- United States

- /

- Leisure

- /

- NasdaqCM:POWW

3 US Penny Stocks With Market Caps Over $30M

Reviewed by Simply Wall St

The U.S. stock market has recently reached new highs, with major indices like the Dow Jones, S&P 500, and Nasdaq surging following the presidential election results. In this context of heightened investor optimism, penny stocks remain a relevant area for those seeking opportunities in smaller or newer companies that can offer both affordability and growth potential. While the term "penny stocks" may seem outdated, these investments continue to attract attention when backed by strong financials.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.7995 | $5.81M | ★★★★★★ |

| RLX Technology (NYSE:RLX) | $1.61 | $2.06B | ★★★★★★ |

| LexinFintech Holdings (NasdaqGS:LX) | $3.58 | $603.4M | ★★★★★★ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $170.21M | ★★★★★★ |

| Commercial Vehicle Group (NasdaqGS:CVGI) | $2.40 | $99.68M | ★★★★☆☆ |

| Flexible Solutions International (NYSEAM:FSI) | $4.04 | $50.42M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $69.71M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.56 | $51.48M | ★★★★★★ |

| PHX Minerals (NYSE:PHX) | $3.46 | $128.99M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $1.12 | $99.38M | ★★★★★☆ |

Click here to see the full list of 755 stocks from our US Penny Stocks screener.

Let's review some notable picks from our screened stocks.

AMMO (NasdaqCM:POWW)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: AMMO, Inc. designs, produces, and markets ammunition and ammunition component products for a diverse clientele including sport and recreational shooters, hunters, individuals seeking personal protection, manufacturers, as well as law enforcement and military agencies; it has a market cap of $140.13 million.

