leading to an operating cash to total debt ratio of 27%, signalling that ACIW’s debt is appropriately covered by operating cash.

Can ACIW pay its short-term liabilities?

At the current liabilities level of US$297m, it appears that the company has maintained a safe level of current assets to meet its obligations, with the current ratio last standing at 1.91x. The current ratio is the number you get when you divide current assets by current liabilities. Usually, for Software companies, this is a suitable ratio as there's enough of a cash buffer without holding too much capital in low return investments.

Can ACIW service its debt comfortably?

With a debt-to-equity ratio of 65%, ACIW can be considered as an above-average leveraged company. This is not uncommon for a mid-cap company given that debt tends to be lower-cost and at times, more accessible. No matter how high the company’s debt, if it can easily cover the interest payments, it’s considered to be efficient with its use of excess leverage. A company generating earnings after interest and tax at least three times its net interest payments is considered financially sound. In ACIW's case, the ratio of 4.14x suggests that interest is appropriately covered, which means that lenders may be inclined to lend more money to the company, as it is seen as safe in terms of payback.

Next Steps:

ACIW’s high cash coverage means that, although its debt levels are high, the company is able to utilise its borrowings efficiently in order to generate cash flow. This may mean this is an optimal capital structure for the business, given that it is also meeting its short-term commitment. Keep in mind I haven't considered other factors such as how ACIW has been performing in the past. I recommend you continue to research ACI Worldwide to get a more holistic view of the mid-cap by looking at:

- Future Outlook: What are well-informed industry analysts predicting for ACIW’s future growth? Take a look at our free research report of analyst consensus for ACIW’s outlook.

- Valuation: What is ACIW worth today? Is the stock undervalued, even when its growth outlook is factored into its intrinsic value? The intrinsic value infographic in our free research report helps visualize whether ACIW is currently mispriced by the market.

- Other High-Performing Stocks: Are there other stocks that provide better prospects with proven track records? Explore our free list of these great stocks here.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqGS:ACIW

ACI Worldwide

Develops, markets, installs, and supports software products and services for facilitating electronic payments in the United States and internationally.

Very undervalued with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

GE Vernova revenue will grow by 13% with a future PE of 64.7x

A buy recommendation

Growing between 25-50% for the next 3-5 years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026