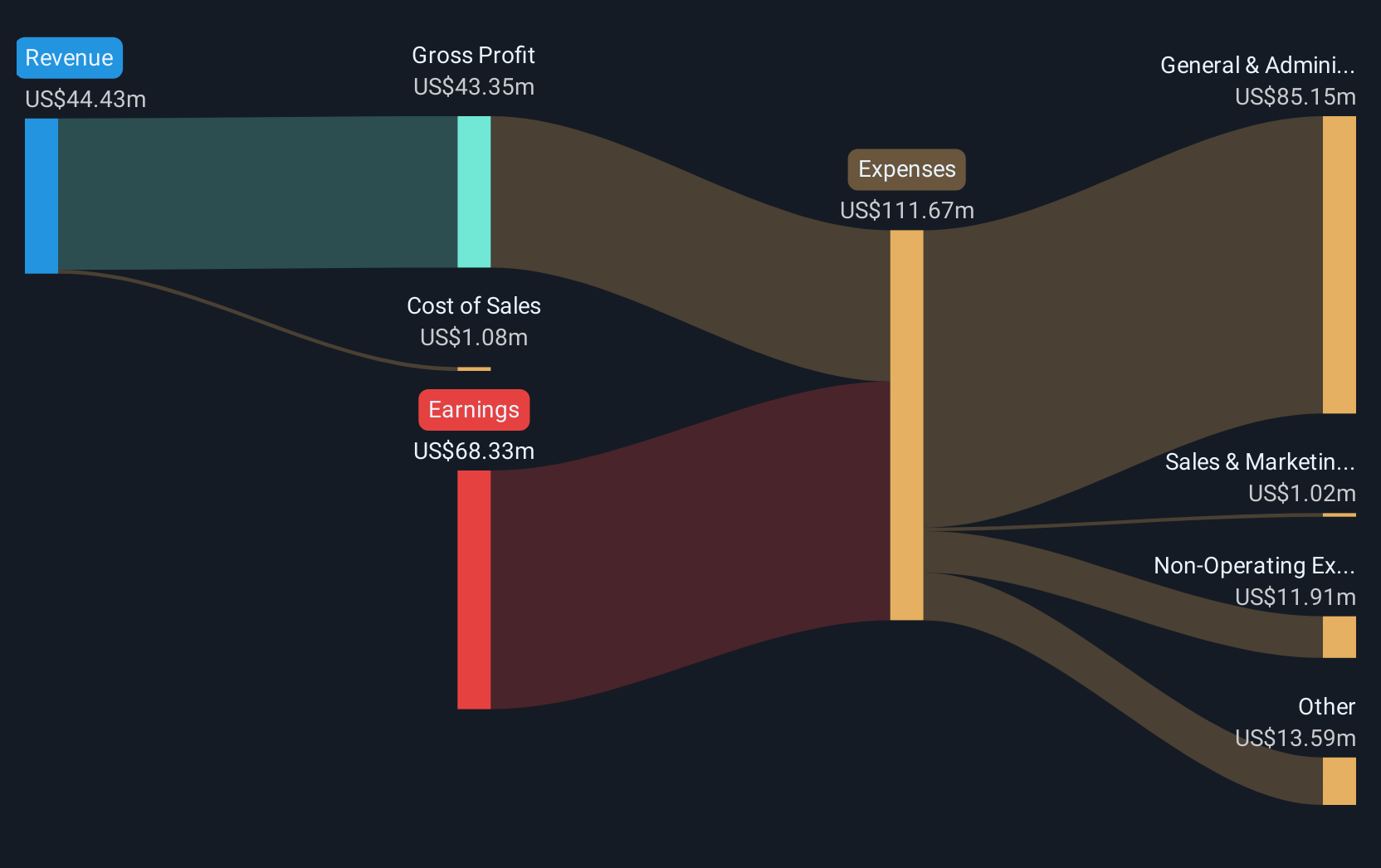

Operations: The company's revenue is derived from two primary segments: Ammunition, generating $89.44 million, and Marketplace, contributing $52.31 million.

Market Cap: $140.13M

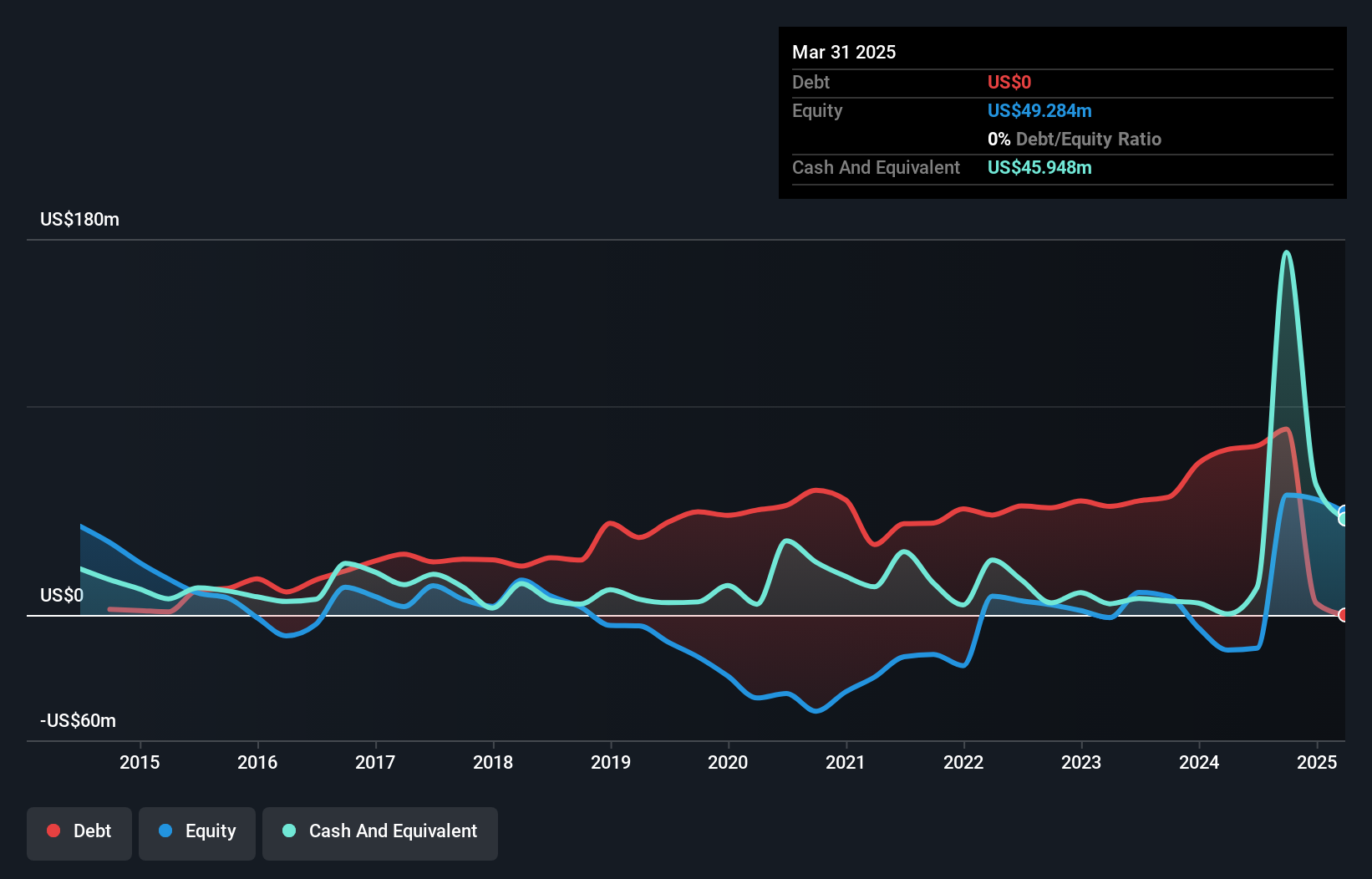

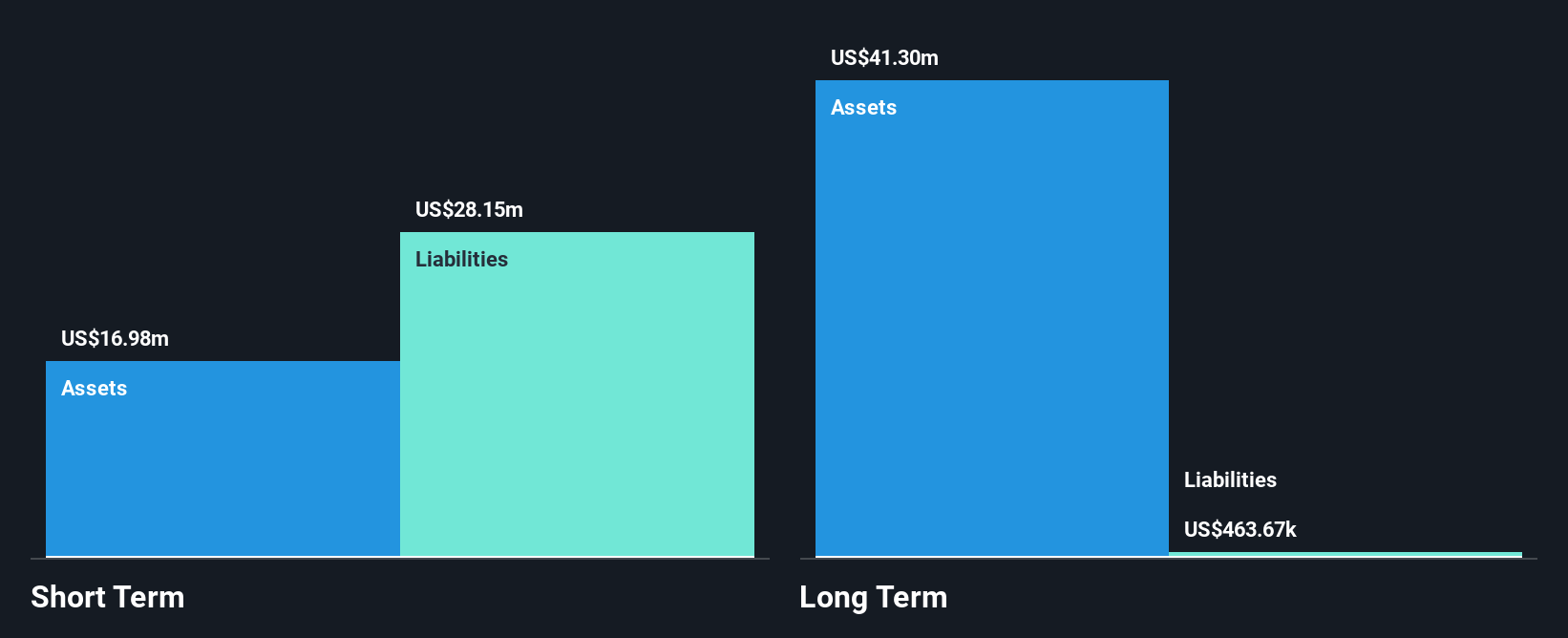

AMMO, Inc. faces challenges typical of penny stocks, such as unprofitability and a negative return on equity at -6.19%. Despite these hurdles, the company maintains a strong cash position with short-term assets of US$134 million exceeding long-term liabilities of US$12.2 million and has reduced its debt-to-equity ratio significantly over five years. Recent legal issues, including a class action lawsuit alleging misleading statements about business operations, add risk to the investment profile. However, AMMO's strategic management changes aim to enhance margins and internal processes amid ongoing financial losses and revenue declines in recent quarters.

- Click here to discover the nuances of AMMO with our detailed analytical financial health report.

- Learn about AMMO's future growth trajectory here.

Sequans Communications (NYSE:SQNS)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Sequans Communications S.A. is a fabless company that designs, develops, and supplies cellular semiconductor solutions for the massive and broadband internet of things markets across various international regions, with a market cap of $67.40 million.

Operations: Sequans Communications does not report distinct revenue segments.

Market Cap: $67.4M

Sequans Communications has recently achieved profitability, with a significant net income of US$72.28 million in Q3 2024, compared to a loss the previous year. This turnaround is partly due to a large one-off gain impacting its financial results. The company has strong short-term assets of US$209.3 million, comfortably covering both short and long-term liabilities, and trades significantly below estimated fair value. Despite shareholder dilution over the past year and increased share price volatility, Sequans' seasoned management team continues to navigate challenges while leveraging strategic partnerships like Qualcomm's recent investment through private placement notes.

- Unlock comprehensive insights into our analysis of Sequans Communications stock in this financial health report.

- Gain insights into Sequans Communications' future direction by reviewing our growth report.

Starco Brands (OTCPK:STCB)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Starco Brands, Inc. markets consumer products through retail and online channels in the United States, with a market cap of $38.15 million.

Operations: The company's revenue is derived from its segments, with Skylar contributing $10.63 million, Soylent generating $42.33 million, and Starco Brands adding $14.66 million.

Market Cap: $38.15M

Starco Brands, Inc. is navigating the penny stock landscape with a market cap of US$38.15 million and diverse revenue streams from segments like Skylar (US$10.63 million) and Soylent (US$42.33 million). Despite being unprofitable, it maintains a positive cash flow with a runway exceeding three years, supported by satisfactory debt levels. The company's recent launch of Winona Popcorn Spray's Garlic Butter flavor aims to bolster its consumer product lineup amid declining sales—second-quarter sales fell to US$15.57 million from US$17.51 million year-over-year, while net losses widened to US$11.56 million from US$6.02 million previously.

- Navigate through the intricacies of Starco Brands with our comprehensive balance sheet health report here.

- Review our growth performance report to gain insights into Starco Brands' future.

Next Steps

- Click this link to deep-dive into the 755 companies within our US Penny Stocks screener.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:POWW

Flawless balance sheet and overvalued.

Market Insights

Community Narratives